While Bitcoin and the rest of the cryptocurrency market are seeing a recovery from recent declines, some analysts are warning of the possibility of further declines.

Ali Martinez, an X expert analyst, recently highlighted bearish pattern in Bitcoin’s short-term price action. According to him, on the daily chart, Bitcoin is forming a rising wedge, a pattern often associated with downtrends.

While Bitcoin could rise to $57,000 at the top of the wedge, there is a potential breakout that could push it back to around $51,000. This observation raises important questions about Bitcoin’s near-term future.

Bitcoin Rising Wedge Pattern

The rising wedge is a bearish continuation pattern that often appears during uptrends. This pattern is characterized by converging trend lines, with support and resistance lines sloping upward.

Such convergence reflects a weakening of the upward momentum and often precedes a reversal to the downside.

Currently, the Bitcoin price action on Ali’s chart illustrates this pattern. The price could rise to the upper boundary of the wedge, in the range of $56,000 to $57,000. A break below the rising support line could mean a trend reversal, potentially taking the price to $51,000.

Technical indicators highlight bearish sentiment

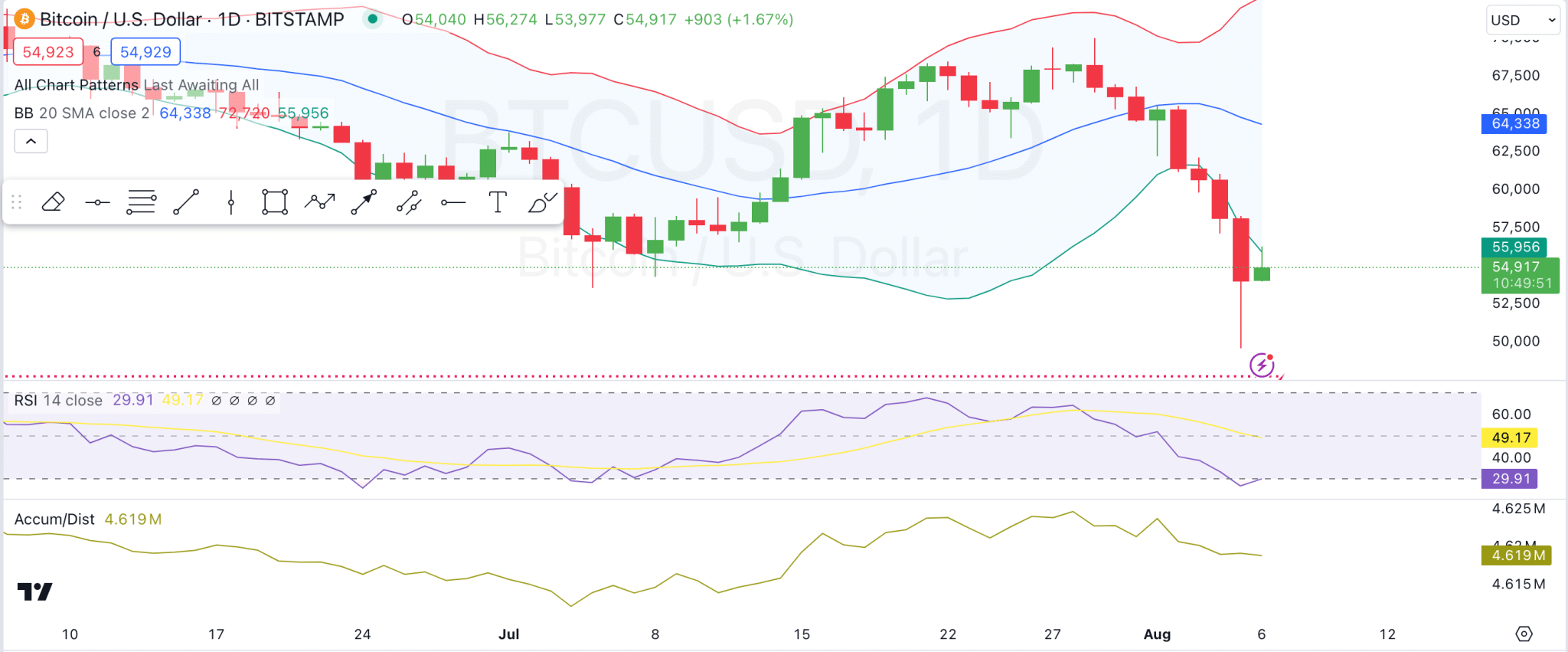

Technical indicators on the daily chart support this bearish sentiment. Bollinger Bands are pointing to increasing volatility, with price near the lower band, indicating potential oversold conditions.

The Relative Strength Index (RSI) is at 30.04, putting Bitcoin in oversold territory (below 40). This suggests that the asset is potentially undervalued in the short term. Additionally, the Accumulation/Distribution (Acc/Dist) line is showing a slight decline, indicating greater distribution (selling pressure) than accumulation (buying pressure) over the past period, with a current value of 4.619M.

Long-term analysts see potential for growth

Despite the short-term bearish outlook, some analysts maintain a long-term bullish outlook. Chart expert Peter Brandt recently highlighted Potential for Bitcoin to Continue to Rise: In a recent chart, Brandt used an 8-period moving average to track short-term trends.

Bitcoin experienced a strong surge in the first quarter, setting a bullish tone. Although there were fluctuations, Bitcoin has shown resilience, recovering from each dip and approaching previous highs.

Brandt’s analysis suggests that while Bitcoin may face short-term bearish pressure, the long-term outlook remains positive.