Table of Contents

Market capitalization of cryptocurrencies 2023

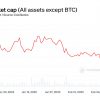

The cryptocurrency market capitalization, often referred to as “crypto market cap,” is the total value of all cryptocurrencies in circulation. It is calculated by multiplying the current price of each cryptocurrency by the total supply of that particular cryptocurrency and then summing up these values for all cryptocurrencies in existence.

Understanding market capitalization of cryptocurrencies

Market capitalization is a crucial metric in finance, aiding in risk assessment for potential investors. It takes into account both the stock price and the company’s size. Here’s a breakdown of its components and implications:

Stock Price

- High Demand Boosts Price: When a company goes public, supply and demand dynamics come into play, influencing stock prices. Increased demand typically drives prices higher.

Company Size 2. Large Companies (>$10 Billion): Established giants like Apple and Amazon offer stability but may not yield quick returns due to their sheer size. They enjoy favorable financing terms but face limited growth opportunities.

Average Capitalization (Between $2 and $10 Billion): Mid-cap companies are poised for growth but carry more risk than large enterprises, making them attractive to investors interested in potential high returns.

Small Capitalization (<$2 Billion): These companies, often in emerging markets or niches, come with high risk due to their smaller size, novelty, and limited resources.

Mergers and Acquisitions 5. Enterprise Value: Market capitalization measures share value but doesn’t determine acquisition cost. Enterprise value factors in liabilities and cash, aiding in assessing potential mergers and acquisitions.

Cryptocurrency Market Capitalization Understanding market capitalization in the cryptocurrency realm is essential for investors. It involves:

Price and Market Value 6. Price and Market Value: Investors evaluate cryptocurrency coins based on their price and market value, akin to traditional investments. Market value provides a comprehensive overview of the cryptocurrency’s standing.

- Calculation Method: Cryptocurrency market capitalization is computed by multiplying the circulating supply by the coin’s market price, revealing the market value of the coin.

Examples:

- Cryptocurrency No. 1: 500,000 tokens with a market value of $500K, resulting in a $1 per token value.

- Cryptocurrency No. 2: 125,000 tokens with a market value of $250K, equating to a $2 per token value.

Market Capitalization Categories in Cryptocurrencies 8. Large Capitalization (>$10 Billion): Includes Bitcoin, Ethereum, and top 20 altcoins, offering stability and liquidity.

Average Capitalization ($1 – $10 Billion): Associated with higher risk but significant growth potential.

Small Capitalization (<$1 Billion): Offer substantial profit potential but exhibit greater price volatility.

Token Supply Metrics When considering cryptocurrency market capitalization, it’s essential to assess supply metrics, including:

Circulating Offer: Reflects tokens actively circulating in the market.

Total Offer: Encompasses all tokens currently in existence, excluding burned tokens.

Maximum Offer: Represents the maximum number of tokens that can ever exist.

Negotiable vs. Fully Diluted Offer Using Bitcoin as an example, the choice of supply metric impacts market capitalization. For instance, 19 million BTC in circulation leads to a lower market capitalization than the fully diluted supply of 21 million BTC.

Investors must be mindful of future supply changes, including locked tokens that can impact market capitalization. Evaluating market capitalization through various supply metrics offers a more comprehensive perspective in the cryptocurrency space.

A cryptocurrency exchange is an online platform where you can buy, sell, or trade cryptocurrencies like Bitcoin, Ethereum, and others.

Safety varies by exchange. Look for platforms with strong security measures, like two-factor authentication and cold storage for funds.

Consider factors like security, fees, available coins, user interface, and customer support.

Centralized exchanges are managed by a company, while decentralized exchanges operate without a central authority.

Many exchanges require Know Your Customer (KYC) verification for security and regulatory compliance.

Trading fees vary but typically include maker fees (for adding liquidity) and taker fees (for removing liquidity).

Yes, most exchanges offer cryptocurrency-to-cryptocurrency trading pairs.

Withdrawal times depend on the exchange and the cryptocurrency. Some are instant, while others may take hours or even days.

A wallet address is like a bank account number for cryptocurrencies. It’s required to send your crypto to the right place.

Yes, depending on your country’s tax laws, trading cryptocurrencies may have tax consequences. Consult a tax professional for guidance.

Yes, many cryptocurrency exchanges operate 24/7, allowing you to trade at any time.

A market order buys or sells at the current market price, while a limit order sets a specific price at which you want to buy or sell.

Yes, each exchange sets its own minimum and maximum trading limits, which can vary widely.

It’s not recommended. For security, it’s better to use a cryptocurrency wallet, especially for significant holdings.

Exchanges typically have account recovery processes, including password reset options and support for forgotten usernames.

Some exchanges offer insurance, but coverage can be limited. It’s essential to check an exchange’s insurance policy.

Use strong passwords, enable two-factor authentication, and be cautious of phishing scams and suspicious emails.

Yes, but it’s recommended to learn the basics of trading and understand the risks involved before you start.

Stablecoins are cryptocurrencies pegged to the value of a fiat currency like the US dollar. They provide stability and are commonly used for trading and transferring funds on exchanges.

Yes, regulations vary by country. Many countries have implemented or are considering regulations to govern cryptocurrency exchanges for consumer protection and financial stability.