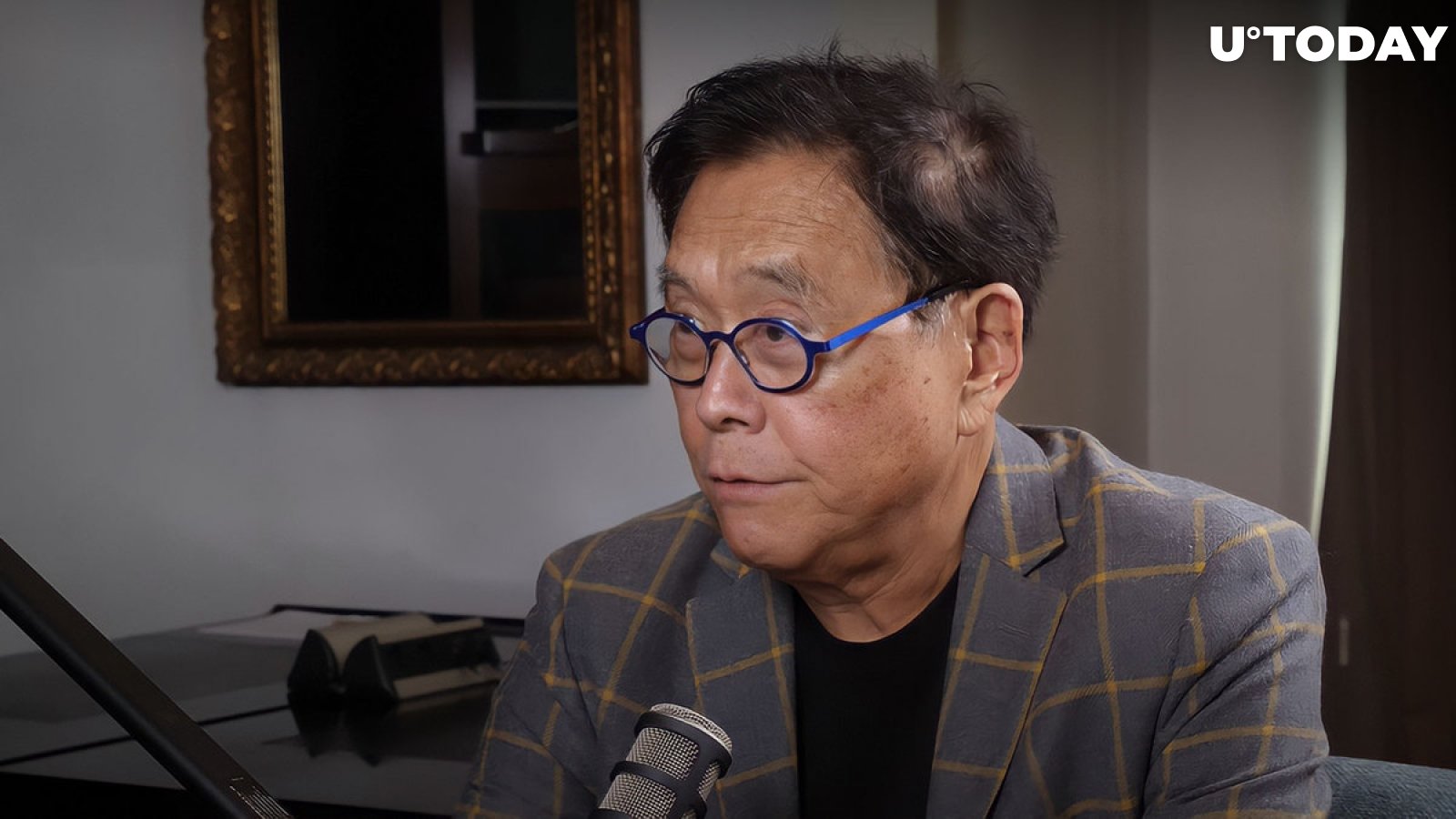

In a recent social media update, the popular author Robert Kiyosaki, best known for his book “Rich Dad, Poor Dad,” has provided crucial insight into the current economic landscape while issuing a stern warning to his followers. The central point of his message revolves around the potential of Bitcoin amid an ominous forecast of an impending economic depression.

In a recent social media update, the popular author Robert Kiyosaki, best known for his book “Rich Dad Poor Dad,” has provided crucial insight into the current economic landscape while issuing a stern warning to his followers. The central point of his message revolves around the potential of Bitcoin amid an ominous forecast of an impending economic depression.

Kiyosaki’s latest post underscores his belief that being prepared for adverse financial conditions is paramount. Urging his audience to move away from the metaphorical “Disneyland” of financial ignorance, Kiyosaki advocates for proactive measures to secure wealth, particularly through astute investments in tangible assets such as gold, silver and the increasingly prominent cryptocurrency, BTC.

“The best time to get rich”

In a thought-provoking turn, Kiyosaki reflects on his earlier thesis about economic crises as opportunities for wealth accumulation. He highlights the need to break the illusion of prosperity and face the harsh realities of economic cycles.

For Kiyosaki, the looming prospect of depression serves as a catalyst for proactive wealth creation, urging people to seize the moment and diligently prepare for the road ahead.

This is not the first time Kiyosaki has sounded the alarm about economic instability. He posits that, amid fear, doubt and uncertainty, Bitcoin stands out as a model of potential wealth accumulation, citing its resilience in the face of inflationary pressures and currency devaluation.

Of particular interest is Kiyosaki’s bullish stance on the future trajectory of Bitcoin’s price. Forecasts that its value will soar to staggering heights, including predictions that it will reach $120,000 by the end of the year and a staggering half a million the following year, have raised eyebrows and sparked debate in financial circles.