The price of Optimism (OP) is slowly moving higher, but this is creating uncertainty among investors.

Lack of conviction has led to whale selling and bearish development among major groups.

Optimistic investors see the downside

The optimistic price rise may slow as investors continue to shift their holdings across the network. Two main groups, whales and long-term holders, are showing a bearish attitude, which could affect the price soon.

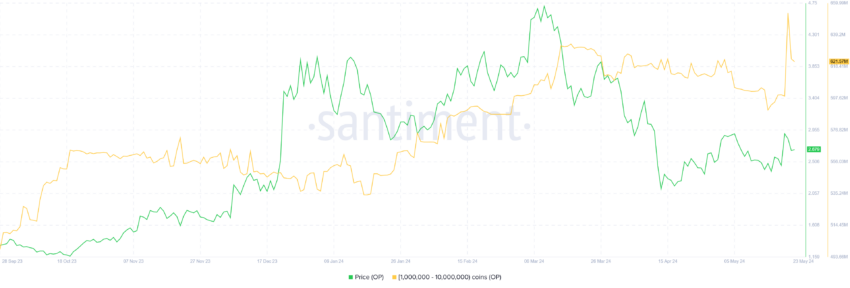

Addresses containing between 1 and 10 million POs recently purchased more than 52 million POs in one day. However, the next day, they sold 30 million OPs worth around $78 million. This shows that the accumulation by the large portfolio holder was not done out of conviction, but probably as a profit move.

Optimism Sale of whales. Source: Santimento

Additionally, long-term (LTH) holders have also recently sold a huge portion of their holdings. These investors are known to hold their bid for more than a year and their move tends to be a bearish signal.

The impact of their actions can be assessed using the age consumed metric. Shows the total volume moved multiplied by the days since the last move. This provides insight into the sentiment of long-term bond holders.

Read more: What is optimism?

Optimism Consumed Age. Source: Santimento

Spikes in this metric suggest a growing bearish attitude among LTHs, who are likely looking to sell their holdings. The OP observed the largest spike since September 2023, raising concerns about future price action.

OP Price Prediction: Consolidation Ahead?

Optimism price has been on an uptrend over the past month and a half, taking the altcoin to $2.68 at the time of writing. However, during this time, OP attempted to breach the $2.99 resistance twice, failing both times.

The altcoin has also consolidated the $2.33 level as a crucial support base, and going forward, these will be the limits of consolidation. Bearish signals will keep the price of optimism moving sideways.

Read more: Optimism vs. Arbitrum: Ethereum Layer-2 rollup comparison

Optimism Price analysis. Source: TradingView

However, a breakout or crash could change this sentiment. The chances of a breakout are higher than those of a breakdown.

A move above $2.99 will allow OP to break above $3.17 and head towards $3.59, which would also invalidate the bearish outlook.