After weeks of positive performance and dominant bullish sentiment, the cryptocurrency market has moved into a slightly bearish short-term position. Bitcoin (BTC) led the move, with a retracement below the previous all-time high support level of $69,000.

This activity has also changed the open interest (OI) landscape in the derivatives market with the recent massive liquidations. Previously, long positions dominated all cryptocurrencies, which is now the case with short positions.

Essentially, cryptocurrency traders experienced a long squeeze on their positions, pushing prices to lower levels. Therefore, the scenario currently favors short squeezes, which are expected to occur if short sellers are liquidated, pushing prices higher.

In particular, Finbold has identified two cryptocurrencies CoinGlass with higher short-squeeze potential that could pump next week.

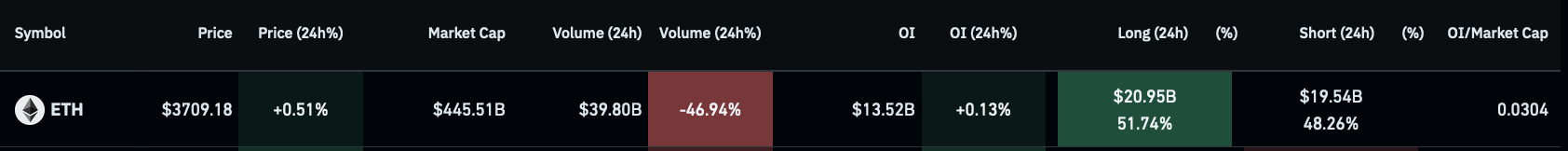

Ethereum (ETH) Short Squeeze Alert

First, Ethereum (ETH) is trading at $3,709, with neutral price action less than nearly 47% of its daily volume. This lower volume is reflected in long positions which dominated the last 24 hours by 51.74%.

However, the remaining open interest on larger time frames is still dominated by shorts. Considering that the last 24 hours represent only 0.13% of Ethereum’s entire OI.

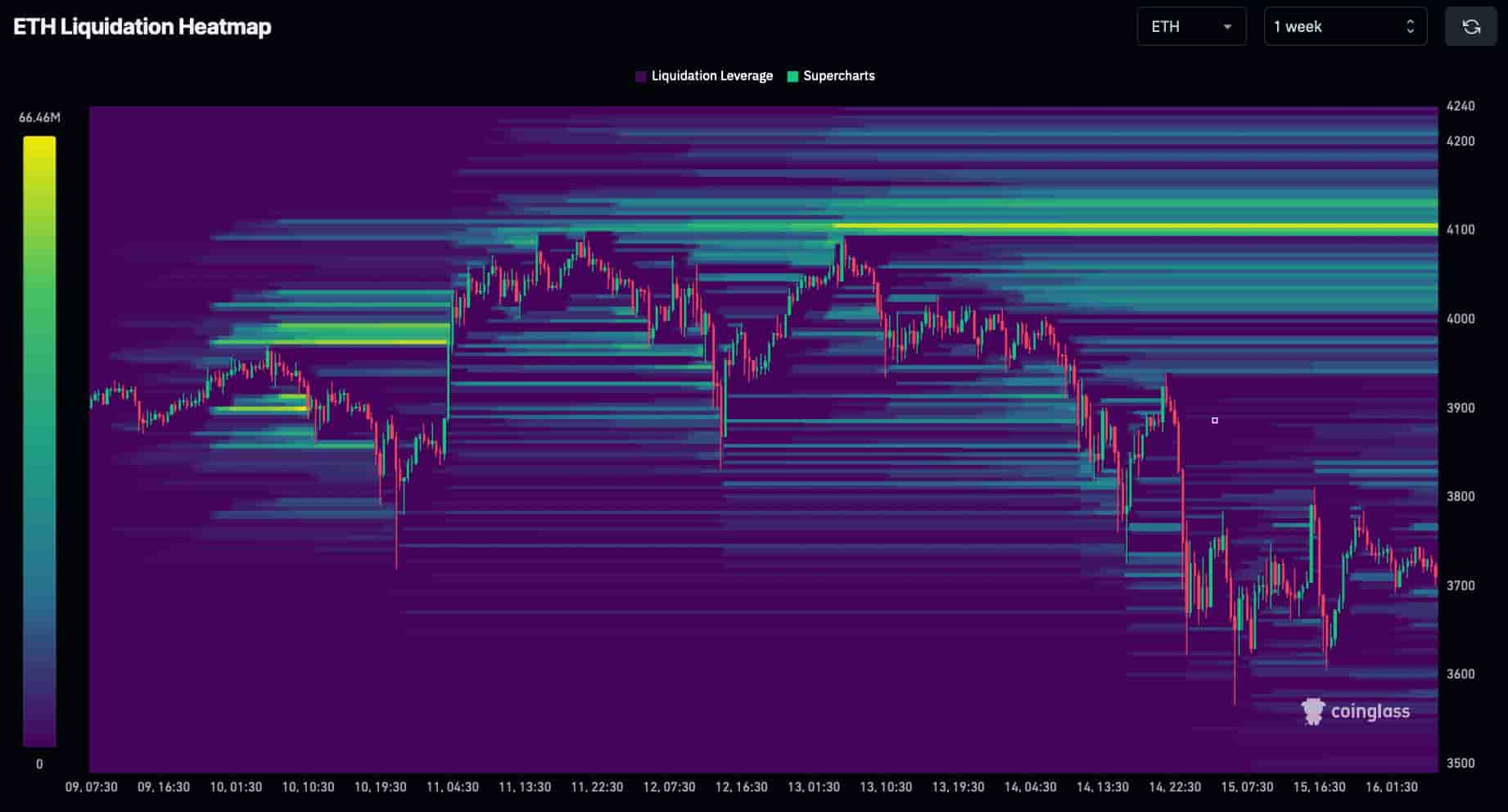

The weekly heat map of ETH liquidations demonstrates this, with cumulative short liquidations in the $4,100 zone. Market makers could hunt this area through a short squeeze, pumping the price into this liquidity pool and beyond.

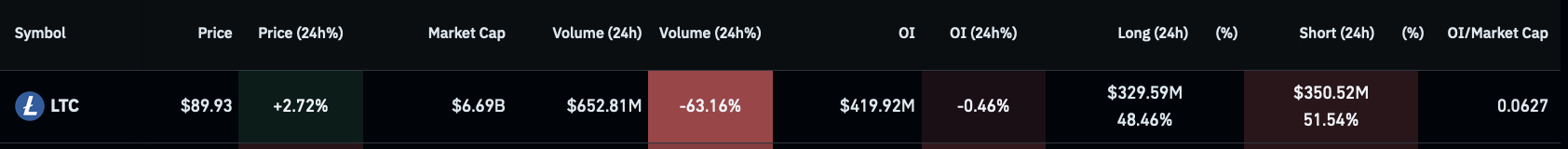

Litecoin (LTC)

Secondly, Litecoin (LTC) is trading at $89.93, up slightly by 2.72% over the past 24 hours following the “Payments” cryptocurrency narrative.

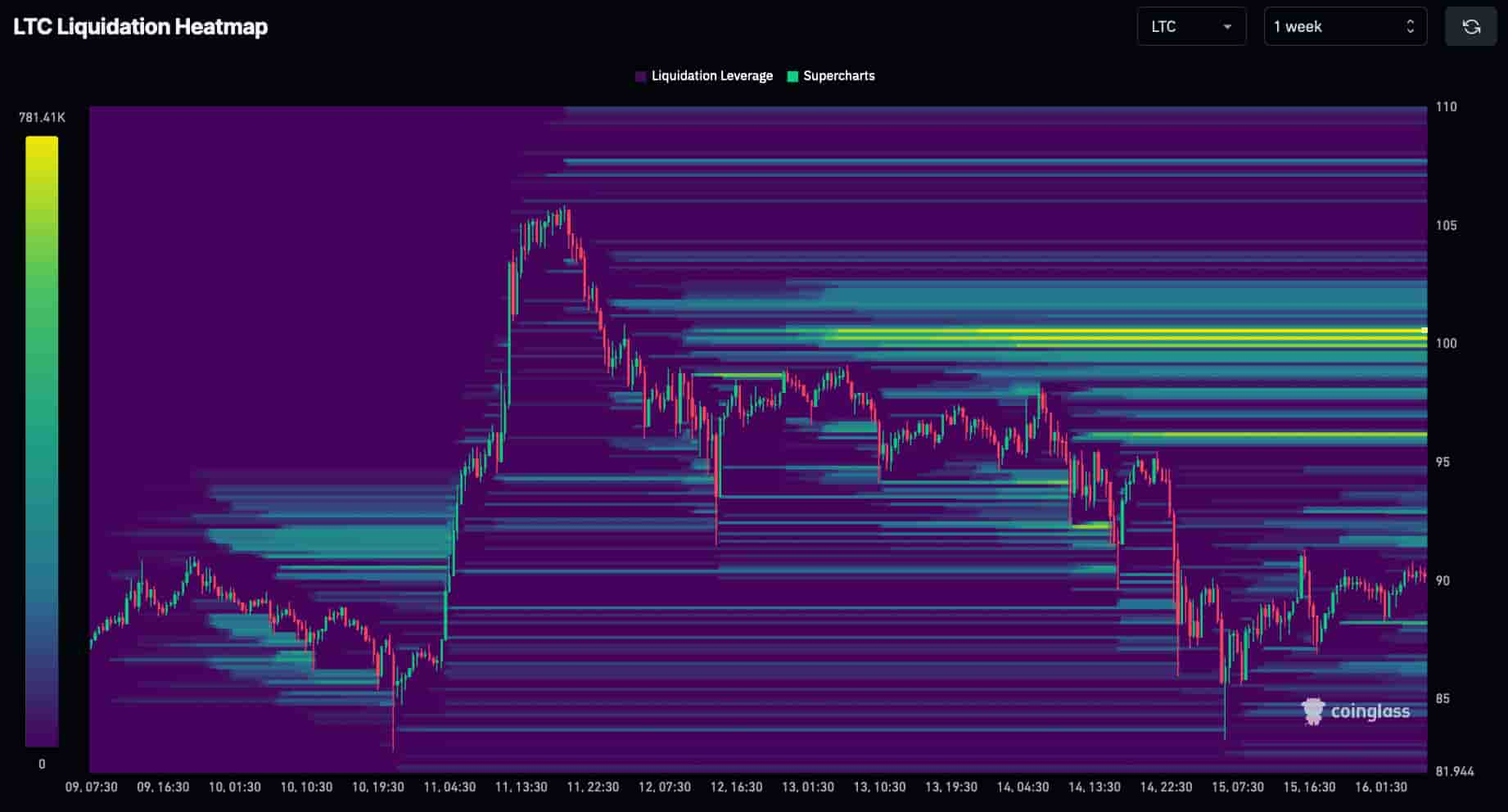

Likewise, LTC has a significant upside liquidity pool, resulting from a dominant short position in Litecoin OI. Notably, the heat map shows three such pools at the $100 psychological resistance zone. Therefore, a likely target for a potential short squeeze next week.

In summary, a short squeeze into the potential zones would represent gains of 10.5% and 11.2% for ETH and LTC, respectively. However, cryptocurrencies are volatile and unpredictable assets. Traders must open positions carefully while applying adequate risk management to avoid liquidation.

Disclaimer: The content of this site should not be considered investment advice. Investing is speculative. When you invest, your capital is at risk.