What is Bitcoin?

In this article about, we’ll break down the basics of this unique cryptocurrency. We’ll talk about how it decentralization, how there’s only a limited amount of it, and how you can use it anywhere with an internet connection. Whether you’re new to crypto or know a lot about it, Guru Investing is here to help you understand it better.

Table of Contents

Bitcoin is a decentralized digital currency that was created in 2009 by an anonymous person or group of people using the pseudonym Satoshi Nakamoto. It is often referred to as a cryptocurrency because it relies on cryptographic techniques to secure and verify transactions. Bitcoin operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

Bitcoin has gained widespread attention and adoption as both a digital currency and a store of value. Some people use it for everyday transactions, while others see it as a long-term investment. Its impact on the financial industry and discussions about the future of money and finance continue to evolve.

Decentralization: Bitcoin is not controlled by any central authority, such as a government or central bank. Instead, it relies on a network of nodes (computers) that collectively maintain the blockchain ledger.

Digital and Pseudonymous: It’s all digital, and ownership is shown through special codes. People have a code (address) to get this digital stuff and another code to make sure transactions are okay. But, these codes don’t show real names, so it’s kind of like using a nickname.

Limited Supply: Bitcoin has a fixed supply cap of 21 million coins. This scarcity is built into the protocol and is intended to create a deflationary economic model.

Security: Based on complex cryptographic algorithms, making it highly resistant to fraud and hacking. Transactions are irreversible once confirmed on the blockchain.

Transparency: All transactions are recorded on the blockchain, which is a public ledger that anyone can inspect. This transparency enhances security and trust in the system.

Peer-to-Peer Transactions: Bitcoin allows users to send and receive funds directly to and from each other without the need for intermediaries like banks. This can lead to faster and cheaper cross-border transactions.

Volatility: Price is volatile. It can experience rapid increases and decreases in value, which makes it attractive to some as an investment but also risky.

Mining: Transactions are validated and added to the blockchain through a process called mining. Miners use specialized hardware and compete to solve complex mathematical puzzles. In return, they are rewarded with newly created coins and transaction fees.

Global Reach: Can be used anywhere in the world with an internet connection, making it accessible to people in regions with limited access to traditional banking services.

Who is Satoshi Nakamoto?

Satoshi Nakamoto, born on April 5, 1975, is the pseudonymous figure behind the development of Bitcoin, the authorship of the white paper, and the creation and deployment of the original reference implementation of Bitcoin. Nakamoto is also credited with devising the first blockchain database as a fundamental component of Blockchain. His active involvement in Bitcoin’s development continued until December 2010.

The true identity of Satoshi Nakamoto has been a subject of widespread speculation, with various individuals being suggested as potential candidates behind this pseudonym. Although Nakamoto claimed to be a man living in Japan in a 2012 statement, most of the conjecture has focused on software and cryptography experts from the United States or Europe.

Development of Bitcoin

Nakamoto initiated the development of the Bitcoin code in 2007. On August 18, 2008, either Nakamoto or a group of people registered the domain name bitcoin.org and established a website at that address. On October 31, Nakamoto published a white paper titled “Bitcoin: A Peer-to-Peer Electronic Cash System” on the cryptography mailing list at metzdowd.com, outlining the concept of a digital cryptocurrency.

On January 9, 2009, Nakamoto released the initial version (0.1) of the Bitcoin software on SourceForge and launched the network by defining the genesis block of Bitcoin, known as block number 0, which had a reward of 50 coins. This block contained a noteworthy message in its coinbase transaction: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks,” referencing a headline from The Times, a UK newspaper, published on that date. This message has been interpreted both as a timestamp and a critical remark on the perceived instability resulting from fractional-reserve banking.

Nakamoto continued to collaborate with other developers on the Bitcoin software until mid-2010, personally overseeing all modifications to the source code. Eventually, he entrusted control of the source code repository and the network alert key to Gavin Andresen, transferred several related domains to prominent members of the Bitcoin community, and ceased his recognized involvement in the project.

Nakamoto’s Ownership and Wealth

Satoshi Nakamoto is believed to own a substantial number of bitcoins, estimated to be between 750,000 and 1,100,000. In November 2021, when Bitcoin reached its highest value of over US$68,000, this would have translated to a net worth of up to US$73 billion, briefly making Nakamoto one of the wealthiest individuals globally, ranking 15th at the time.

Characteristics and Identity

Satoshi Nakamoto has remained steadfast in not revealing any personal information in the context of technical discussions. However, he has occasionally offered insights into banking and fractional-reserve banking. In a 2012 profile on the P2P Foundation, Nakamoto claimed to be a 37-year-old male residing in Japan. Nonetheless, some experts have cast doubt on the likelihood of him being Japanese due to his native-level command of the English language.

Speculation has arisen suggesting that Nakamoto might be a team of individuals rather than a single person. Security researcher Dan Kaminsky, upon reviewing the Bitcoin code, suggested that Nakamoto could be either a “team of people” or a “genius.” Developer Laszlo Hanyecz, who corresponded with Nakamoto, believed that the code was too sophisticated for a single individual. Gavin Andresen commented on Nakamoto’s code, describing it as “brilliant but quirky.”

Furthermore, the use of British English in Nakamoto’s source code comments and forum postings, such as phrases like “bloody hard,” terminology like “flat” and “maths,” and spellings like “grey” and “colour,” has led to speculation that Nakamoto, or at least one member of a consortium claiming to be him, had Commonwealth origins. Additionally, the reference to London’s Times newspaper in the first Bitcoin block mined by Nakamoto has fueled speculation about a particular interest in the British government.

Stefan Thomas, a Swiss software engineer and active community member, analyzed the timestamps of Nakamoto’s more than 500 forum posts. He discovered a distinctive pattern of reduced activity between 5 a.m. and 11 a.m. Greenwich Mean Time, which corresponds to an unusual sleep pattern for someone purportedly residing in Japan. This pattern persisted even on weekends, suggesting that Nakamoto consistently slept during these hours.

Top 5 Powerful Use-Cases for Bitcoin

Global Money Transfer

BTC’s borderless nature makes it ideal for disrupting the remittance industry, eliminating middlemen and reducing costs. With a growing market volume, Bitcoin’s use in remittances is just beginning, especially with scaling solutions like Lightning Network.

Payments

Bitcoin transactions are no longer limited to large sums, thanks to Lightning Network, which offers low fees and near-instant settlement. Lightning Network’s growth has made Bitcoin suitable for everyday transactions, surpassing MasterCard and Visa in cost-effectiveness.

Monetizing Energy

Bitcoin offers a unique opportunity to monetize stranded and waste energy, as seen in remote areas using hydroelectric dams and flare gases. This can benefit conservation efforts, reduce energy costs, and minimize environmental impact.

Broadening Financial Access

It significantly increase financial inclusion, especially in countries lacking modern banking services. El Salvador’s adoption of BTC as legal tender demonstrates its potential to bank the unbanked.

Censorship and Corruption

Bitcoin operates independently of censorship and corruption, offering users financial freedom and security from ill-advised monetary policies. In an era of increasing financial censorship, Bitcoin provides a reliable alternative.

Bitcoin in El Salvador: A Revolutionary Leap into the Digital Future

El Salvador, a small Central American nation, made headlines in September 2021 when it became the first country in the world to officially adopt Bitcoin as legal tender. This historic decision by the Salvadoran government has sparked intense debate and fascination globally, as it represents a groundbreaking experiment that could potentially reshape the financial landscape not only in El Salvador but also in other countries considering similar moves.

Bitcoin’s Legal Tender Status

On September 7, 2021, the Salvadoran Congress approved the Bitcoin Law, making it legal tender alongside the US dollar, which has been the country’s official currency since 2001. This bold move was spearheaded by President Nayib Bukele, who argued that it would facilitate remittances from Salvadorans living abroad, boost financial inclusion, and attract foreign investment.

Challenges and Controversies

While the decision to embrace Bitcoin has received both praise and criticism, it has certainly not been without its share of challenges. The rollout of the government’s official Bitcoin wallet, Chivo, faced initial technical glitches and security concerns. Additionally, some Salvadorans were wary of the cryptocurrency’s volatility, which could potentially impact their savings.

Economic Implications

One of the key motivations behind El Salvador’s adoption of Bitcoin was to reduce the costs of remittances. With approximately 20% of the country’s GDP coming from remittances, this move could have a significant economic impact. By using Bitcoin, Salvadorans abroad can send money back home without going through traditional banking systems, potentially saving on fees and time.

Global Reactions and Implications

El Salvador’s decision to embrace Bitcoin has not gone unnoticed by the international community. Some countries have expressed interest in following suit, while others have raised concerns about the potential risks associated with cryptocurrency adoption, such as money laundering and financial instability. The International Monetary Fund (IMF) and World Bank have also expressed reservations about the move.

Conclusion

El Salvador’s decision to adopt Bitcoin as legal tender is a bold experiment that could have far-reaching consequences. While it has the potential to bring financial services to the unbanked and reduce remittance costs, it also faces significant challenges and opposition. The world will be watching closely as El Salvador navigates the complex path of integrating Bitcoin into its economy, and the outcome could shape the future of digital currencies on a global scale.

In conclusion, the journey of Bitcoin in El Salvador is a fascinating case study in the evolving world of cryptocurrencies and their impact on traditional financial systems. Only time will tell whether this pioneering move proves to be a success or a cautionary tale for other nations considering similar steps into the realm of digital currency.

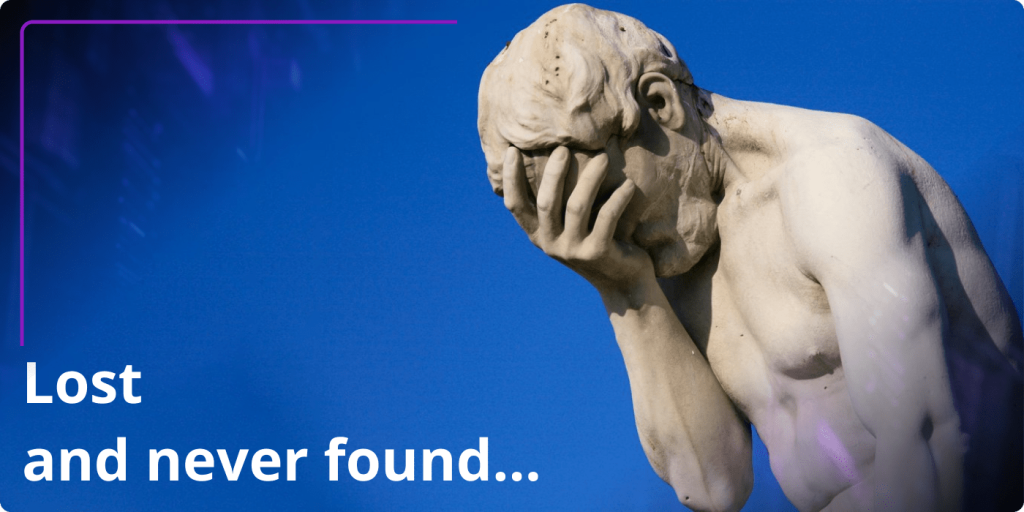

Bitcoin Loss

James Howells: One of the most famous cases is that of James Howells, a British IT worker who accidentally threw away a hard drive containing approximately 7,500 bitcoins in 2013. The bitcoins are now buried in a landfill, and he has been unsuccessful in retrieving them.

Mt. Gox: Mt. Gox was one of the largest cryptocurrency exchanges in the world until it filed for bankruptcy in 2014. This event resulted in the loss of around 850,000 bitcoins, which belonged to thousands of users. The exchange’s CEO, Mark Karpeles, faced legal troubles as a result.

QuadrigaCX: In 2019, the Canadian cryptocurrency exchange QuadrigaCX filed for bankruptcy after the sudden death of its CEO, Gerald Cotten. It was revealed that Cotten was the only person with access to the private keys for the exchange’s cold wallets, which contained a significant amount of customers’ funds. The keys were lost with Cotten’s death, leading to the loss of those funds.

Bitfinex Hack: In 2016, the Bitfinex cryptocurrency exchange was hacked, resulting in the loss of 120,000 coins (worth over $70 million at the time). Bitfinex issued tokens to its users to represent their losses, and the exchange later reimbursed them.

Conclusion

In this article Guru Investing explored the fundamentals of Bitcoin, a decentralized digital currency created by the mysterious Satoshi Nakamoto in 2009. Bitcoin operates on a blockchain, offering transparency, security, and the ability to conduct peer-to-peer transactions without intermediaries. It boasts a fixed supply cap of 21 million coins, making it deflationary by design, but it’s also known for its price volatility.

Satoshi Nakamoto, the enigmatic creator of Bitcoin, has never revealed his true identity, sparking widespread speculation. The development of Bitcoin began in 2007, with Nakamoto actively involved until 2010. He is believed to own a substantial number of bitcoins, which made him one of the world’s wealthiest individuals during Bitcoin’s peak value.

We discussed the powerful use-cases for Bitcoin, including its potential to disrupt global money transfers, offer efficient payment solutions through the Lightning Network, monetize energy resources, broaden financial access in underserved regions, and provide financial freedom in the face of censorship and corruption.

The article also touched upon the revolutionary adoption of Bitcoin as legal tender in El Salvador in 2021. This historic move aims to reduce remittance costs and enhance financial inclusion but faces challenges and international scrutiny.

In conclusion, Bitcoin remains a remarkable and influential force in the world of finance and technology. Its potential benefits and risks continue to shape discussions on the future of digital currencies, while its journey in El Salvador serves as a compelling case study for nations exploring the world of cryptocurrencies. Nevertheless, Bitcoin’s history is also marked by notable losses, highlighting the importance of responsible management of digital assets in this evolving landscape.

Investing in Bitcoin

Investing can be a speculative and volatile endeavor, so it’s essential to approach it with caution and careful consideration. Here are five pieces of advice to keep in mind when buying Bitcoin:

Educate Yourself: Before investing in Bitcoin, take the time to understand what it is, how it works, and the technology behind it (blockchain). Familiarize yourself with the risks and benefits associated with cryptocurrency investments. There are many online resources, courses, and books available to help you gain a better understanding.

Start Small: Don’t invest more than you can afford to lose. Cryptocurrency markets are highly volatile, and prices can fluctuate dramatically in a short period. Start with a small amount that won’t have a significant impact on your overall financial situation.

Use Reputable Exchanges: Choose a reputable cryptocurrency exchange to buy and store your Bitcoin. Look for exchanges that have a strong track record of security, customer support, and user-friendliness. Examples include Coinbase, Binance, and Kraken, among others. Be cautious of smaller or less-known exchanges, as they may pose higher risks.

Secure Your Investments: Security is paramount in the world of cryptocurrencies. Use hardware wallets or secure software wallets to store your Bitcoin, and enable two-factor authentication (2FA) wherever possible. Never share your private keys or seed phrases with anyone, and be cautious of phishing attempts and scams.

Diversify Your Portfolio: Bitcoin should be just one component of a well-diversified investment portfolio. Don’t put all your funds into a single asset class, as this can expose you to unnecessary risks. Consider other investments, such as stocks, bonds, or real estate, to spread your risk.

Purchasing cryptocurrency involves considering various factors, including your location and the underlying protocol. Thankfully, acquiring Bitcoin is a straightforward and secure process through either the Binance or BybIt exchange. It offers a convenient and swift solution: