Polygon (MATIC) hints at a double bottom reversal from critical support after an intense correction wave. Is there enough underlying demand for the next distribution wave to reach $1?

With the altcoin bull market gradually returning, Polygon is preparing to overcome the bearish influence to resume its bull run. Despite the predominant decline for several months, the altcoin finds an opportunity for a trend reversal at key support.

So, let’s take a look at Polygon’s price analysis to see if it’s a worthwhile opportunity to buy shares on the dip.

Polygonal bull route from channel crossroad

Polygon is trying to recover after receiving a huge supply influx since March 2024. Bulls are expecting a double bottom reversal for a new recovery after reaching support at $0.38.

However, the intense 68% decline from the 52-week high of $1.29 shows massive bearish influence. Moreover, the intense correction leads to a strong resistance line, maintaining a constant supply inflow.

According to the weekly RSI line, the two dips in the weekly log price chart show a bullish divergence in play. This increases the chances of a bullish comeback in Polygon.

Currently, the price of MATIC is trading at $0.412 and with a 21% retracement, the weekly candle forms a long tail. Thus, with increasing demand at lower levels, Polygon is signaling a potential trend reversal.

Polygon signals bullish momentum with rising network activity

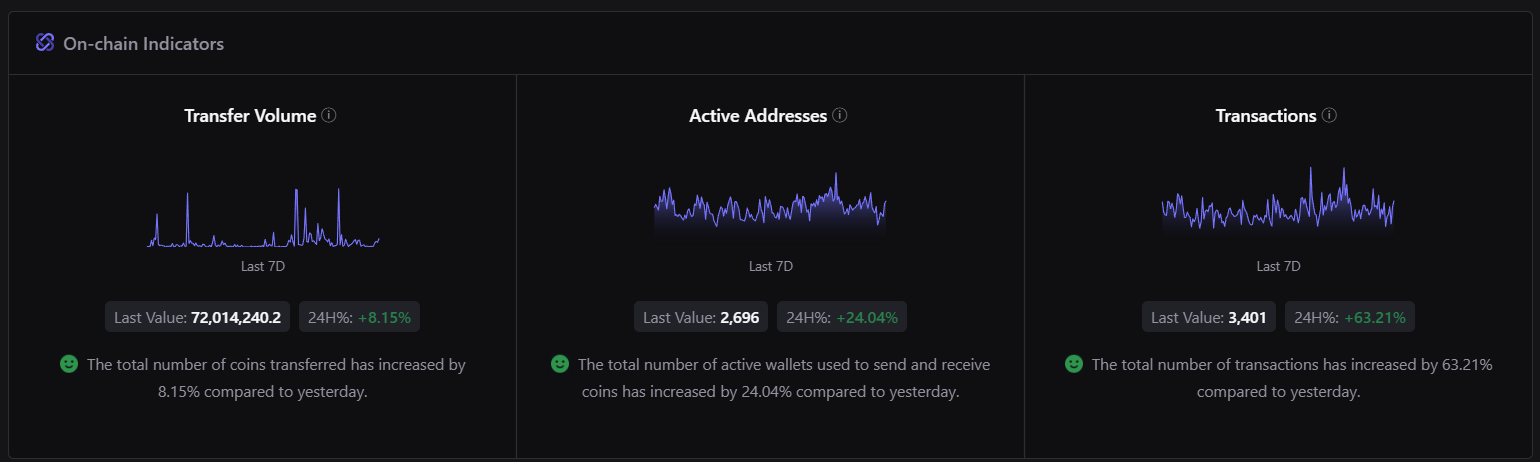

According to CryptoQuant, the latest Polygon network metrics point to a positive trend with a sharp increase in network activity over the past week.

The volume of transfers increased by 8.15% to reach 72 million MATIC. The number of active addresses also jumped by 24.04% to 2696, indicating increased user engagement. In addition, the number of transactions increased sharply by 63.21% to 3401. In fact, the on-chain data reflects a significant increase in activity on the Polygon network.

Growth Chances for Polygon

Bulls are overwhelmed by rising underlying demand as market and network indicators show gains. Therefore, a break of the upper trendline will indicate a price action buying opportunity.

According to Fibonacci levels, the MATIC uptrend could reach the 23.60% Fibonacci level at $0.616. Optimistically, a broader market push could lift the altcoin to $1.