The following is a guest post by Shane Neagle.

Regardless of an asset’s fundamentals, its value is governed by one underlying characteristic: market liquidity. Is it easy for the general public to sell or buy this asset?

If the answer is yes, the asset receives high trading volume. When this happens, executing trades at different price levels is easier. In turn, a feedback loop is created: stronger price discovery increases investor confidence, which increases market participation.

Since Bitcoin was launched in 2009, it has relied on cryptocurrency exchanges to establish and extend its market depth. The easier it became to trade Bitcoin around the world, the easier it became for the price of BTC to rise.

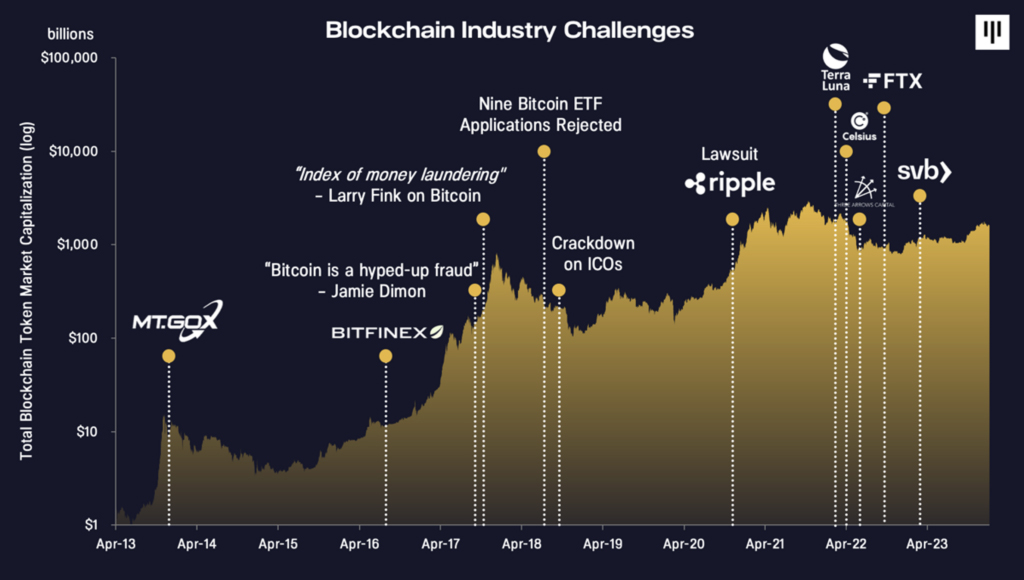

Likewise, when fiat-to-crypto binaries like Mt. Gox or FTX fail, the price of BTC suffers greatly. These are just a few obstacles on Bitcoin’s path to legitimization and adoption.

However, when the Securities and Exchange Commission (SEC) approved 11 spot-traded Bitcoin exchange-traded funds (ETFs) in January 2024, Bitcoin gained a new level of liquidity.

This is a milestone in terms of liquidity and a new level of credibility for Bitcoin. Entering the world of regulated exchanges, along with stocks, has discouraged naysayers who questioned Bitcoin’s status as decentralized digital gold.

But how will this new market dynamic develop in the long term?

The democratization of Bitcoin through ETFs

From the beginning, What was new about Bitcoin was its weakness and its strength. On the one hand, it is a monetary revolution to keep wealth in your head and then be able to transfer it without borders.

Bitcoin miners can transfer it without permission, and anyone with access to the Internet can become a miner. No other good has this property. Even gold, with its relatively limited inflation-resistant supply, can easily be confiscated as happened in 1933 with Executive Order 6102.

This means that Bitcoin is an inherently democratizing vehicle of wealth. But with self-custody comes great responsibility and room for error. Glassnode data shows this that approximately 2.5 million bitcoins have become inaccessible due to the loss of keywords that can regenerate access to the Bitcoin mainnet.

This is 13.2% of Bitcoin’s 21 million BTC fixed supply. Indeed, self-custody induces anxiety among both retail and institutional investors. Would fund managers engage in Bitcoin allocation with such risk?

But Bitcoin ETFs have completely changed this dynamic. Investors looking to protect themselves from currency devaluation can now delegate custody to large investment firms. And they, from BlackRock and Fidelity to VanEck, delegate it to chosen cryptocurrency exchanges like Coinbase.

While this reduces Bitcoin’s self-custodial functionality, it increases investor confidence. At the same time, miners, through proof-of-work, continue to make Bitcoin a decentralized asset, regardless of the amount of BTC accumulated in ETFs. And Bitcoin remains both a digital asset and a physical asset based on computing power (hashrate) and energy.

Bitcoin ETFs reshape market dynamics and investor confidence

Since January 11, Bitcoin ETFs have opened the door for capital to delve deeper into the Bitcoin market, with a cumulative volume of $240 billion. This substantial inflow of capital has also shifted the break-even price for many investors, influencing their strategies and expectations about future profitability.

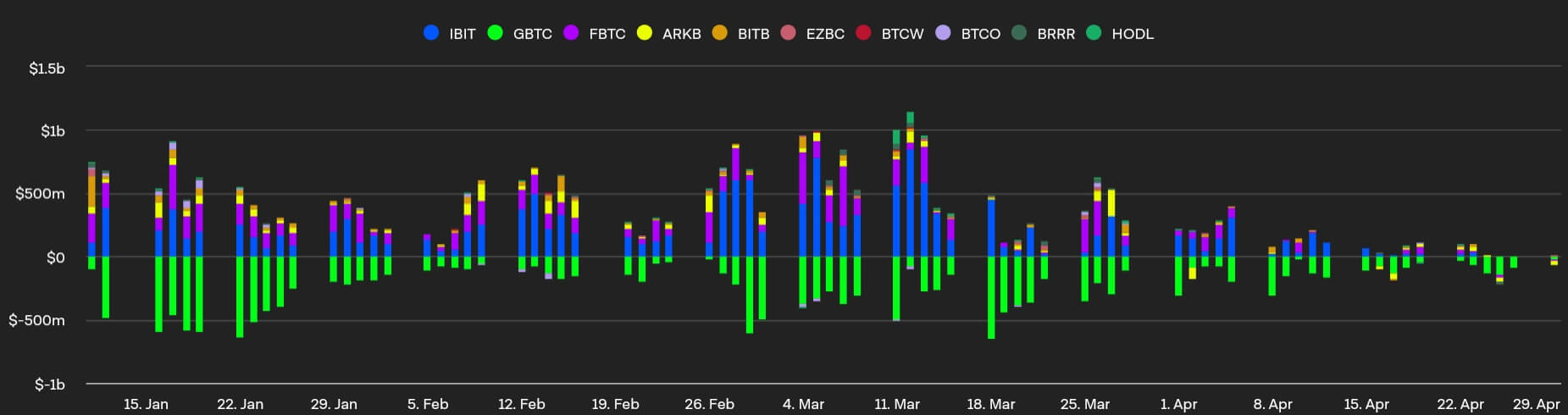

However, while the launch was largely successful in exceeding expectations, negative outflows gained traction as the Bitcoin ETF hype subsided.

As of April 30, Bitcoin ETF flows totaled negative $162 million, marking the fifth consecutive day of negative outflows. For the first time, Ark’s ARKB outflow (yellow) surpassed GBTC (green), with a negative value of $31 million versus $25 million, respectively.

Considering that this occurred after Bitcoin’s fourth halving, which reduced Bitcoin’s inflation rate to 0.85%, it is safe to say that macroeconomic and geopolitical concerns have temporarily overshadowed Bitcoin’s fundamentals and deepened the depth of the market.

This was even more evident when the opening of Bitcoin ETFs by the Hong Kong Stock Exchange failed to yield results. Despite access to capital open to Hong Kong investors, volume amounted to just $11 million ($2.5 million in Ether ETFs), compared to the expected $100 million.

In short, the Hong Kong cryptocurrency ETF’s debut was almost 60 times lower than that of the United States. While Chinese citizens with businesses registered in Hong Kong can participate, mainland Chinese investors are still barred.

Likewise, taking into account that the New York Stock Exchange (NYSE) is about five times larger than HKSE, it is not likely that HKSE’s Bitcoin/Ether ETFs will exceed $1 billion in flows in the first two years, according to the Bloomberg ETF analyst. Eric Balchunas.

Future prospects and potential challenges

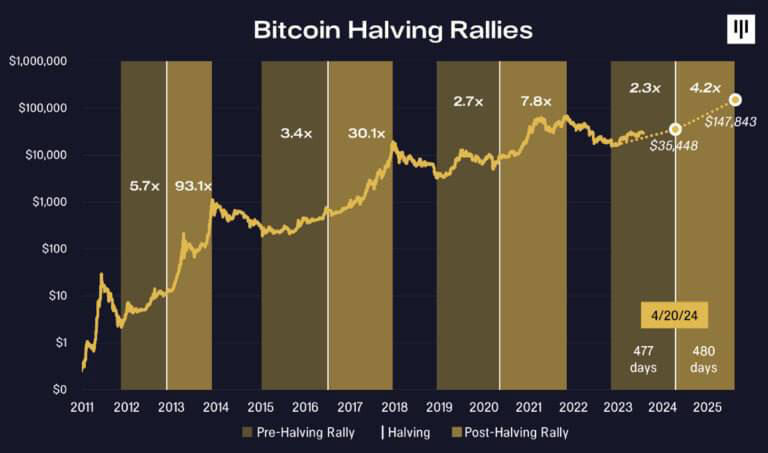

During the Bitcoin ETF liquidity extravaganza, BTC price probed the threshold above $70,000 several times, reaching a new all-time high of $73.7k in mid-March.

However, miners and holders took the opportunity to apply selling pressure and reap gains. With morale now contained in the $60,000 range, investors will have more opportunities to purchase discounted Bitcoin.

Not only is Bitcoin’s inflation rate at 0.85% after the fourth halving, compared to the Fed’s USD target of 2%, but more than 93% of BTC’s supply has already been mined. The inflow of mined BTC went from ~900 BTC per day to ~450 BTC per day.

This results in greater scarcity of Bitcoin, and what is scarce tends to become more valuable, especially after legitimizing Bitcoin investments on an institutional level through Bitcoin ETFs. So much so that Bybit’s analysis predicts supply shocks on exchanges by the end of 2024. Alex Greene, senior analyst at Blockchain Insights, said:

“The increase in institutional interest has stabilized and dramatically increased demand for Bitcoin. This increase will likely exacerbate the shortage and push prices higher after the halving.”

After previous halvings in the absence of the Bitcoin ETF environment, the price of Bitcoin has risen to 7.8 times earnings in 480 days. While Bitcoin’s higher market capitalization makes such gains less likely, multiple appreciation drivers remain on the table.

In the meantime, however, market volatility is still to be expected. With Binance situation resolvedIn addition to putting the series of cryptocurrency-related bankruptcies behind us in 2022, the main source of FUD remains the government.

Despite Tom Emmer’s effortsAccording to the GOP majority, self-custody wallets could also be targeted as money transmitters. The FBI recently hinted at this direction with the warning against the use of “unregistered crypto money transmission services”.

Likewise, this year, the Federal Reserve’s interest rate policy could suppress appetite for risky assets like Bitcoin. However, the perception of Bitcoin and the market surrounding it has never been more mature and stable.

If the regulatory regime changes course, small businesses may even abandon similar solutions invoice financing and switch to a BTC ETF-backed system.

Conclusion

After years of rejecting Bitcoin ETFs for spot trading, these investment vehicles have erected new liquidity bridges. Although suppressed by Barry Silbert’s Grayscale (GBTC), they demonstrated great institutional demand for an appreciating asset.

With the fourth Bitcoin halving behind us, growing scarcity and allocations by fund managers are now a certainty. Furthermore, the prevailing sentiment is that fiat currencies will be perpetually devalued as long as a central bank exists.

After all, how could governments continue to finance themselves despite gigantic budget deficits?

This makes Bitcoin even more compelling in the long term after holders profit from new ATH points. Between these peaks and valleys, the bottom of Bitcoin will likely continue to rise into deeper institutional waters.