Cryptocurrency investments for beginners 2023

If you’ve been contemplating entering the realm of cryptocurrencies but lack a clear starting point, this cryptocurrency investment guide aims to assist you. Despite any preconceived notions or misconceptions you may have about cryptocurrencies, they are essentially another category of assets. The strategies for investing in them are not significantly distinct from those employed in stocks, bonds, or options.

Nevertheless, for those new to the world of crypto investments, there’s an initial learning curve to navigate. Once you acquire a foundational understanding of cryptocurrencies, your confidence is bound to grow. In this article, I will furnish you with some valuable tips and recommendations for cryptocurrency investment.

Table of Contents

Exploring the Cryptocurrency Market

The Genesis of Cryptocurrency: In 2009, the cryptocurrency market saw the birth of Bitcoin. However, it wasn’t until 2013 that it began to gain recognition.

Bitcoin’s Rise: The true surge in Bitcoin’s price commenced in 2017, attracting a growing number of investors to the market.

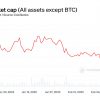

A Rollercoaster Ride: Yet, by mid-2018, Bitcoin and other cryptocurrencies experienced a sharp drop in market capitalization. Curiously, this decline didn’t dampen interest.

Diverse Cryptos: Today, there are over 1,600 cryptocurrencies apart from Bitcoin, known as altcoins.

Divergent Views: Some dismiss cryptocurrencies as unserious, while others envision a future where they replace traditional currency. The reality likely lies between these extremes.

Potential Profits: Early cryptocurrency investors have reaped significant gains. However, the market’s high volatility demands a keen awareness of risks.

Unveiling Blockchain Technology

The Foundation of Cryptos: To grasp cryptocurrency functionality, one must fathom blockchain technology.

Blockchain Defined: A blockchain serves as a public digital ledger tracking and recording all transactions. Multiple independent computer networks oversee this process.

Practical Illustration: Consider Sasha purchasing a mountain bike from Zhenya using Bitcoin. Blockchain confirms Sasha’s Bitcoin balance and updates the ledger accordingly.

Beyond Cryptos: Blockchain finds applications beyond cryptocurrencies, suitable for storing various types of information.

Interconnected Yet Distinct: Cryptocurrencies rely on blockchain, but blockchain can exist independently.

Opportunities in Cryptocurrency Investing

Bitcoin Craze: Novice investors often equate cryptocurrency with Bitcoin due to its renown.

Diverse Options: Beyond Bitcoin, there are other significant cryptocurrencies to explore, including Ethereum, Ripple, Litecoin, Bitcoin Cash, EOS, and Cardano.

Bitcoin Dominance: Bitcoin captures 45% of the crypto market and holds a central position, influencing other coins.

Ethereum’s Potential: Ethereum, the second-largest cryptocurrency, boasts substantial growth potential, especially through its platform for creating blockchain projects.

Ripple’s Scope: Ripple, ranking third by market capitalization, offers fast and secure international payment transfers, collaborating with top-tier banks.

Litecoin’s Speed: Litecoin improves upon Bitcoin technology, processing transactions five times faster.

Bitcoin Cash’s Evolution: Bitcoin Cash, a Bitcoin offshoot, benefits from an increased block size for more efficient processing.

EOS Innovation: EOS stands out with advanced technology capable of handling up to 100,000 transactions per second, making it resilient to market fluctuations.

Cardano’s Advancements: Cardano, created by an Ethereum co-founder, rivals Ethereum by offering advanced technology for app development.

Navigating Cryptocurrency Exchanges

Where to Trade: Cryptocurrency trading primarily occurs on organized exchanges.

Choosing the Right Exchange: Factors to consider include available cryptocurrencies, liquidity, spread, fees, and platform convenience.

Top 3 Reliable Cryptocurrency Exchanges

Coinbase: A widely used platform known for its solid reputation and cryptocurrency security through the Coinbase insurance fund.

KuCoin: Offers margin trading for experienced investors, a variety of digital currency options, and features like Bitcoin, Ethereum, and Ripple.

Binance: A low-fee, high-liquidity exchange based in Malta. It offers a range of coins, including Bitcoin, Litecoin, and Ethereum. Additionally, Binance provides a user-friendly cryptocurrency investing app.

Navigating Cryptocurrency Investment: Risks and Features

Investing in cryptocurrencies holds the promise of substantial gains in a relatively short span, making it an alluring prospect for many. Yet, this emerging asset class also carries inherent risks that demand vigilance and due diligence.

Pros of Cryptocurrency Investment:

Potential for High Returns: The allure of cryptocurrency investment lies in the potential for significant profits over a short timeframe, drawing investors seeking lucrative opportunities.

Portfolio Diversification: Including a modest percentage of major cryptocurrencies can enhance portfolio efficiency, mitigating risk across assets.

Cons and Risks of Cryptocurrency Investment:

Liquidity Challenges: Cryptocurrencies lack the robust liquidity of traditional assets, making trading more susceptible to slippage, particularly during turbulent market conditions.

Regulatory Uncertainty: Regulatory interventions can disrupt the cryptocurrency market, impacting the value of digital assets. Government agencies may impose restrictions to prevent fraud and manipulation.

Valuation Complexity: Unlike stocks with ample fundamental data, cryptocurrencies lack transparency in investment analysis. Determining a “fair” price becomes more challenging, often influenced by market sentiment rather than fundamentals.

High Correlation: Cryptocurrencies, including Bitcoin, tend to exhibit strong correlations with each other. Diversifying across different coins may not provide the expected level of risk reduction.

Building a Cryptocurrency Portfolio:

When constructing a cryptocurrency portfolio, considerations must account for individual factors such as risk tolerance, age, and financial circumstances.

Aggressive Investors: Those comfortable with higher risk may allocate up to 20% of their portfolio to cryptocurrencies, with the remaining 80% in traditional assets.

Conservative Investors: Risk-averse individuals may find a 5-10% allocation to cryptocurrencies more suitable, with the bulk of their investments in conventional assets.

Risk Management: It’s essential to allocate only funds you are willing to lose, as cryptocurrency investment inherently carries speculative risk.

In Conclusion:

This article introduces the fundamentals of cryptocurrency investment. After reading, individuals should consider whether they wish to explore this investment avenue or if it aligns with their financial goals. Maintaining an open-minded perspective and evaluating both potential benefits and associated risks are key to navigating the cryptocurrency market successfully.

A cryptocurrency exchange is an online platform where you can buy, sell, or trade cryptocurrencies like Bitcoin, Ethereum, and others.

Safety varies by exchange. Look for platforms with strong security measures, like two-factor authentication and cold storage for funds.

Consider factors like security, fees, available coins, user interface, and customer support.

Centralized exchanges are managed by a company, while decentralized exchanges operate without a central authority.

Many exchanges require Know Your Customer (KYC) verification for security and regulatory compliance.

Trading fees vary but typically include maker fees (for adding liquidity) and taker fees (for removing liquidity).

Yes, most exchanges offer cryptocurrency-to-cryptocurrency trading pairs.

Withdrawal times depend on the exchange and the cryptocurrency. Some are instant, while others may take hours or even days.

A wallet address is like a bank account number for cryptocurrencies. It’s required to send your crypto to the right place.

Yes, depending on your country’s tax laws, trading cryptocurrencies may have tax consequences. Consult a tax professional for guidance.

Yes, many cryptocurrency exchanges operate 24/7, allowing you to trade at any time.

A market order buys or sells at the current market price, while a limit order sets a specific price at which you want to buy or sell.

Yes, each exchange sets its own minimum and maximum trading limits, which can vary widely.

It’s not recommended. For security, it’s better to use a cryptocurrency wallet, especially for significant holdings.

Exchanges typically have account recovery processes, including password reset options and support for forgotten usernames.

Some exchanges offer insurance, but coverage can be limited. It’s essential to check an exchange’s insurance policy.

Use strong passwords, enable two-factor authentication, and be cautious of phishing scams and suspicious emails.

Yes, but it’s recommended to learn the basics of trading and understand the risks involved before you start.

Stablecoins are cryptocurrencies pegged to the value of a fiat currency like the US dollar. They provide stability and are commonly used for trading and transferring funds on exchanges.

Yes, regulations vary by country. Many countries have implemented or are considering regulations to govern cryptocurrency exchanges for consumer protection and financial stability.