- Convenient access to futures trading.

- Seamless access to perpetual contracts and options.

- Diverse opportunities for passive income.

- Capability to deposit and retain fiat currency.

- Demonstrated commitment to robust security measures.

- Unavailability in the United States and certain other regions.

- Limited selection with only four spot trading coins.

- Insufficient resources tailored for beginners.

Quick Facts About Bybit

Operating Entity: Bybit exchange is run by Bybit Fintech Limited, a company registered in the British Virgin Islands.

Experienced Team: Bybit’s executive team consists of industry experts with backgrounds in the forex industry and banking sector. Some team members have previous affiliations with renowned institutions like Morgan Stanley and Tencent.

Product Diversity: Bybit offers three main product categories for trading: Spot, Derivatives, and Options, providing a range of options for traders with varying strategies and preferences.

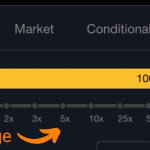

Leverage: Traders on the Bybit platform have access to leverage, with ratios reaching as high as 100:1, enabling the potential for amplified gains or losses.

Incentives: Bybit offers attractive incentives for users who sign up using their referral links, providing additional benefits to those who join the platform through these links.

Table of Contents

History of ByBit Exchange

Foundation and Early Development (2018-2019):

- Bybit was founded in March 2018 by a group of cryptocurrency enthusiasts and experts in blockchain technology.

- The exchange officially launched its services in December 2018, initially offering Bitcoin perpetual contracts.

- Bybit started gaining traction in the crypto trading community due to its user-friendly interface, high leverage options, and robust trading engine.

Rapid Growth and Expansion (2019-2020):

- In 2019, Bybit expanded its offerings to include contracts for Ethereum (ETH), Ripple (XRP), and EOS (EOS), in addition to Bitcoin.

- The exchange introduced a variety of trading pairs and derivatives products, catering to both retail and institutional traders.

- Bybit’s user base grew substantially, as traders appreciated its competitive fee structure and responsive customer support.

Introduction of New Features (2020-2021):

- Bybit continued to innovate and introduced features like the Mutual Insurance Fund to protect traders against adverse market movements.

- In 2020, the exchange launched its spot trading platform, enabling users to trade a selection of cryptocurrencies in addition to derivatives.

- Bybit also expanded its global presence, establishing offices in multiple countries and offering services to traders worldwide.

Security and Compliance (2020-2021):

- Bybit placed a strong emphasis on security, implementing advanced security measures to safeguard user funds and data.

- The exchange also focused on regulatory compliance, adapting to evolving cryptocurrency regulations in different regions.

Challenges and Controversies (2020-2021):

- Like many cryptocurrency exchanges, Bybit faced challenges related to scalability and handling high trading volumes during periods of market volatility.

- It also encountered regulatory scrutiny in some countries, prompting the exchange to adapt its services accordingly.

Who Owns Bybit?

Bybit, established in 2018, has its roots traced back to its founder and current CEO, Ben Zhou. Ben Zhou brings a wealth of experience to the cryptocurrency industry, derived from his successful tenure in the forex market, where he effectively operated a forex exchange for a remarkable span of eight years.

Ben Zhou, owner & CEO of Bybit

Furthermore, Bybit’s success isn’t solely attributed to Ben Zhou. The exchange boasts a formidable team comprising individuals with diverse and substantial backgrounds. Notably, several key team members have harnessed their expertise from renowned organizations such as Morgan Stanley and Tencent, adding a layer of credibility and professionalism to the platform’s operations.

The combined experience and knowledge of these co-founders and team members have played a pivotal role in Bybit’s rapid ascent in the cryptocurrency exchange landscape, contributing significantly to its remarkable success.

Where Is Bybit Based?

Bybit’s primary headquarters are situated in Dubai, with additional operational offices established in Hong Kong. The exchange conducts its operations under the corporate entity Bybit Fintech Limited, which is officially registered in the British Virgin Islands.

Exchange Native Token

ByBit, while not having its proprietary token, is affiliated with BitDAO, a collective entity. BitDAO features BIT as its native token. BitDAO, distinct from a traditional company, comprises a community of developers and stakeholders, all vested in the success of the project through their holdings of BIT tokens.

There were no widely reported security breaches or hacks involving Bybit.

Are Bybit Services Available to U.S. Citizens?

Technically, it is not illegal for residents of the United States to engage in leverage trading on the Bybit platform. Historically, some users from restricted regions, like the U.S., attempted to circumvent these restrictions by using virtual private networks (VPNs) to obtain IP addresses from unrestricted countries. However, Bybit revised its policy in May 2023, introducing mandatory Know Your Customer (KYC) procedures for both new and existing users.

Now, to perform actions beyond simple cryptocurrency withdrawals, users must undergo level-1 verification. This process entails submitting a selfie and a government-issued ID for review by the Bybit team. Importantly, the provided ID cannot be from a restricted region, effectively excluding U.S. users from the Bybit app.

However, the implementation of KYC by Bybit might open the door for potential approval from the U.S. Securities and Exchange Commission (SEC). The SEC typically requires cryptocurrency trading platforms to have robust controls, including KYC procedures, for individual investors to trade derivatives legally. Nevertheless, given the current regulatory climate in the United States concerning cryptocurrencies, approval is not guaranteed.

It’s worth noting that Bybit’s restricted access is not limited to the United States. Bybit made the decision to exit the United Kingdom in 2021 and announced plans to discontinue services in Canada in 2023. Additionally, due to regulatory actions, Japan may follow suit. Bybit is also inaccessible in several countries, including China, Russia, Iran, and North Korea, for reasons beyond the exchange’s control.

Bybit Interface & User Experience: User-Friendly Design

Bybit’s interface is designed to provide users with a user-friendly and visually appealing experience. Here are some key aspects of Bybit’s interface and user experience:

User-Friendly Design: Bybit’s interface is often praised for its user-friendliness. It offers a clean and intuitive layout, making it easier for users to navigate the platform and execute trades.

Inspired by Binance: Bybit’s interface appears to draw inspiration from Binance, another well-known cryptocurrency exchange recognized for its user-friendly design. This design approach aligns with the notion that user-friendliness contributes to the success of cryptocurrency exchanges.

Dark and Normal Mode: Bybit offers both dark and normal modes for its interface, allowing users to select the visual style that suits their preferences.

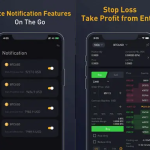

Mobile Application: Bybit has developed a mobile application available for both iOS and Android users. The mobile app offers functionality similar to the desktop version, including advanced charting tools and order management. Users can receive push notifications for various price levels, enabling them to stay updated on their trades while on the go.

Positive Reviews: Bybit’s mobile app has garnered positive reviews on both the iTunes Store and Google Play, indicating its functionality and user satisfaction.

Visual Real Estate: While the mobile app provides traders with the flexibility to monitor their positions on the go, traders who require extensive chart analysis and market monitoring may prefer the larger screen of the web and PC-based trading versions.

Bybit’s emphasis on user-friendliness, along with its mobile app offering, caters to a diverse range of traders, from those seeking quick access to their positions to digital nomads who need to manage trades while on the move. The availability of dark and normal modes allows users to customize their visual experience on the platform.

Available Coins and Derivatives on Bybit

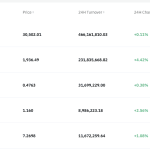

Bybit distinguishes itself as a cryptocurrency exchange primarily focused on derivatives trading, and while its selection of outright purchasable coins is relatively limited compared to other exchanges, it offers a diverse range of trading pairs, totaling nearly 400, with many involving Bitcoin as a base currency.

Spot Trading:

- Bybit allows outright purchase of 27 different cryptocurrencies, which is notably fewer than most other exchanges.

Derivatives Market: For those interested in derivatives trading, Bybit offers a more extensive range of options:

Perpetual Contracts: Bybit provides over 250 contracts, including perpetual contracts that never expire. These perpetual contracts allow traders to hold positions indefinitely, provided they can cover the associated funding fees.

Inverse Perpetual Contracts: These contracts, unlike traditional futures, are settled in cryptocurrency rather than fiat currency, making them useful for traders looking to increase their exposure to specific cryptocurrencies, such as Bitcoin.

Futures Contracts: Bybit offers traditional futures contracts, which are binding agreements to buy or sell an asset at a predetermined price on a future date. Traders use futures to speculate on price movements, either going long (expecting prices to rise) or short (expecting prices to fall).

Options Contracts: Bybit also provides options contracts, which come with an expiration date. However, unlike futures contracts, the holder isn’t obligated to fulfill the contract upon maturity. All of Bybit’s available options are settled in USDC, a stablecoin.

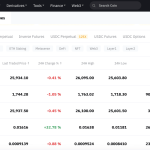

Here are the top 10 trading pairs by 24-hour trading volume on Bybit at the time of this writing:

- BTC/USD (USDT perpetual)

- ETH/USDT (USDT perpetual)

- BTC/USD (inverse perpetual)

- LINA/USDT (USDT perpetual)

- PEPE/USDT (USDT perpetual)

- BNB/USDT (USDT perpetual)

- XRP/USDT (USDT perpetual)

- SOL/USDT (USDT perpetual)

- MATIC/USDT (USDT perpetual)

- SUI/USDT (USDT perpetual)

Bybit’s derivatives market caters to a wide array of blockchain use cases, including metaverse coins, NFTs, Ethereum staking, and decentralized finance (DeFi). Traders can engage in these markets to speculate on the price movements of various cryptocurrencies and digital assets.

Crypto Trading on Bybit: A Comprehensive Overview

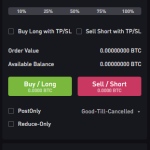

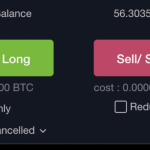

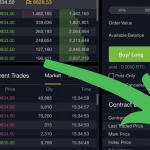

At first glance, Bybit’s user interface appears quite similar to that of many other cryptocurrency exchanges. It offers a user-friendly one-click interface for straightforward spot purchases and features a peer-to-peer (P2P) trading section. Notably, Bybit also includes a panel for converting one cryptocurrency into another, and this service is offered free of charge. Additionally, users can deposit fiat currency and hold it in their accounts without immediately purchasing cryptocurrencies, providing added flexibility.

Fiat Deposits: Bybit permits fiat deposits with limits set at $20,000 per day for level 1 verification and $100,000 per day for level 2 verification. This allows users to onboard funds from traditional currencies into the cryptocurrency market.

Derivatives and Leveraged Trading: Bybit’s distinctive focus on derivatives and leveraged trading sets it apart. The platform offers beginner-friendly interfaces for margin trading and leveraged tokens, providing easier access to high-risk, high-reward trading opportunities.

Risk Mitigation: Bybit offers risk management features, including an insurance fund that protects leveraged positions. This means that traders cannot lose more than their initial margin. If the market price falls below the liquidation price, the system automatically sells the assets, preventing further losses. The cost of this insurance is funded by traders’ activities on the platform.

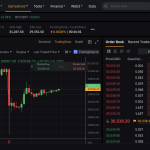

Derivatives Trading Interface: By heading to the derivatives portal, users can access the full range of derivative trading pairs. All of Bybit’s primary derivative products can be traded on a single interface. The platform provides various indicators and a continually updating order book for market analysis and informed decision-making.

Advanced Tools: Bybit offers a variety of advanced tools, including a time-weighted average price (TWAP) tool for more precise long-term orders. Copy trading allows users to emulate successful investors’ trading strategies. Additionally, there is an on-site interface for building and managing trading bots, making automated trading more accessible.

Crypto Loans: Bybit provides crypto loan services, allowing users to use their crypto holdings as collateral. These loans are commonly used for margin trading but can also be employed for staking or withdrawal to other wallets.

Bybit MasterCard: Bybit offers a MasterCard that is linked to users’ crypto wallets, enabling them to make purchases at locations where MasterCard is accepted, providing a bridge between the crypto and traditional financial worlds.

Bybit’s comprehensive offering of trading features, risk management tools, and accessibility to leveraged trading makes it an attractive platform for both experienced and risk-tolerant traders. However, users should be aware of the associated risks and consider their trading strategies carefully.

Bybit Copy Trading: A User-Friendly Trading Option

Bybit offers a copy trading feature that simplifies cryptocurrency trading, especially for individuals who may lack previous trading knowledge and experience. Copy trading allows traders to select an experienced trader registered on the Bybit exchange to follow and automatically replicate their trading strategies.

Here are some key aspects of Bybit’s copy trading feature:

Expert Trader Selection: Copy trading enables users to choose an expert trader from the pool of registered traders on the Bybit platform. Users can select a trader whose trading style and performance align with their goals and risk tolerance.

Profit and Loss Replication: When individuals engage in copy trading on Bybit, they mirror the trading activities of the expert trader they are following. This means they experience the same profits and losses as the expert trader. This can be beneficial for less experienced traders as it allows them to benefit from the expertise of others.

Profit Sharing: To participate in copy trading on Bybit, users agree to share 10% of their net profit with the expert trader they are copying. This incentivizes expert traders to make sound trading decisions, as their earnings are linked to the success of those following them.

Simplicity for New Traders: Copy trading on Bybit provides an accessible and straightforward way for new traders to engage in cryptocurrency trading, even if they lack comprehensive knowledge of the crypto market. It allows them to leverage the expertise of more experienced traders.

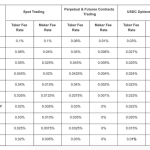

Trading Fees & Rates

The trading fees you encounter on Bybit are influenced by several key factors, including the type of products you’re trading, your VIP level, and whether you are a maker or a taker. Let’s delve into the intricacies of Bybit’s trading fees:

Maker vs. Taker: Bybit distinguishes between two types of traders: makers and takers. Makers place limit orders, contributing to the exchange’s trading volume, while waiting for their orders to be executed. Takers, on the other hand, place market orders that are immediately executed, reducing Bybit’s market depth.

Fee Levels by Product:

- Spot Trading: For spot trading, both makers and takers begin with a fee of 0.1%.

- Contract Trading: Contract trading starts with a taker fee of 0.06% and a maker fee of 0.01%.

- USDC Option Trading: USDC option trading begins with a fee of 0.03% for all users.

VIP Program: Bybit offers a VIP program that rewards traders based on their trading volume. To qualify for VIP status, users must either trade over $250,000 per month or maintain that amount in their trading account. VIP status unlocks improved fee structures. For instance, at VIP level 1, taker fees for contracts drop to 0.05%, and maker fees reduce to 0.006%. Once your trading volume exceeds $500 million, maker trades become fee-free.

Deposit and Withdrawal Fees: Bybit typically does not impose fees on deposits. However, the platform does charge withdrawal fees, and these fees vary depending on the specific blockchain used for the withdrawal. Users can find the withdrawal fee for each blockchain in the dropdown menu when selecting a chain for withdrawal.

Funding Fees: Traders who hold perpetual contracts on Bybit are required to pay funding fees to maintain their positions. Since perpetual contracts do not have expiration dates, funding fees serve as a mechanism to ensure that contract prices remain in close proximity to the asset’s index price. If perpetual contracts are priced higher than the index price, long position holders (those speculating on price increases) pay short position holders (those speculating on price decreases), and vice versa if perpetual contracts are priced lower than the index price.

Staking and Passive Earnings on Bybit

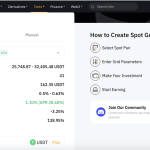

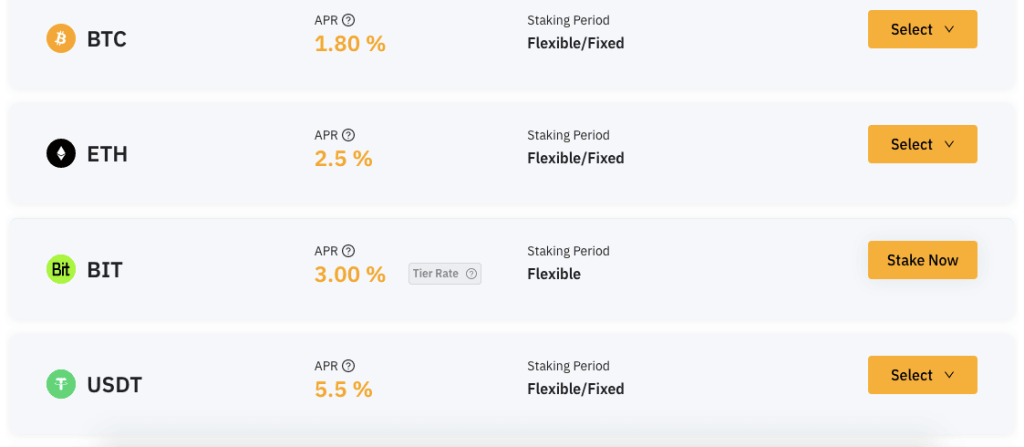

Bybit provides a variety of options for users looking to engage in staking and passive income generation, all grouped under the Bybit Earn umbrella. Here’s an overview of the different opportunities available:

Bybit Savings: Bybit Savings is a stable and steady option for users interested in staking. This involves locking up a portion of a specific cryptocurrency in exchange for earning interest on it. The yields vary, ranging from a modest 1.8% for BTC to a potentially more lucrative 18% for tokens like MEE (the in-game token for the blockchain-based strategy game Medieval Empires). It’s important to note that while high yields are possible, they often come with higher risks.

Liquidity Mining: For users seeking passive income with a higher risk tolerance, Bybit offers liquidity mining. Unlike traditional staking, liquidity miners provide their crypto assets to an exchange to enhance its liquidity. While it may not be as lucrative as in the past, some investors still find value in supporting an exchange’s community through this method.

Dual Asset Trading: Dual asset trading on Bybit is a strategy designed to hedge against potential losses. Traders set a target price for a specific coin and lock up their funds. If the coin’s price aligns with the target price, the trader either buys more (if the price is higher) or sells for more (if the price is lower). This approach minimizes risk but involves locking in your funds for a longer duration.

stETH Staking: Bybit offers staking for Ethereum 2.0’s new stETH token. Stakers earn a daily yield, with an average annual yield of approximately 4%. This allows users to participate in Ethereum’s transition to a proof-of-stake consensus mechanism and earn rewards in the process.

Launchpool: Bybit’s Launchpool is designed to incentivize the use of newly launched tokens. Users can stake their tokens in the Launchpool to earn rewards, making it an attractive option for those looking to participate in the early stages of new projects.

Bybit’s range of staking and passive earning options provides users with the flexibility to choose the strategy that aligns with their risk tolerance and financial goals. However, it’s essential for users to conduct thorough research and understand the associated risks before participating in these programs.

Funding Methods (Deposit and Withdrawal) on Bybit

Bybit has evolved from its initial crypto-to-crypto exchange model and now offers a more diverse range of funding methods, making it easier for users to deposit and carry out transactions on the platform. Here’s an overview of the funding options available on Bybit:

Fiat Currencies: Bybit now supports over 55 fiat currencies, allowing users to deposit and trade with traditional currencies like USD and EUR. This expanded fiat support facilitates easier onboarding of funds from the conventional financial system into the cryptocurrency market.

Cryptocurrencies: Users can deposit and transact with more than 20 cryptocurrencies on the Bybit platform. This includes popular cryptocurrencies like Bitcoin, Ethereum, XRP, and EOS, providing a wide range of options for trading and investment.

Payment Methods: Bybit accommodates an extensive selection of over 547 payment methods, ensuring flexibility and convenience for users. Among these methods, users have the option to make payments using credit cards, streamlining the utilization of the crypto exchange and simplifying the funding process.

The inclusion of fiat support, cryptocurrencies, and a broad array of payment methods enhances accessibility and usability for Bybit users, making it more convenient for both beginners and experienced traders to engage with the platform.

Bybit Withdrawal Time: A Unique Feature

Bybit distinguishes itself from other leverage exchanges by offering a unique withdrawal schedule that allows users to withdraw funds multiple times per day, rather than just once a day at a specific time. Here’s an overview of Bybit’s withdrawal time policy:

Withdrawal Frequency: Bybit users can initiate withdrawals up to three times per day, providing greater flexibility for managing their funds.

Withdrawal Times: Withdrawal times on Bybit occur at specific intervals during the day. These withdrawal times are set at 0800, 1600, and 2400 UTC. Users can submit withdrawal requests at any of these times, depending on their preferences and requirements.

Pending Withdrawals: When a withdrawal request is made, it enters a pending status until it is confirmed by Bybit. The duration of the pending status depends on the time of the withdrawal request and the next scheduled withdrawal time.

Confirmation Timing: Withdrawal requests are confirmed by Bybit at the scheduled withdrawal times. Consequently, the withdrawal time could vary depending on the time the request is made in relation to the next scheduled confirmation time.

Maximum Time: The maximum time users may need to wait for a withdrawal confirmation is 8 hours. This is because withdrawal confirmations occur every 8 hours, aligning with Bybit’s withdrawal schedule.

30-Minute Rule: There is a 30-minute rule to consider. Withdrawal requests submitted after 0730 UTC will not be confirmed at 0800 UTC but will instead be confirmed at the next scheduled withdrawal time, which is 1600 UTC.

Security and Fund Safety on Bybit

Security is a paramount concern for cryptocurrency traders and investors, and it’s important to evaluate the safety measures taken by cryptocurrency exchanges. Here’s a look at the security and fund safety measures implemented by Bybit:

Hacking History: As of the information available up to my knowledge cutoff date in September 2021, Bybit had not experienced any reported security breaches or hacks. This track record places it among exchanges with a strong security history, similar to exchanges like BitMEX, Kraken, and Coinbase.

Trust and Risk: It’s essential for users to understand that no cryptocurrency exchange is entirely risk-free. When depositing funds on any exchange, users inherently place trust in that platform to safeguard their assets. It’s vital to conduct due diligence and assess the credibility of the exchange before using it.

Cold Storage: Bybit employs a security measure by storing user funds in cold storage. Cold storage is an offline method of storing cryptocurrencies, making it less susceptible to hacking attempts compared to hot wallets (online wallets).

Compensation for Loss: Bybit’s commitment to customer fund protection includes a promise to provide full compensation to customers in the event of a hack or security breach. This demonstrates a proactive approach to mitigating potential losses for users.

Proof of Reserve: Bybit has taken an additional step to enhance transparency and trust by providing Proof of Reserve for funds under its control. This measure allows users to verify the exchange’s solvency and the existence of sufficient reserves to cover user balances.

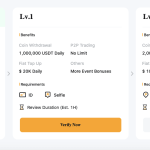

Bybit and KYC (Know Your Customer) Verification

Bybit is a secure trading platform that encourages its users to undergo the KYC (Know Your Customer) verification process. While trading cryptocurrencies like Bitcoin and Ethereum is possible on Bybit without completing KYC, there are limitations on withdrawal amounts. Here’s an overview of Bybit’s KYC policy and the levels of verification:

No KYC (Withdrawal Limit): Users who choose not to complete KYC verification can still trade cryptocurrencies on Bybit. However, their daily withdrawal limit is restricted to 2 BTC (Bitcoin) per day.

Level 1 KYC (50 BTC Withdrawal Limit): Users who opt for Level 1 KYC verification can increase their daily withdrawal limit to 50 BTC. To complete Level 1 KYC, users are required to provide the following information:

- Document issued by the country of origin (ID card/Passport)

- Facial recognition screening

Level 2 KYC (100 BTC Withdrawal Limit): For those seeking an even higher daily withdrawal limit of 100 BTC, Bybit offers Level 2 KYC verification. In addition to the Level 1 requirements, Level 2 KYC requires the submission of “Proof of residential address.” This can be provided by submitting documents such as a bank statement, utility bill, or any government-issued residential proof.

How to Complete KYC Verification on Bybit: Completing KYC verification on Bybit is a straightforward process:

- Log in to your Bybit account.

- Click on “Account & Security” in the upper right-hand corner of the screen.

- Under “Account Information,” find the “Identity Verification” column.

- Click “Verify Now” under Lv.1 or Lv.2 Verification, depending on the level you wish to achieve.

- Follow the prompts to provide the necessary information and documentation as per the selected level of verification.

Reasons to Choose Bybit Exchange

Lightning-Fast Transactions: Bybit boasts one of the industry’s fastest transaction times, with an impressive throughput of over 135,000 transactions per second (tps), ensuring swift and efficient trading experiences.

Extensive Fiat Support: Bybit goes beyond the crypto realm by accepting up to 55 fiat currencies and offering a whopping 547 payment methods on its platform, making it accessible to users worldwide.

Credit Card Payments: The inclusion of credit card support allows users to complete a wide range of transactions seamlessly on the platform, enhancing convenience.

Spot Trading Variety: Bybit supports spot trading with a substantial selection of over 371 trading pairs, featuring 60 listed tokens and a robust daily trading volume of $3.4 billion.

Diverse Futures Trading: The exchange caters to futures traders by offering various futures products, including Inverse Perpetual, USDT Perpetual, and Inverse Futures, catering to different trading preferences.

Leading Options Platform: Bybit is recognized as a top-tier crypto options trading platform, collaborating with up to 5 professional options market makers as exchange partners, ensuring a competitive and comprehensive options trading experience.

Crypto Loans: Bybit’s crypto loan services empower users to utilize their funds across the Bybit ecosystem, including spot, margin, and futures trading, with exceptionally low-interest rates starting at 0.0002%.

Zero Trading Fees: Bybit stands out with one of the industry’s most substantial zero-trading fee campaigns, saving traders costs on their transactions.

These standout features, among others, have attracted a growing number of traders to Bybit. As a renowned and award-winning crypto exchange platform, Bybit is expected to continue its trajectory of innovation and growth in the crypto industry in the year 2023 and beyond.

Bybit Exchange Customer Support – 24/7

bybit help center

Bybit sets itself apart in the cryptocurrency exchange landscape with its standout feature: exceptional 24/7 customer support. This level of support is often regarded as one of the most compelling reasons to choose Bybit as your trading platform. Here’s why:

Prompt Responsiveness: Bybit’s customer service agents are known for their rapid response times. They prioritize addressing user inquiries and concerns promptly, ensuring a smooth and efficient trading experience.

Customer-Centric Approach: Bybit’s support team is dedicated to going the extra mile to assist users. They consistently strive to provide comprehensive solutions and assistance, putting the customer’s needs at the forefront.

Positive User Feedback: Bybit’s customer support has garnered widespread acclaim across social media platforms and within the cryptocurrency community. Influential figures on platforms like YouTube frequently highlight Bybit’s stellar customer service as a major differentiator from its competitors.

Comparison with BitMEX: When compared to BitMEX, Bybit emerges as the clear winner in terms of customer support. BitMEX has faced criticism for slow responses and, at times, offering unsatisfactory solutions to user problems.

Ease of Contact: For convenient communication with the Bybit team, users can simply click the chat box located in the bottom right corner of the platform’s interface, ensuring quick access to assistance whenever needed.

Assessment of Bybit’s Help Center:

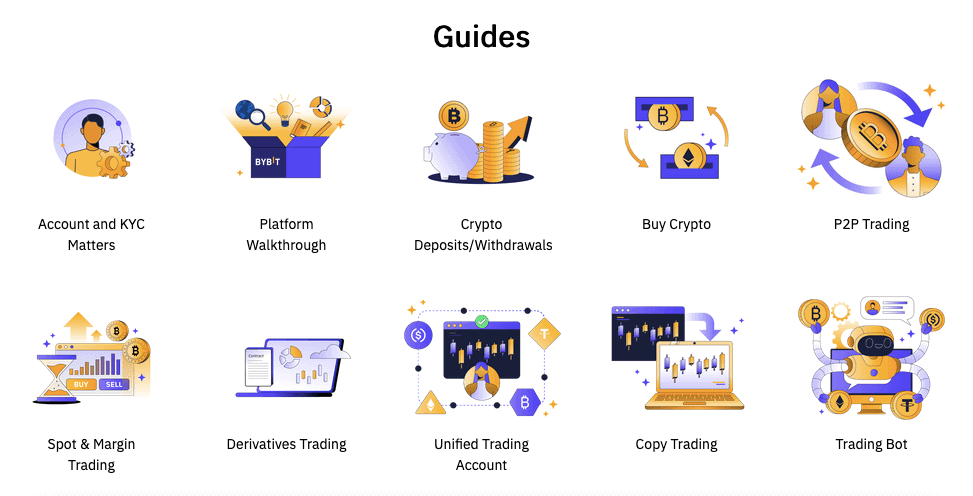

Bybit’s help center appears to offer a substantial number of articles, demonstrating an effort to provide users with informative resources. However, when delving into the basics, particularly starting with the “Platform Walkthrough,” certain issues become apparent:

Organizational Structure: At a high level, Bybit’s help center is well-organized, making it easy for users to locate relevant information.

Challenges for Beginners: The main challenge arises when users venture into the basics section. It becomes evident that the knowledge base might not cater effectively to beginners. Articles are reported to be poorly edited and, at times, confusingly titled, which can hinder the learning experience for newcomers.

Complex Language: Some articles may employ complex language and concepts that are better suited for experienced traders rather than those who are new to cryptocurrency trading.

Improvements in the help center’s beginner-focused content, clarity, and editing could enhance the overall user experience and provide more effective support to users who are just starting their cryptocurrency trading journey.

Final Thoughts on Bybit:

When evaluating the Bybit trading platform, a crucial consideration revolves around whether it’s worthwhile for individuals residing in restricted regions to bypass KYC restrictions and utilize VPNs to access the platform. Here’s a nuanced perspective:

Qualified “Yes”: Bybit presents a qualified “yes” to this question. The platform excels in offering a wide array of cryptocurrency derivatives trading options, including futures, options, and perpetual contracts. This diversity provides traders with numerous avenues to potentially generate profits, a feature that sets Bybit apart from many competitors. However, users should exercise caution and consider the regulatory and legal implications when using Bybit in restricted regions.

Not for Beginners: Bybit is unequivocally not suitable for cryptocurrency beginners. Its primary focus on derivatives trading can pose significant risks for inexperienced traders who may mistakenly perceive it as a typical spot trading exchange. Engaging in derivatives trading without a solid understanding can lead to substantial financial losses.

In conclusion, Bybit shines as a cryptocurrency derivatives exchange, offering a plethora of trading opportunities for experienced users. However, its complexities and the need for responsible trading practices make it less suitable for beginners. Traders should carefully assess their knowledge and risk tolerance before considering Bybit as their trading platform of choice.

Please note that the regulatory landscape for cryptocurrency trading platforms is subject to change, and it’s essential to stay updated on the latest developments and adhere to legal requirements in your jurisdiction when using such platforms.

Features

Social | |

WebSite | |

Trading Fees | Spot trading fee: 0.1% Instant buy/sell fee: 0.5% 25% fees discount if you use BNB |

Deposit Fees |

|

Withdrawal Fees |

|

Minimum Fiat Withdrawal |

|

Minimum Crypto Withdrawal | Varies by currency |

Supported Countries | 180+ |

Margin Trading | U.S.: No Global: Yes |

Futures Trading | US: No Global: Yes |

Staking Rewards |

|

Asset Protection | Secure Asset Fund for Users (SAFU) |

Customer Support Options | Support tickets only |

Mobile App Availability | iOS and Android |

Promotions | Yes |

Frequently Asked Questions(FAQ)

A cryptocurrency exchange is an online platform where you can buy, sell, or trade cryptocurrencies like Bitcoin, Ethereum, and others.

Safety varies by exchange. Look for platforms with strong security measures, like two-factor authentication and cold storage for funds.

Consider factors like security, fees, available coins, user interface, and customer support.

Centralized exchanges are managed by a company, while decentralized exchanges operate without a central authority.

Many exchanges require Know Your Customer (KYC) verification for security and regulatory compliance.

Trading fees vary but typically include maker fees (for adding liquidity) and taker fees (for removing liquidity).

Yes, most exchanges offer cryptocurrency-to-cryptocurrency trading pairs.

Withdrawal times depend on the exchange and the cryptocurrency. Some are instant, while others may take hours or even days.

A wallet address is like a bank account number for cryptocurrencies. It’s required to send your crypto to the right place.

Yes, depending on your country’s tax laws, trading cryptocurrencies may have tax consequences. Consult a tax professional for guidance.

Yes, many cryptocurrency exchanges operate 24/7, allowing you to trade at any time.

A market order buys or sells at the current market price, while a limit order sets a specific price at which you want to buy or sell.

Yes, each exchange sets its own minimum and maximum trading limits, which can vary widely.

It’s not recommended. For security, it’s better to use a cryptocurrency wallet, especially for significant holdings.

Exchanges typically have account recovery processes, including password reset options and support for forgotten usernames.

Some exchanges offer insurance, but coverage can be limited. It’s essential to check an exchange’s insurance policy.

Use strong passwords, enable two-factor authentication, and be cautious of phishing scams and suspicious emails.

Yes, but it’s recommended to learn the basics of trading and understand the risks involved before you start.

Stablecoins are cryptocurrencies pegged to the value of a fiat currency like the US dollar. They provide stability and are commonly used for trading and transferring funds on exchanges.

Yes, regulations vary by country. Many countries have implemented or are considering regulations to govern cryptocurrency exchanges for consumer protection and financial stability.

ByBit Details

Claim up to $30,030 in Bonus