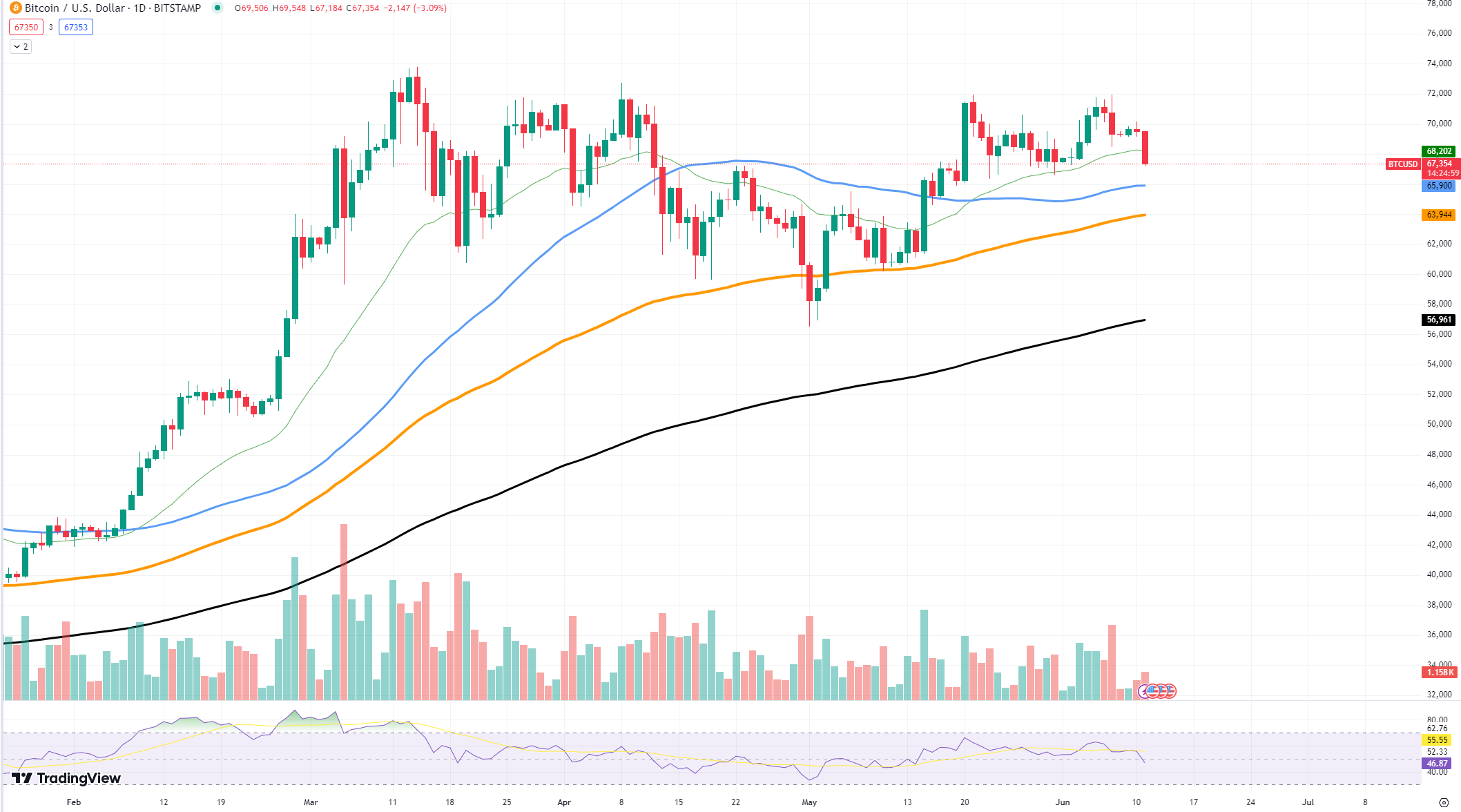

Bitcoin has failed to regain its footing above $70,000, but what are the key reasons behind this? The latest liquidation group data, ETF inflows and market evidence could give us some answers.

Bitcoin has failed to regain its footing above $70,000, but what are the key reasons behind this? The latest liquidation group data, ETF inflows and market evidence could give us some answers.

First of all, the liquidation heatmap data shows notable sell-offs that have contributed to the decline in Bitcoin price. The chart shows that the $72,000, $69,000, and $66,000 levels saw significant clusters of liquidations. These liquidations show strong selling pressure because the price was forced to drop due to the forced closure of leveraged positions. Recent Bitcoin price developments show that this cascading effect of liquidations often results in a rapid and steep decline.

Secondly, the exit of US ETFs that track Bitcoin has been very significant. After 19 days of inflows, these ETFs recorded a net outflow of $64.93 million on Monday. This is noteworthy because it shows that investors are moving away from accumulation and towards taking profits or taking less risk.

Grayscale’s GBTC had the largest outflow, totaling $40 million, followed by Invesco Galaxy Digital’s BTCO, Valkyrie’s Bitcoin ETF, and Fidelity’s FBTC. The money being withdrawn from Bitcoin ETFs indicates a decline in institutional interest, despite the relatively low volume of outflows.

Third, market dynamics show a general decline in enthusiasm. Although recent outflows suggest a turnaround, there has been a 19-day streak of net inflows totaling more than $4 billion, bringing the total net spot Bitcoin ETF inflows since January to $15 billion.

The overall trend has turned negative even though the only funds that recorded net inflows of $6 million and $8 million, respectively, were Bitwise’s BITB and BlackRock’s IBIT. This change in sentiment is likely the result of profit-taking following a prolonged period of positive inflows, not just among institutional investors.

Alex Dovbnya

Alex Dovbnya