Amid a tumultuous week for the cryptocurrency market, ETH whales have made substantial moves, cashing in millions ahead of Ethereum’s price drop. In the last four days of market downtime, three smart traders have dumped a staggering 26,946 ETH, equivalent to a staggering $95.7 million. Their combined profits amount to an impressive $39 million, according to data from Point on the chain.

Amid a tumultuous week for the cryptocurrency market, ETH whales have made substantial moves, cashing in millions ahead of Ethereum’s price drop. In the last four days of market downtime, three smart traders have dumped a staggering 26,946 ETH, equivalent to a staggering $95.7 million. Their combined profits amount to an impressive $39 million, according to data from Point on the chain.

The first trader, identified as “0xb82”, executed a strategic move, selling 7,300 ETH for $24.4 million in stablecoins via Binance, making a hefty 22.7% profit, equivalent to a notable 4 .59 million dollars. Not far away, “0xebf” deposited 8,870 ETH, valued at $33.1 million, on Binance on March 16, making an estimated total profit of $25.3 million, an impressive 55.8% gain.

Lastly, “0xa43” sold 10,776 ETH for $38.2 million on March 15, making a notable profit of $9.14 million, equivalent to a 31.5% gain.

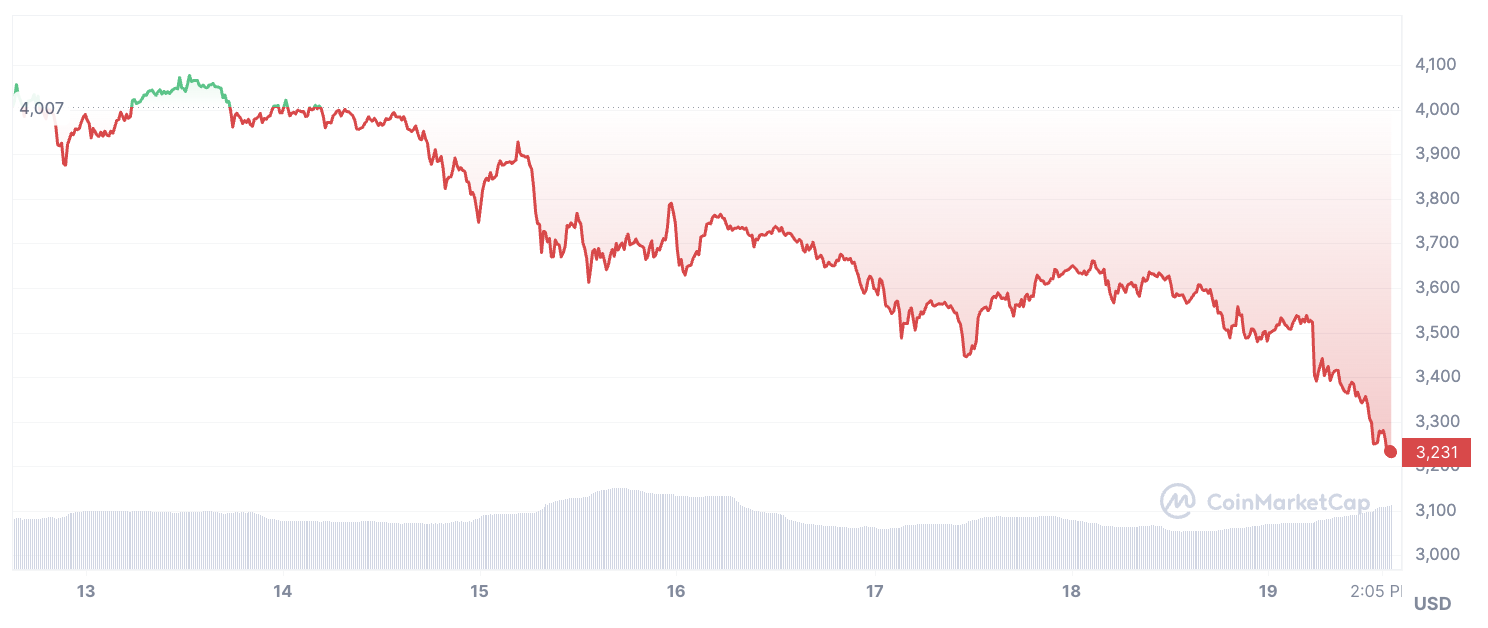

These moves come against the backdrop of Ethereum’s price dropping more than 11% since the start of the week. After hitting a two-year high of $4,093 last week, Ethereum faced a significant sell-off, causing its price to fall to $3,200 per ETH.

glass coin reports that positions totaling $120 million were liquidated in the last 24 hours, of which approximately 85% were long positions, suggesting a wave of massive selling and profit-taking among investors.

Massive cash withdrawals by ETH whales amid the price crash raise questions about the future trajectory of Ethereum and the broader cryptocurrency market. Whether the leading altcoin finds a foothold will largely be both the cause and consequence of how events unfold.