The rise in the price of Stacks (STX) has seen the crypto asset join the list of altcoins that have begun to recover lost gains during the recent downturn.

But STX investors are in too much of a hurry. They are trying to profit from the bearish trend instead of pushing for a recovery.

Stacks Investors Expect a Slump

STX price has risen significantly over the past few days, pushing the altcoin to a multi-week high. Accordingly, STX’s relative strength index (RSI) is showing signs of bullish momentum for the first time in a month.

This technical indicator measures the magnitude of recent price changes to assess overbought or oversold conditions. It suggests a shift toward increased buying pressure. An RSI crossing into the bullish zone is often seen as a positive signal, indicating a potential upward price move.

Rising RSI also reflects growing interest and optimism among investors. Therefore, a bullish RSI can act as a catalyst for sustained price growth.

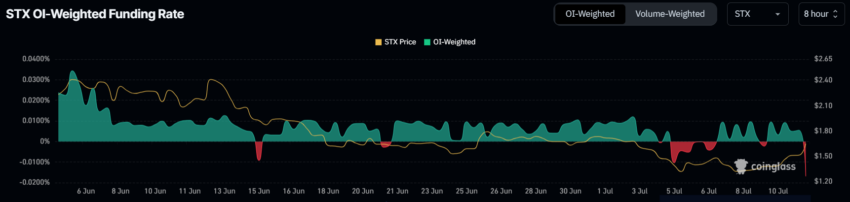

In contrast, the STX funding rate has seen a marked decline, becoming negative. The funding rate, which is the cost incurred to hold a position in a futures contract, typically indicates a balance between long and short positions. A negative funding rate suggests that short contracts dominate the market.

The sharp drop in the funding rate highlights the growing bearish sentiment among market participants. This scenario occurs when traders expect the price of STX to decline and open short positions to profit from the expected downtrend. This could put downward pressure on the price, counteracting the bullish signals from the RSI.

Overall, the STX market is currently showing mixed signals as investors try to prevent a recovery.

STX Price Forecast: Resistances Present

STX price has seen a sharp 19% recovery in the last 24 hours, pushing the altcoin to trade at $1.66. Meanwhile, Stacks has bounced off the $1.24 support level, now trying to move higher towards $1.80.

The chances of breaking this barrier are slim, as the above factors suggest bearish investor sentiment. This could hamper any attempts by the altcoin to rise.

The likely outcome is consolidation within $1.80 and $1.53, both of which have been tested as resistance and support respectively.

Read more: 10 Best Cryptocurrencies of 2024

However, if the latest support level is lost, a drop to $1.24 is likely. This would invalidate the bullish thesis and leave STX price vulnerable to further declines.