Spot cryptocurrency ETFs just launched in Hong Kong could help us predict what demand for Ether ETFs might be in the United States.

Or not.

In any case, the new funds offer a starting point, so to speak, to consider the current differing investor interests in ETH and BTC and how this may evolve.

The Securities and Exchange Commission’s approval of spot bitcoin ETFs in January provided euphoria during a month often marred by holiday hangovers.

Many wondered what the immediate and long-term demand for these highly anticipated products would be. Another common question following the industry’s regulatory victory: When will we see spot ether ETFs?

After all, ether is the second-largest crypto asset by market cap, with a market capitalization of $370 billion, nearly a third of bitcoin’s $1.25 trillion. US issuers have started trying to launch spot ETH products as early as 2021.

Not to mention, Ether has a regulated futures market and (what do you know) the SEC has already approved ETFs that hold ETH futures contracts. Those launched last October.

While the regulator is set to rule on spot ether products this month, it is unclear when the SEC might finally allow them to trade.

To know more: Ether ETF Coming in May? That’s why many are bearish

But launch timing aside, the other question is what the demand will be if and when they debut.

Between the asset bases of ether futures ETFs, data on U.S. bitcoin spot fund flows, and seed capital for Hong Kong’s bitcoin and ether offerings, perhaps we’re starting to paint a picture.

Or maybe fortune-telling related to cryptocurrencies, even with data entry, is a fool’s game.

However, I try to make sense of the numbers

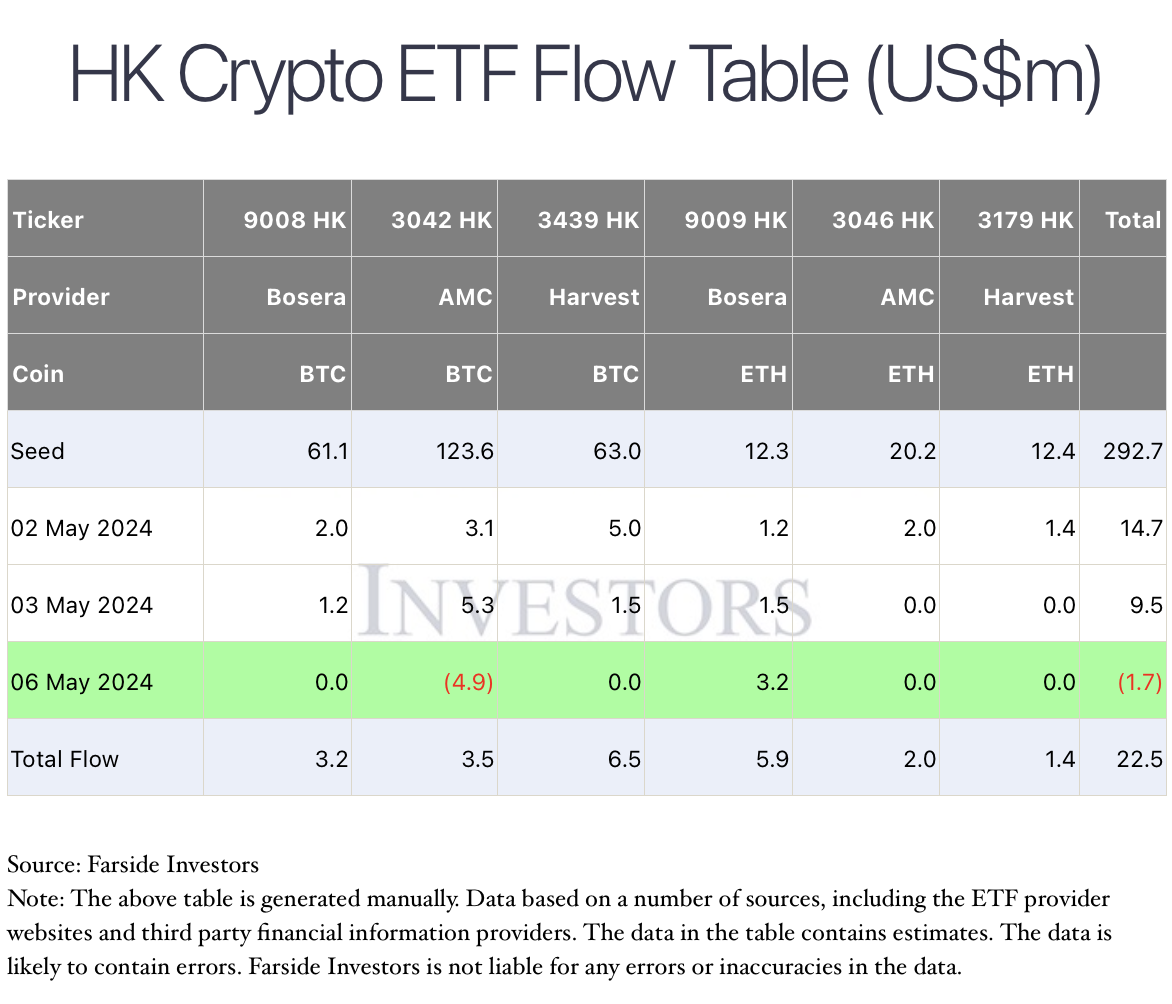

According to data from Farside Investors, the six new spot ETFs on Hong Kong cryptocurrencies (three bitcoin funds and three ether funds) have opened initial capital worth $292 million.

Bitcoin funds attracted a significantly larger share of initial capital, with the Ether ETF’s day one assets accounting for 15% of the total, analyst Eric Balchunas noted.

He and others pointed to the initial capital for offerings, used to fund ETF creation units, as a proxy for comparing demand for BTC and ETH. Subsequent flows into the six funds have been insignificant, amounting to about $23 million over the past three trading days, making initial capital perhaps the best barometer.

The US and Hong Kong obviously differ, and Hong Kong ETFs have just been launched. But at least we have some numbers to work with.

Sumit Roy, senior analyst at ETF.com, said the 15% initial asset ratio for ether ETFs in Hong Kong seems about right to him.

“It’s not peanuts,” he told Blockworks. “But since Ether has much less name recognition than Bitcoin, it is natural that it attracts fewer investment dollars than Bitcoin from ETF investors.”

Matthew Sigel, head of digital asset research at VanEck, noted that Hong Kong ETH funds accept in-kind subscriptions and redemptions – a feature the SEC is unlikely to allow for proposed U.S. ether ETFs.

Such a transaction model allows investors to buy and sell ETF shares using the ETF’s underlying asset – in this case ETH – rather than cash.

Given this expected difference, Hong Kong’s BTC/ETH ratio “may not be the best indicator” for predicting U.S. demand, he said, adding that they could garner less than 15% of the inflows recorded by bitcoin funds.

The 11 spot Bitcoin ETFs in the U.S. have totaled nearly $11.6 billion since most of them launched on Jan. 11.

The “Ethereum story” has room to grow

While it would make sense for spot ether ETFs to initially see a similar percentage of bitcoin ETF assets in the U.S. as they did in Hong Kong, Roy said, that could be short-lived.

“As the history of Ethereum becomes better known and people begin to appreciate the return – if available to ETF investors – that comes from staking ether, they may even prefer the cryptocurrency over bitcoin,” he noted.

The ability of ETFs to stake could be the key to wider adoption.

Hong Kong funds do not offer this advantage. In recent months, potential issuers of spot ether ETFs in the United States have added terms related to staking their assets to their applications.

Ether staking is the process of depositing ETH to secure the Ethereum blockchain and earning yield on that ETH for doing so.

Christopher Jensen, who leads cryptocurrency research at traditional finance giant Franklin Templeton, told Blockworks in an April interview that bitcoin’s simple “store of value” characteristics may be a “block” for some institutional investors .

ETH resonates better with some of them.

“Many times, [an investor will say] ‘with Ethereum, I understand that it generates revenue and has a yield and is more like aa [traditional finance] resource,” Jensen noted.

Roy said he expects ether ETFs to initially attract the same types of investors as bitcoin ETFs, albeit in smaller numbers. These include those who want to speculate on the price or invest in an alternative store of value.

Sigel agrees that a non-staking ether ETF would likely be attractive more to speculators than long-term investors.

“But over time,” Roy added, “ether ETFs could appeal to a broader spectrum of investors than bitcoin ETFs as people come to appreciate that ether is much more than just a store of value.”