All You Need to Know About Stablecoins

Which Stablecoin Is the Most Reliable?

Virtually every cryptocurrency investor has embraced the use of stablecoins, which are digital currencies typically tied to an underlying asset, often the US dollar.

Stablecoins play a pivotal role as the main currency for facilitating transactions, thanks to their consistent value and swift transaction processing.

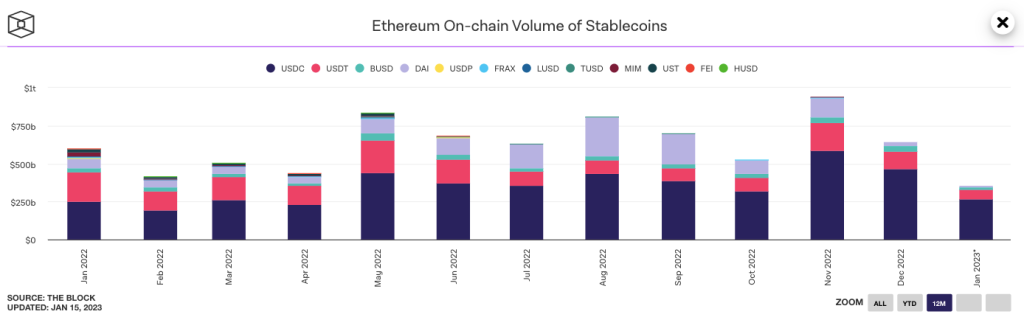

Within the expansive stablecoin landscape, there exists a multitude of variations characterized by diverse governance mechanisms, collateralization techniques, levels of popularity, and more. Nonetheless, the market’s hegemony is firmly held by the top four stablecoins.

Table of Contents

Classification of Stablecoins

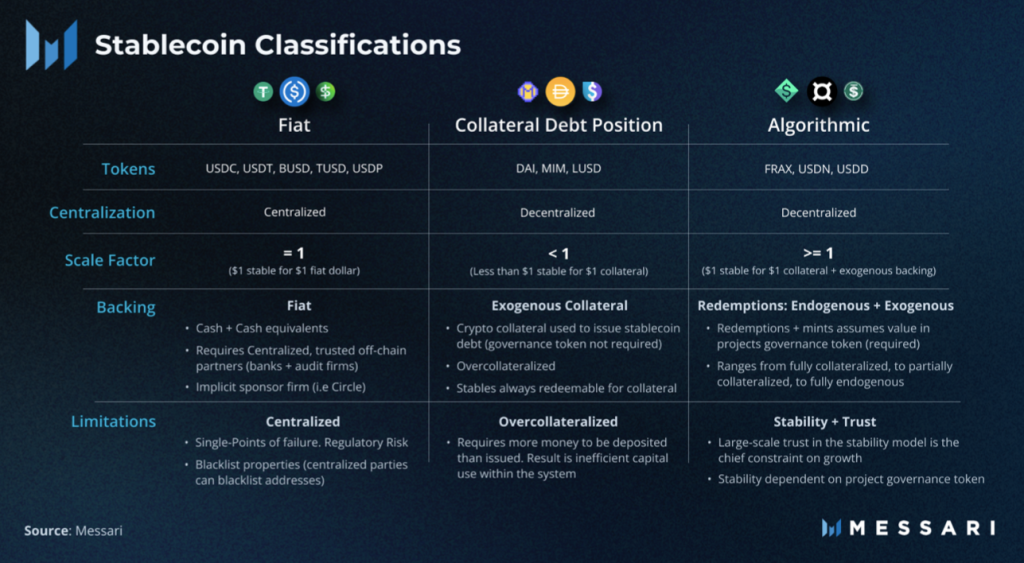

Stablecoins are typically categorized into two primary groups:

Decentralized Stablecoins

Centralized Stablecoins

Centralized stablecoins, exemplified by USDT (Tether), are under the complete control of specific organizations, who oversee both the issuance of the stablecoin and its entire infrastructure. In contrast, decentralized stablecoins are community-driven and lack a single controlling entity, making it challenging to make significant alterations to their operational principles.

Centralized stablecoins are commonly backed by real-world fiat currencies like the US dollar (USD) or the euro (EUR). Decentralized projects, on the other hand, lack a direct link to tangible assets and therefore cannot be backed by real currency.

USDT (Tether)

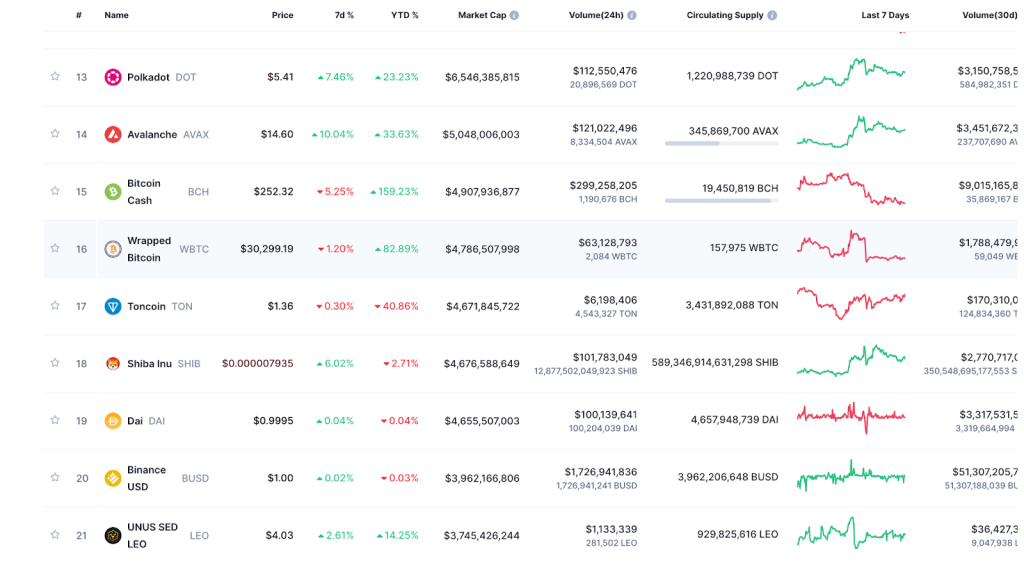

USDT, originally introduced in 2014 under the name Realcoin before rebranding, holds the third position in the cryptocurrency rankings according to CoinMarketCap. In terms of trading volume, it currently surpasses even Bitcoin and Ethereum.

Initially built on the Bitcoin blockchain using the Omni Layer protocol, USDT is now available on various other blockchains, including TRON (TRC-20), BNB Smart Chain (BEP-2), EOS, AVAX C-Chain, BNB Beacon Chain (BEP-20), Algorand, Solana, Polygon, Tezos, OMG Network, Ethereum (ERC-20), and more. A substantial portion of USDT’s supply is concentrated on the TRON blockchain, with Ethereum being the second most popular network for USDT transactions.

USDT Issuance Process

The issuance of USDT tokens is managed by Tether Limited. When users deposit fiat currency into the company’s bank account, Tether Limited creates an equivalent number of USDT tokens on a 1:1 basis with the deposited fiat currency. In other words, for each dollar received, 1 USDT is issued to the user, effectively circulating the tokens. Conversely, when users wish to redeem USDT, the tokens are sent back to Tether Limited, and fiat currency is transferred to the user, after which the tokens are destroyed.

Tether Limited also issues stablecoins linked to various other fiat currencies, including EURT (pegged to the euro), CNHT (pegged to the Chinese yuan), and XAUT (pegged to real gold). As of April 17, 2023, approximately 84 billion USDT has been issued, with the token’s issuance not being capped, as it depends on the assets backing the stablecoin. Currently, there are approximately 66 billion USDT in circulation.

USDT Collateralization

USDT is backed by a mix of assets, including US dollars (USD), US Treasury bills, corporate bonds, precious metals, Bitcoin, other investments, and secured loans (none to affiliated entities). Officially, these assets are allocated as follows:

- Cash & Cash Equivalents & Other Short-Term Deposits: 84.7%

- Corporate Bonds: 0.17%

- Precious Metals: 4.14%

- Bitcoin: 1.83%

- Other Investments: 2.61%

- Secured Loans (None To Affiliated Entities): 6.54%

It’s important to note that currently, no stablecoin project fully backs its stablecoin with actual US dollars. However, despite past controversies, Tether has maintained its 1:1 peg to the US dollar for over eight years.

Considerations for USDT Users

Users of USDT should be aware that Tether has the authority to freeze and unfreeze USDT accounts across all networks it operates on. There is also the possibility of zeroing out the balance of a frozen account. These actions are typically taken to thwart hackers’ attempts to compromise various projects. While blockchains do not record users’ locations, wallet providers, including decentralized ones, may collect user data.

These account freeze capabilities have been in use since 2017, with the number of blocked wallets increasing over time. Tether also cooperates with law enforcement agencies, such as temporarily blocking USDT holdings upon their request.

Additionally, users can request the recovery of mistakenly sent USDT, with requests accepted for amounts starting from $1,000. However, this process involves fees of up to 10% of the recovery amount or a minimum of $1,000 USD, deducted from the reimbursement. Given the complexities and limitations involved, it’s advisable to exercise caution to avoid losing USDT, as recovering them can be a challenging endeavor.

USDC (USD Coin)

USDC, introduced in 2018, was developed through a partnership between Circle and Coinbase exchange.

As per CoinMarketCap rankings, USDC holds the 6th position in the cryptocurrency market. Its daily trading volume is approximately 8.5 times lower than that of USDT. Nevertheless, it remains a popular stablecoin.

The Circle website provides up-to-date statistics for USDC.

Initially launched on the Ethereum blockchain as an ERC-20 token, USDC now operates on several other networks, including Algorand, Avalanche, Flow, Hedera, Solana, Stellar, TRON, and Polygon (via a cross-chain bridge).

USDC Collateralization

USDC is backed by reserves held in cash and short-term US Treasury bonds. Currently, the allocation is 9% ($2.7 billion) in cash and 90% ($24.8 billion) in short-term US Treasury bonds.

These reserves are managed by prominent organizations such as BlackRock, Bank of New York, and BNY Mellon, which helps alleviate concerns in the market about the adequacy of their reserves.

Reports on these reserves are presently published on a monthly basis.

USDС Issuance Process

The mechanism for issuing USDC closely mirrors that of USDT, so we won’t delve further into this topic.

Considerations for USDС Users

Circle has the authority to freeze wallets. In 2022, for instance, it blocked wallets containing over 75,000 USDC linked to the Bitcoin mixer Tornado Cash. Similarly, in 2020, $100,000 worth of USDC was blocked at the request of law enforcement agencies.

Notably, USDC aims to become the official stablecoin of the United States. Circle operates as a regulated company in the USA, distinguishing it from Tether, although Tether also freezes funds based on government requests.

On March 11, 2023, USDC temporarily lost its peg to the US dollar and traded at $0.92. This occurred after Circle announced holding $3.3 billion in reserves with the government-regulated Silicon Valley Bank (SVB). However, the exchange rate has since recovered.

BUSD (Binance USD)

BUSD was jointly created by Paxos and Binance in 2019, making it the newest among the popular major stablecoins.

As per CoinMarketCap rankings, BUSD holds the 20th position in the cryptocurrency market. Its daily trading volume is approximately 10 times lower than that of USDT.

BUSD is issued as an ERC-20 token on the Ethereum blockchain. Additionally, Binance issues BUSD tokens on the BEP-20 network and stores them in an Ethereum address (ERC-20). BUSD can be moved between these networks through withdrawals on the Binance exchange or via the Binance Bridge.

How BUSD Issuance Works

BUSD (ERC-20) is issued by Paxos using a mechanism similar to that of USDC and USDT. However, due to an ongoing investigation involving the company, Paxos has temporarily suspended the issuance of BUSD (ERC-20). Issuance and conversion operations will continue to be supported until February 2024.

BUSD (BEP-20), on the other hand, is a token linked to BUSD (ERC-20) and is exclusively issued by Binance. It is not associated with Paxos and is, therefore, not subject to regulation by the New York State Department of Financial Services, unlike BUSD (ERC-20).

BUSD Collateralization

The reserves for BUSD (ERC-20) consist of American debt obligations and fiat currency.

Since BUSD (BEP-20) is issued by Binance and not tied to Paxos, the stablecoin is not backed by dollars but rather by BUSD (ERC-20) tokens held in reserves by the exchange.

Considerations for BUSD Users

BUSD has not experienced wallet freezes for its holders so far, but this possibility always exists since the stablecoin is centralized.

Despite news related to Paxos, BUSD has not lost its peg to the US dollar. However, the situation after Paxos ceases its operations with BUSD remains uncertain.

Decentralized Stablecoins

Decentralized stablecoins maintain their value through smart contracts that automatically work to support the coin’s value. Within this category, stablecoins can be further divided into two types: algorithmic and over-collateralized with popular cryptocurrencies like BTC, ETH, or others.

Over-collateralized Stablecoins

Typically, the value of these coins is backed by other fundamental and highly liquid crypto-assets, such as ETH, BTC, or BNB.

Examples of such coins include DAI, USDD, and MIM. While they are algorithmic in nature because their management occurs automatically, they are not commonly referred to as such. Let’s delve into how DAI operates as an example.

DAI

DAI, launched by the MakerDAO project, currently holds the 19th position in the cryptocurrency ranking according to CoinMarketCap.

Unlike some other stablecoins, DAI’s contract does not include provisions to freeze accounts. This feature makes it a preferred choice for hackers to convert centralized assets into DAI because once you hold DAI, it cannot be seized under any circumstances.

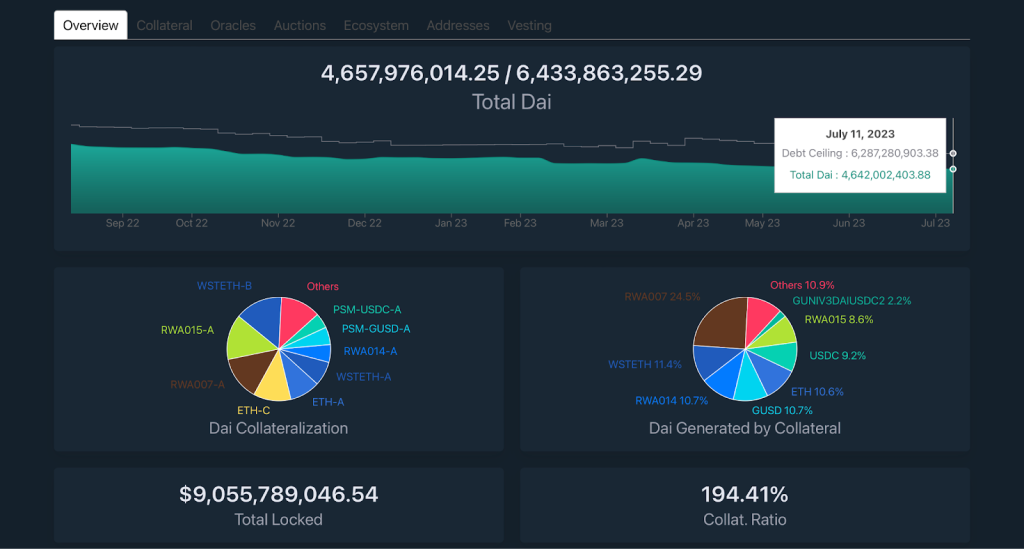

Collateralization and Issuance of DAI

DAI operates on an over-collateralization model, with collateralization ranging from 150-200%. This means that to obtain 100 DAI, you need to provide another liquid asset worth $150 to $200. If the price of your collateral asset falls to the minimum required collateral level, any blockchain user can initiate the liquidation process through the DAI contract. Typically, this is done by independent bots and applies to the issuance of tokens. If you are purchasing DAI on an exchange, you don’t need to be concerned about this process.

Currently, 4.65 billion DAI has been issued, with $9 billion worth of locked assets serving as collateral.

Risks of DAI

A significant portion of DAI’s reserves is held in USDC. If Circle, the issuer of USDC, were to freeze the USDC used as collateral for DAI, there is a risk that users may not be able to exchange their DAI back to USDC. However, this risk primarily applies to users who obtained DAI by providing collateral and issuing new tokens themselves, rather than those who purchased them on an exchange or wallet.

Algorithmic Stablecoins

Algorithmic stablecoins share similarities with DAI-like coins but rely on a single cryptocurrency as collateral, often tied to the blockchain they operate on. For instance, an algorithmic stablecoin on the Ethereum network would typically be backed solely by ETH.

For example, UST, an algorithmic stablecoin, is backed by the LUNA token through specific mechanisms. When the value of UST rises, Terra mints and sells new UST tokens, using the proceeds to buy LUNA. This creates a reserve of LUNA to back the stablecoin. Conversely, when UST’s value declines, Terra mints LUNA tokens and exchanges them for UST.

To attract capital to algorithmic stablecoins, projects often offer attractive annual yields. Terra, for instance, has offered up to 20% annual yields, enticing capital from other stablecoins to UST.

However, these projects often employ aggressive strategies to attract funds, potentially sacrificing security. Additionally, the backing for such coins is typically 1:1, which, combined with high promised interest rates, poses a risk of insufficient backing even in a stable market.

Algorithmic stablecoins have faced trust issues due to instances like UST’s price crash and USDN’s peg loss, leading to limited adoption. In the USA, there are plans to ban algorithmic stablecoins for a two-year period.

Risks Associated with Stablecoins

While stablecoins are designed to be less volatile than other cryptocurrencies, they are not without risks:

Counterparty Risk: Stablecoins issued by central entities expose investors to counterparty risk, where the issuer may default or go bankrupt, leading to the loss of funds.

Regulatory Risk: Stablecoins are subject to regulatory actions. Violations of securities laws can lead to regulatory measures, impacting a stablecoin’s value.

Market Risk: Stablecoins are not immune to market conditions. Changes in demand can lead to price fluctuations.

Liquidity Risk: The liquidity of a stablecoin depends on the market it’s traded on. Limited buyers and sellers can make it difficult to trade.

Technological Risk: Stablecoins rely on blockchain technology, which is still evolving. Algorithmic stablecoins can be particularly susceptible to algorithm failures.

Competition Among Stablecoins

Stablecoins compete for market dominance, with USDT maintaining a leading position. Other tokens actively vie for prominence in various ways.

Information Warfare in the Stablecoin Market

In the highly competitive stablecoin market, where the products themselves are often quite similar, companies engage in information warfare to gain an edge. Since the nature of stablecoins makes it challenging to differentiate based solely on their features and benefits, companies resort to various tactics to sway users and undermine competitors.

How Information Wars are Conducted

Disclosures and Audits: Following events like the LUNA crash, concerns about reserves held by stablecoin issuers have surfaced. Companies have been compelled to disclose details about their reserves and undergo audits to enhance trust.

FUD Campaigns: Fear, Uncertainty, and Doubt (FUD) campaigns have been used to create doubt or fear around a stablecoin’s reliability or collateralization. For example, Alameda Research initiated a FUD campaign against Terra’s UST, causing its price to plummet. Such tactics have been successful against algorithmic stablecoins that were associated with financial pyramids.

Media Manipulation: Companies may finance media outlets to publish articles with a skeptical tone toward a stablecoin, its issuer, or its collateral. For example, The Wall Street Journal criticized Tether’s reserves, leading to questions about its stability.

Regulatory Allegations: Accusations and investigations by regulatory authorities can be used to undermine confidence in a stablecoin or its associated exchange. For instance, Reuters published articles alleging weak anti-money laundering controls and other issues at Binance, impacting BUSD’s market capitalization.

Open Confrontation

Issuers may engage in open confrontation through various methods:

Competitive Advantage: Some stablecoins offer unique features to attract users. Terra’s Anchor Protocol, which provided up to 20% annual returns through UST staking, led to a capital outflow from other stablecoins. This kind of competitive advantage can result in rapid popularity.

Teamwork: Exchanges like Binance and Coinbase have influenced users to switch from one stablecoin to another. Binance halted support for certain stablecoins and converted balances to BUSD, while Coinbase urged users to transfer assets from USDT to USDC.

Alliances: Regulatory actions or decisions by exchanges can impact the usage of specific stablecoins. For example, the Ontario Securities Commission prohibited the use of USDT, leading to its delisting from certain exchanges.

Profitability of Stablecoin Issuers

Stablecoin issuers generate significant profits. For instance, Tether reported a profit of $700 million for the fourth quarter of 2022. They earn money through short-term investments of the funds backing their stablecoins and by offering redemption services, often charging a commission.

Which Stablecoins to Use

The choice of stablecoin depends on your specific needs and risk tolerance. Stablecoins are commonly used for capital preservation and as a means for cryptocurrency transactions due to their speed, low fees, and price stability. Some popular stablecoins include:

USDT: The most popular USD-pegged cryptocurrency with a track record of stability.

BUSD and USDC: Other USD-pegged stablecoins, though less popular than USDT.

DAI: A decentralized stablecoin with a unique collateralization model.

Diversifying your stablecoin holdings can be a wise approach to reduce risk, especially if you’re concerned about holding all your assets in a single cryptocurrency. Ultimately, the best stablecoin for you depends on your specific use case and preferences.

FAQ

Stablecoins are cryptocurrencies designed to maintain a stable value, often pegged to a specific asset like the US dollar.

Stablecoins achieve stability through collateralization, algorithmic mechanisms, or a combination of both.

Stablecoins can be categorized as centralized or decentralized, and some are over-collateralized with assets like BTC, ETH, or other cryptocurrencies.

The four largest stablecoins are USDT, USDC, BUSD, and DAI.

USDT is issued by Tether Limited in a 1:1 proportion to fiat dollars deposited by users.

USDT is backed by a mix of assets, including cash, US Treasury bills, precious metals, Bitcoin, and more.

Yes, Tether Limited can freeze USDT accounts for various reasons, including legal requirements and security concerns.

USDC is issued by Circle in collaboration with Coinbase and is backed by cash and short-term US Treasury bonds.

USDC lost its peg briefly when Circle announced holding $3.3 billion in reserves with the Silicon Valley Bank.

BUSD is issued by Paxos and Binance, primarily on the Ethereum blockchain as an ERC-20 token.

Binance stopped supporting USDC, USDP, and TUSD stablecoins, converting balances to BUSD.

DAI carries risks related to its over-collateralization model, including liquidation if collateral falls below required levels.

Algorithmic stablecoins rely on specific mechanisms to mint or burn tokens based on market conditions.

Stablecoins can face regulatory actions if they violate securities laws or other regulations.

Companies use tactics like FUD campaigns, media manipulation, and regulatory allegations to sway users and undermine competitors.

Stablecoin issuers profit from short-term investments of reserve funds and by providing redemption services with fees.

The best stablecoin depends on your specific needs. USDT, USDC, BUSD, and DAI are popular choices.

Yes, diversifying your stablecoin holdings can help reduce risk in your cryptocurrency portfolio.

Stablecoins are generally considered safe for preserving capital and conducting crypto transactions.

Consider factors like stability, issuer reputation, regulatory compliance, and use case to choose the right stablecoin.

Centralized organizations like Tether Limited and Circle have control over stablecoin issuance and infrastructure.

Stablecoin issuers can freeze accounts to comply with legal requirements and protect the stability of their stablecoin.

Stablecoins aim to maintain a stable value, making them suitable for transactions and capital preservation, unlike the price volatility of traditional cryptocurrencies.

Risks include counterparty risk, regulatory risk, market risk, liquidity risk, and technological risk.

Algorithmic stablecoins face challenges due to past incidents and regulatory concerns, but their future depends on regulatory decisions and market acceptance.

Email for contact [email protected]

[…] Stablecoins are cryptocurrencies pegged to the value of a fiat currency like the US dollar. They provide stability and are commonly used for trading and transferring funds on exchanges. […]

[…] Stablecoins are cryptocurrencies pegged to the value of a fiat currency like the US dollar. They provide stability and are commonly used for trading and transferring funds on exchanges. […]

[…] Stablecoins are cryptocurrencies pegged to the value of a fiat currency like the US dollar. They provide stability and are commonly used for trading and transferring funds on exchanges. […]

[…] Stablecoins are cryptocurrencies pegged to the value of a fiat currency like the US dollar. They provide stability and are commonly used for trading and transferring funds on exchanges. […]

[…] “Tether has reached an exposure of $72.5 billion in U.S. bonds, becoming one of the 22 largest buyers in the world, surpassing the United Arab Emirates, Mexico, Australia, Spain and others… […]

[…] Stablecoins are cryptocurrencies pegged to the value of a fiat currency like the US dollar. They provide stability and are commonly used for trading and transferring funds on exchanges. […]

[…] Stablecoins are cryptocurrencies pegged to the value of a fiat currency like the US dollar. They provide stability and are commonly used for trading and transferring funds on exchanges. […]

[…] Stablecoins are cryptocurrencies pegged to the value of a fiat currency like the US dollar. They provide stability and are commonly used for trading and transferring funds on exchanges. […]

[…] Circle’s USDC, tailored for NEAR, is set to become the official USD variant within our ecosystem, with an expected rollout scheduled for September. […]

[…] Stablecoins are cryptocurrencies pegged to the value of a fiat currency like the US dollar. They provide stability and are commonly used for trading and transferring funds on exchanges. […]

[…] Stablecoins are cryptocurrencies pegged to the value of a fiat currency like the US dollar. They provide stability and are commonly used for trading and transferring funds on exchanges. […]

[…] Stablecoins are cryptocurrencies pegged to the value of a fiat currency like the US dollar. They provide stability and are commonly used for trading and transferring funds on exchanges. […]

[…] Stablecoins are cryptocurrencies pegged to the value of a fiat currency like the US dollar. They provide stability and are commonly used for trading and transferring funds on exchanges. […]

[…] Stablecoins are cryptocurrencies pegged to the value of a fiat currency like the US dollar. They provide stability and are commonly used for trading and transferring funds on exchanges. […]

[…] Stablecoins are cryptocurrencies pegged to the value of a fiat currency like the US dollar. They provide stability and are commonly used for trading and transferring funds on exchanges. […]

[…] Stablecoins are cryptocurrencies pegged to the value of a fiat currency like the US dollar. They provide stability and are commonly used for trading and transferring funds on exchanges. […]

[…] Stablecoins are cryptocurrencies pegged to the value of a fiat currency like the US dollar. They provide stability and are commonly used for trading and transferring funds on exchanges. […]

[…] Stablecoins are cryptocurrencies pegged to the value of a fiat currency like the US dollar. They provide stability and are commonly used for trading and transferring funds on exchanges. […]

[…] Stablecoins are cryptocurrencies pegged to the value of a fiat currency like the US dollar. They provide stability and are commonly used for trading and transferring funds on exchanges. […]

[…] Stablecoins are cryptocurrencies pegged to the value of a fiat currency like the US dollar. They provide stability and are commonly used for trading and transferring funds on exchanges. […]