Polkadot (DOT) price has fallen more than 10% in the last week. Market woes on Monday saw it trade below $5 for the first time since November 2023. The altcoin even hit a low of $3.75 that day before bouncing back.

DOT is currently trading at $4.59 and is now set to surge above the $5 mark.

Polkadot faces challenges in trying to regain $5

DOT’s key technical indicators assessed on the daily chart suggest that a break above the $5 mark may prove difficult as selling pressure gains strength.

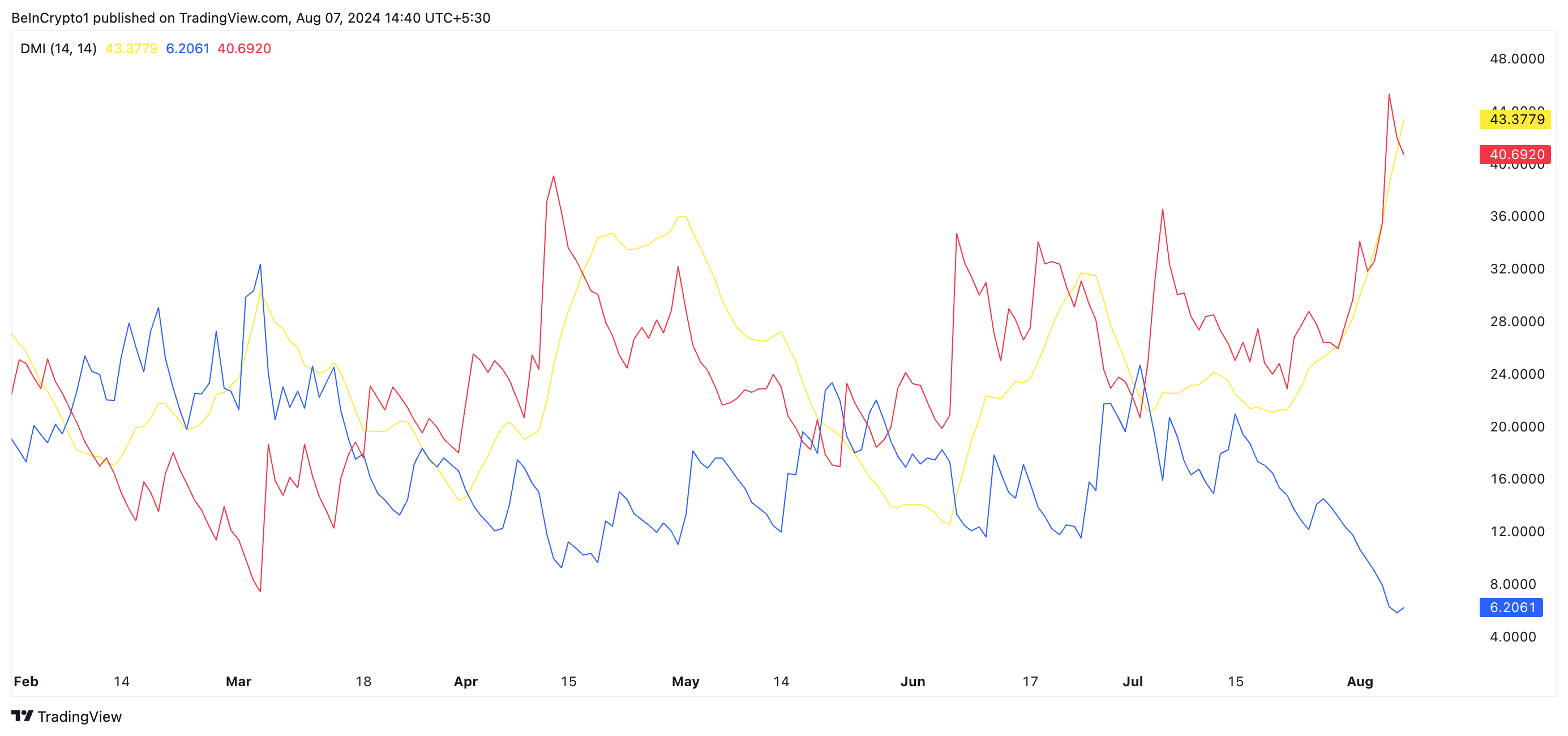

At the time of writing, the Department of Transportation’s Directional Movement Index (DMI) shows its negative directional indicator (-DI) (red) above its positive directional indicator (+DI) (blue).

An asset’s DMI measures the strength and direction of its market trend. A downtrend is strong when the +DI line is below the -DI line. This means that sellers have more control over the market than buyers.

The greater the distance between -DI and +DI, the stronger the downward momentum. In the case of DOT, the downward trend is significant as the -DI line is 40.69 and the +DI line is 6.20.

Next, the Average Directional Index (ADX) of DOT (yellow) is in an uptrend at 43.37. Typically, when an asset’s ADX is rising and the -DI is above the +DI, it indicates that the downtrend is strong and likely to continue.

At the time of publication, DOT is trading below its 20-day exponential moving average (EMA) (yellow) and its 50-day minor moving average (SMA) (blue).

An asset’s 20-day EMA is a short-term moving average that reacts quickly to price changes. It reflects the asset’s average closing price over the past 20 days. On the other hand, its 50-day SMA is a longer-term moving average that measures the average closing price over the past 50 days.

Read more: What is Polkadot (DOT)?

When an asset is trading below these key moving averages, it is a bearish signal. This means that short-term and medium-term traders are selling the asset, which leads to sustained downtrend pressure.

DOT Price Forecast: Rise Above These Averages Is Important

DOT’s 20-day EMA and 50-day SMA may act as resistance levels. If it tries to move above them, it may face selling pressure around these averages and resume its downtrend. If this happens, DOT’s price may fall to its nine-month low of $3.59, which it was trading at on Monday.

Read More: Polkadot (DOT) Price Prediction 2024/2025/2030

However, if the coin starts an uptrend and breaks out of these moving averages, its target price will be $6.76.