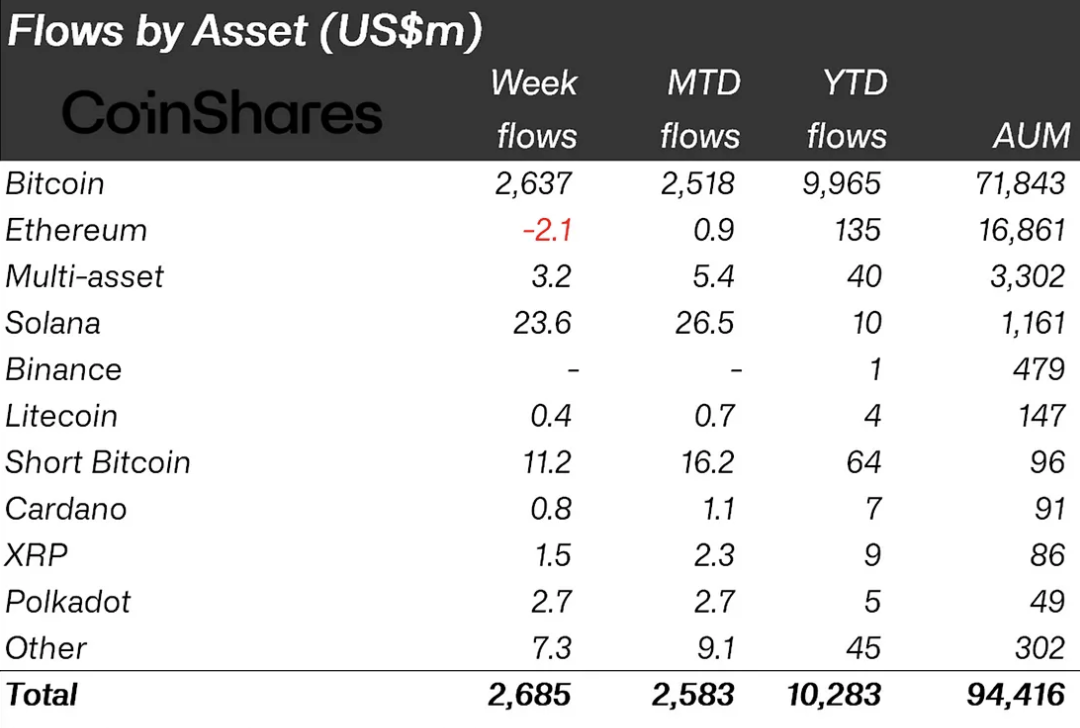

The last CoinShares The report on the flow of funds in the cryptocurrency-oriented investment products market has revealed important movements in the landscape. In particular, XRP-oriented investment products attracted a notable influx of $1.5 million last week. This marks a continuation of XRP’s upward trajectory, with a total of $2.3 million flowing in since the beginning of March and a substantial $9 million since the beginning of the year.

The last CoinShares The report on the flow of funds in the cryptocurrency-oriented investment products market has revealed important movements in the landscape. In particular, XRP-oriented investment products attracted a notable influx of $1.5 million last week. This marks a continuation of XRP’s upward trajectory, with a total of $2.3 million flowing in since the beginning of March and a substantial $9 million since the beginning of the year.

These figures underline XRP’s rise as one of the leaders among altcoin-oriented investment products. Only Solana (SOL), at $23.6 million, and unexpectedly Polkadot, at $2.7 million, have shown larger inflows, demonstrating XRP’s enduring appeal to investors.

The surge in XRP inflows coincides with a broader rally in the cryptocurrency market, driven by Bitcoin’s historic price rise and a substantial influx of funds into Bitcoin ETFs. The current ETF boom has driven digital asset investment products to record levels, with weekly inflows reaching an impressive $2.7 billion. This brings total inflows so far this year to $10.3 billion, moving ever closer to the record inflows of $10.6 billion seen in all of 2021.

Additionally, buoyant market conditions have resulted in staggering trading volume figures, which reached $43 billion for the week, a substantial increase from the previous week’s record of $30 billion. These recent price increases have also driven total assets under management (AuM) to a record level of $94.4 billion, up a notable 14% over the past week and a staggering 88% increase so far. of the year.