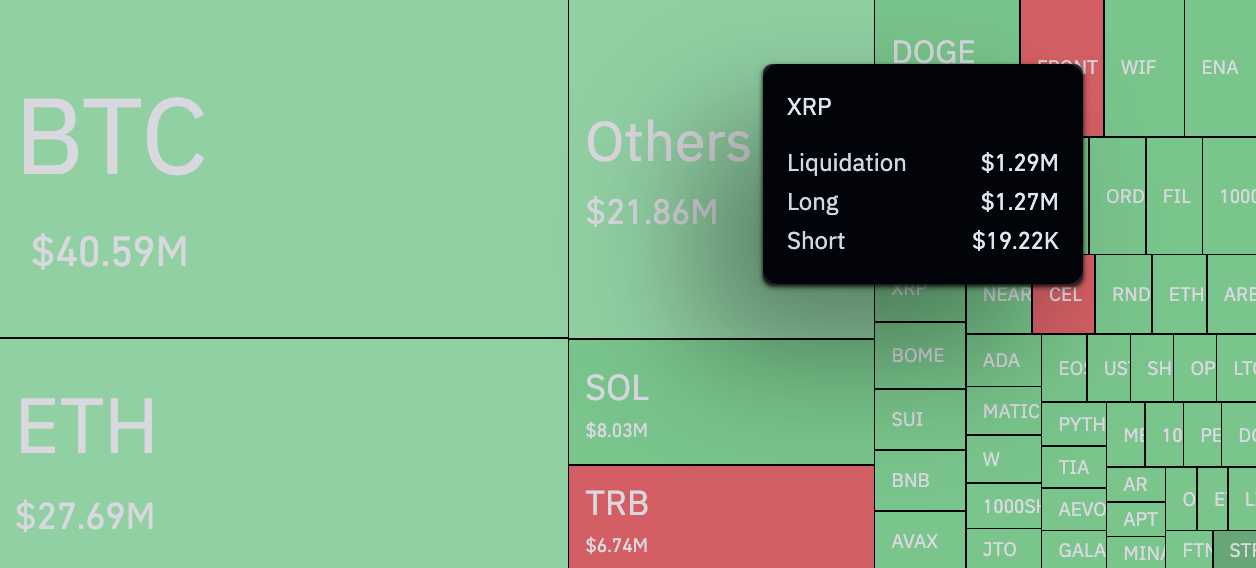

In a notable departure from recent market trends, XRP has seen a notable increase in bullish liquidations, presenting a stark contrast to the relatively subdued activity in bearish positions. According to data obtained from glass coinThe past 24 hours have seen a notable $1.27 million liquidation associated with long positions, dwarfing the comparatively modest $19,220 liquidated from short positions.

In a notable departure from recent market trends, XRP has seen a notable increase in bullish liquidations, presenting a stark contrast to the relatively subdued activity in bearish positions. According to data obtained from glass coinThe past 24 hours have seen a notable $1.27 million liquidation associated with long positions, dwarfing the comparatively modest $19,220 liquidated from short positions.

This substantial variation, amounting to a notable 6,350%, has captured the attention of both analysts and market participants.

The increase in bullish liquidations coincides with a 3.85% drop in the price of XRP, indicating a change in sentiment among investors. However, the precise catalyst behind this major discrepancy in settlement patterns remains elusive, leading to speculation and scrutiny within the cryptocurrency community.

The repercussions of this anomaly extend beyond settlement figures, as derivatives trading volumes for XRP saw a notable drop of over 55% in the same period. This decline reflects a broader trend of reduced business activity amid increased market uncertainty.

Looking ahead, analysts suggest that the fallout from these unusual liquidation patterns may usher in a period of relative stability, with XRP potentially primed for a rebound from key support levels. However, the expected recovery is expected to be driven primarily by institutional investors and larger market participants, rather than retail traders.

As bears take advantage of the XRP price drop to lock in profits, bullish shareholders find themselves nursing the wounds inflicted by the recent downturn.