Litecoin (LTC) has seen a significant increase in network activity, which may indicate a possible price rally. Recent data from feeling shows that Litecoin had an average of approximately 704,000 unique addresses interacting on the network over the past week.

Litecoin (LTC) has seen a significant increase in network activity, which may indicate a possible price rally. Recent data from feeling shows that Litecoin had an average of approximately 704,000 unique addresses interacting on the network over the past week.

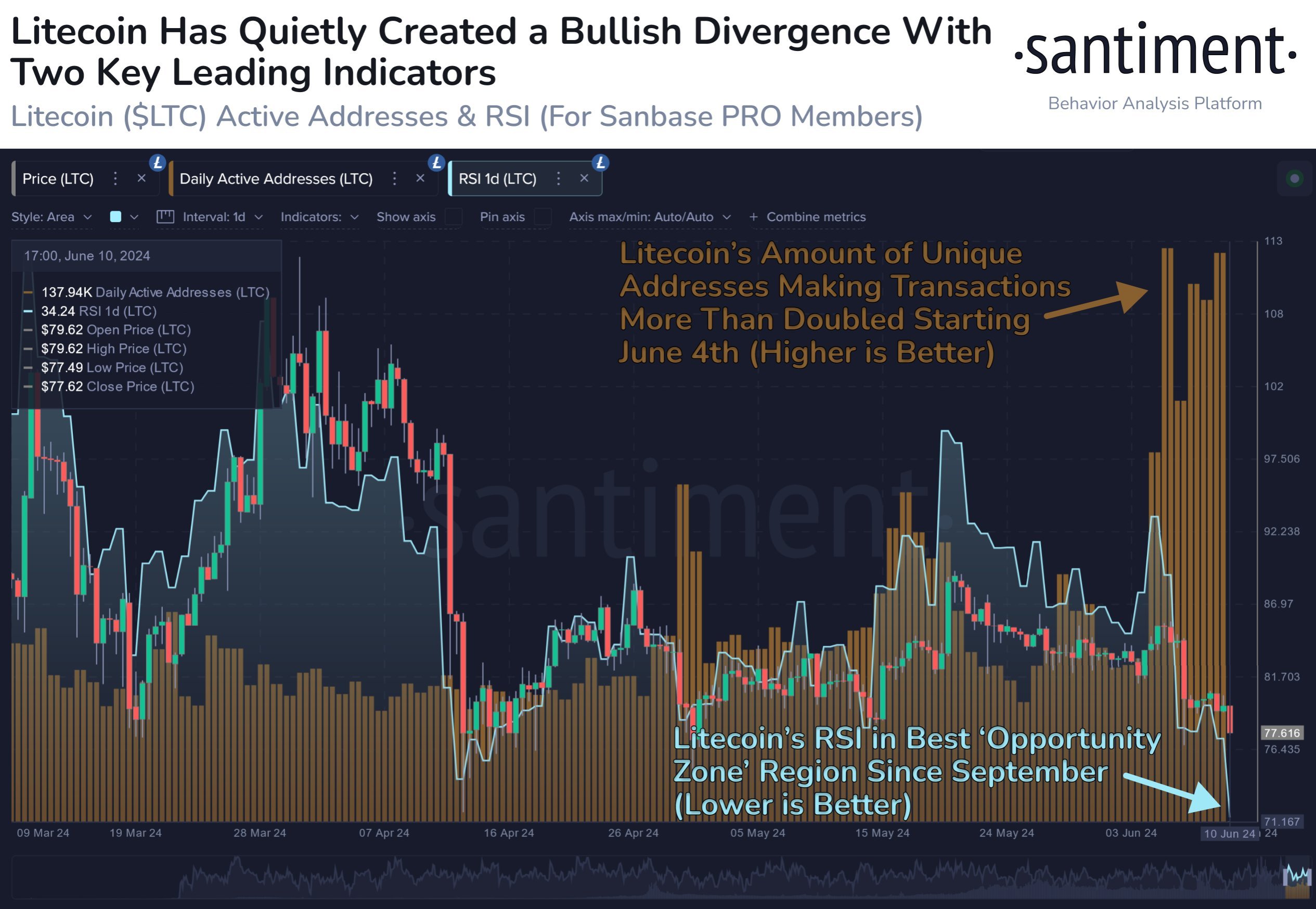

This is a significant increase from the approximately 345,000 addresses seen throughout the month of May. The further doubling of active addresses indicates growing interest and usage of the popular cryptocurrency.

Network growth in the cryptocurrency market usually precedes price increases. When there are more active unique addresses, it indicates a higher number of transactions and higher overall usage. This increase in activity can boost demand and drive up the price.

Additionally, when a network has a large number of active addresses, it often reflects positive investor sentiment and interest in the native asset.

Is Litecoin really undervalued?

Litecoin, often referred to as the silver to Bitcoin’s gold, is a peer-to-peer cryptocurrency created by Charlie Lee in 2011. While both coins share the same basic principles, LTC offers faster transaction times and a different hashing algorithm. These differences make Litecoin more suitable for smaller transactions and a viable option for everyday use.

Litecoin’s Relative Strength Index (RSI) is currently in an optimal zone for potential gains. RSI is a momentum indicator that measures the speed and change of price movements. An RSI well within the opportunity zone indicates that Litecoin is currently undervalued and may be primed for a price increase.

Currently, Litecoin is trading at $79.03 per LTC. Since the beginning of the year, the cryptocurrency is up 8.5%, although it is still behind bitcoin and Ethereum in terms of price performance.

Mushumir to the fullest

Mushumir to the fullest

Yuri Molchan

Yuri Molchan