Bifinity has achieved a remarkable feat by becoming the second-largest corporate taxpayer in Lithuania. This achievement not only cements its presence in the country but also underscores its commitment to boosting the nation’s economic development. Bifinity, a subsidiary of Binance, one of the world’s premier cryptocurrency exchanges, has exhibited impressive financial growth and stability, propelling it to a prominent position among corporate taxpayers in Lithuania.

What’s truly noteworthy is that Bifinity now holds the rank of the fourth-largest taxpayer in the entire state, a testament to its substantial financial impact and its unwavering dedication to meeting its tax responsibilities. This accomplishment is particularly significant as it highlights Bifinity’s pivotal role in supporting the fiscal needs of the Lithuanian government, potentially benefiting a range of public services and infrastructure projects.

Even more impressive is Bifinity’s outperformance of many local and European banks when it comes to tax contributions. This achievement underscores the company’s economic importance and its capacity to generate substantial revenues, even when compared to traditional financial institutions. This success story illustrates the changing landscape of the financial industry, where fintech companies and cryptocurrency-related entities are increasingly emerging as major players on the global economic stage.

Bifinity’s success also casts a favorable light on Lithuania’s business environment, signaling its appeal to international companies seeking to establish a foothold in the European market. The nation’s favorable regulatory framework and supportive government policies have likely played a pivotal role in fostering Bifinity’s growth and attracting businesses from various sectors, including the rapidly expanding cryptocurrency industry.

In conclusion, Bifinity’s ascent to becoming one of Lithuania’s largest corporate taxpayers stands as a remarkable achievement, not only highlighting the company’s financial prowess but also showcasing its commitment to bolstering the local economy. In an ever-evolving financial landscape, Bifinity’s success serves as a shining example of how innovative fintech companies can wield substantial influence in both local and global financial arenas.

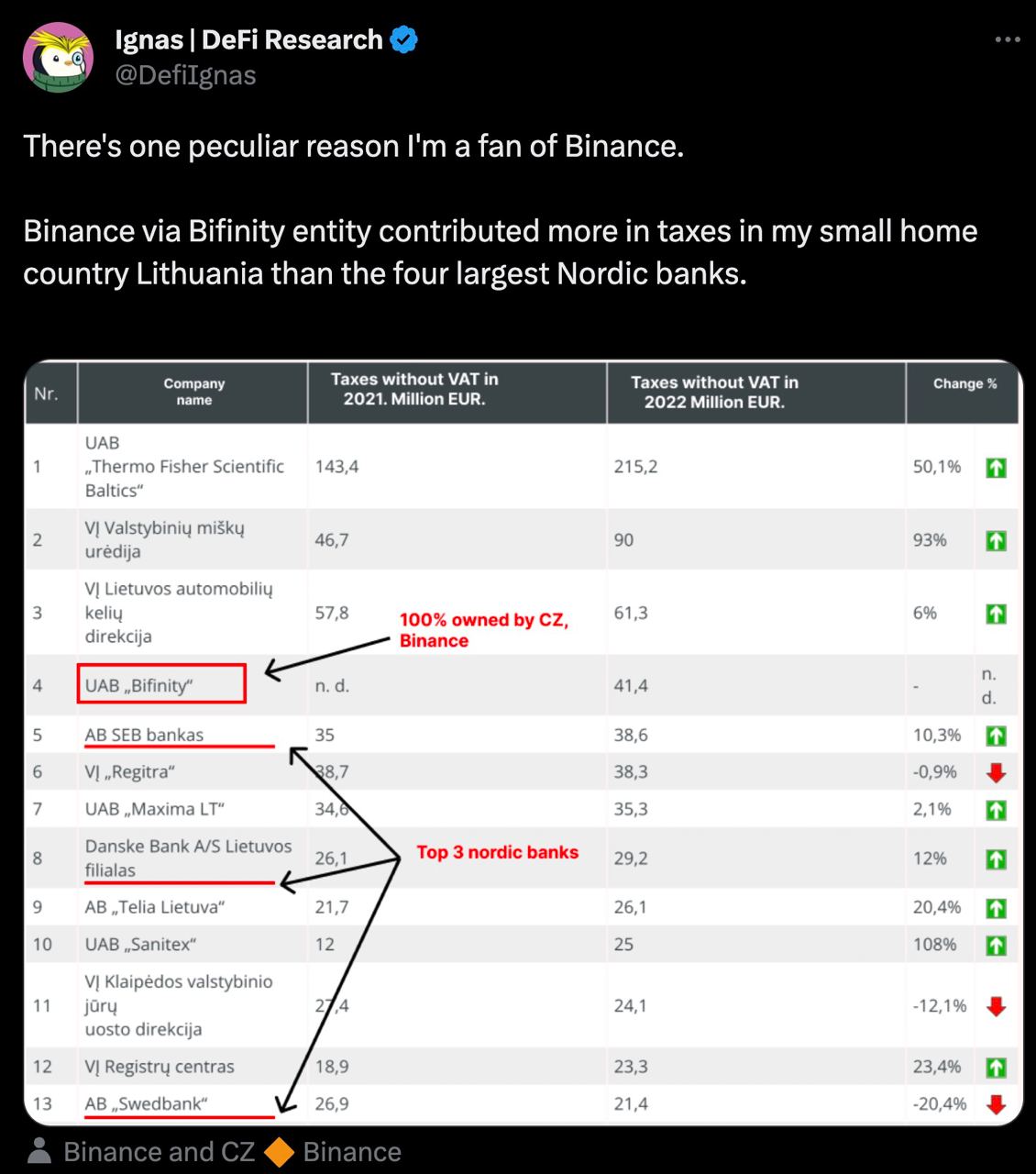

There's one peculiar reason I'm a fan of Binance.

— Ignas | DeFi Research (@DefiIgnas) September 7, 2023

Binance via Bifinity entity contributed more in taxes in my small home country Lithuania than the four largest Nordic banks.

In fact, Binance was the 2nd largest corporate and 4th largest taxpayer overall. Binance funds fixing… pic.twitter.com/TJ9UfHsXWm

A cryptocurrency exchange is an online platform where you can buy, sell, or trade cryptocurrencies like Bitcoin, Ethereum, and others.

Safety varies by exchange. Look for platforms with strong security measures, like two-factor authentication and cold storage for funds.

Consider factors like security, fees, available coins, user interface, and customer support.

Centralized exchanges are managed by a company, while decentralized exchanges operate without a central authority.

Many exchanges require Know Your Customer (KYC) verification for security and regulatory compliance.

Trading fees vary but typically include maker fees (for adding liquidity) and taker fees (for removing liquidity).

Yes, most exchanges offer cryptocurrency-to-cryptocurrency trading pairs.

Withdrawal times depend on the exchange and the cryptocurrency. Some are instant, while others may take hours or even days.

A wallet address is like a bank account number for cryptocurrencies. It’s required to send your crypto to the right place.

Yes, depending on your country’s tax laws, trading cryptocurrencies may have tax consequences. Consult a tax professional for guidance.

Yes, many cryptocurrency exchanges operate 24/7, allowing you to trade at any time.

A market order buys or sells at the current market price, while a limit order sets a specific price at which you want to buy or sell.

Yes, each exchange sets its own minimum and maximum trading limits, which can vary widely.

It’s not recommended. For security, it’s better to use a cryptocurrency wallet, especially for significant holdings.

Exchanges typically have account recovery processes, including password reset options and support for forgotten usernames.

Some exchanges offer insurance, but coverage can be limited. It’s essential to check an exchange’s insurance policy.

Use strong passwords, enable two-factor authentication, and be cautious of phishing scams and suspicious emails.

Yes, but it’s recommended to learn the basics of trading and understand the risks involved before you start.

Stablecoins are cryptocurrencies pegged to the value of a fiat currency like the US dollar. They provide stability and are commonly used for trading and transferring funds on exchanges.

Yes, regulations vary by country. Many countries have implemented or are considering regulations to govern cryptocurrency exchanges for consumer protection and financial stability.