The last month has been characterized by a decline in network activity in the Near (NEAR) protocol. Daily transaction volume dropped, causing network fees and revenue to decline.

This has impacted the NEAR protocol’s native token, which has also seen a double-digit drop in value over the past 30 days.

The near protocol sees the user exodus

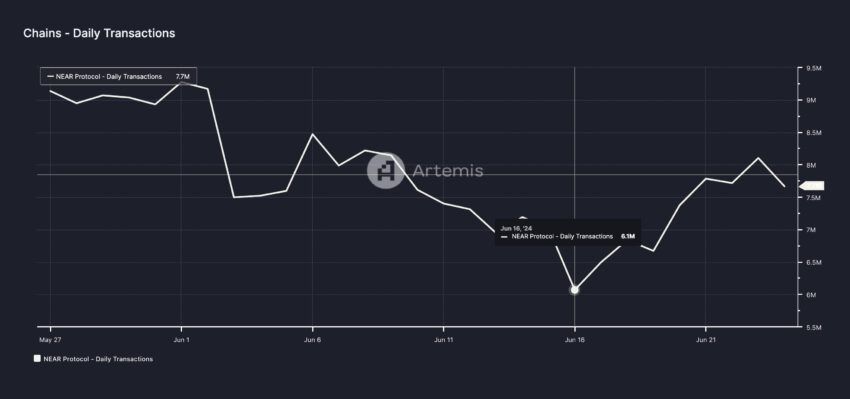

Over the past 30 days, Near has seen an overall decline in demand. The number of unique on-chain interactions with the protocol completed during that period has plummeted by 15%. As of June 24, the total number of transactions completed on Near was 7.7 million.

Almost daily transactions. Source: Artemide

The drop in the number of daily transactions on NEAR is due to the decrease in the number of unique addresses interacting with the protocol.

After peaking at 2.2 million on June 14, Near’s daily active addresses plummeted 18%.

Read more: What is the NEAR Protocol (NEAR)?

Addresses active almost every day. Source: Artemis

Near’s decline in demand over the past month has impacted its network fees and revenue. Near’s transaction fees totaled $24,000 in the reporting period, down 38%.

This resulted in a revenue of $23,000, a 30% decrease.

NEAR Price Prediction: A Change in Market Trend Is Needed

The decline in Near’s network usage over the past 30 days has negatively impacted the performance of its native coin. As of this writing, NEAR is trading at $5.27 and its value has decreased by 30% in the last 30 days.

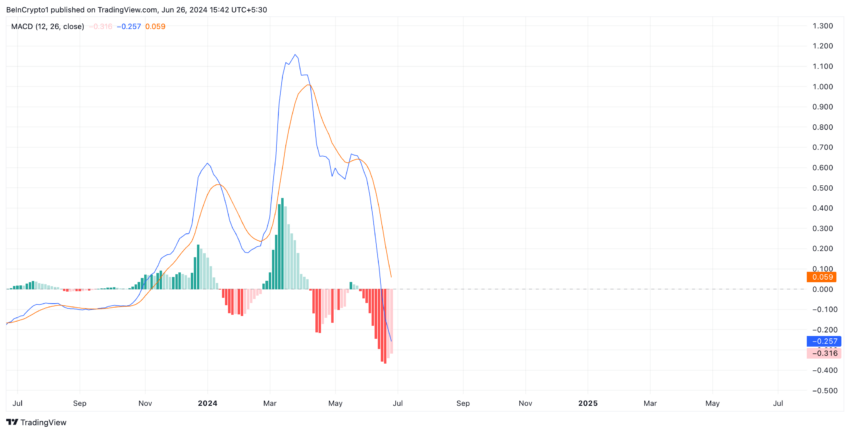

NEAR’s Moving Average Convergence Divergence (MACD) indicator is showing a significant bearish bias towards it. At the time of writing, the token’s MACD line (blue) is below its signal (orange) and zero lines.

Close Analysis. Source: TradingView

Traders often use this indicator to identify trends and potential reversals in asset prices. When the MACD line crosses below the signal line, it suggests that short-term momentum is weaker than long-term momentum.

Coin holders interpret this setup as a signal to consider selling or to avoid opening new long positions until there are signals of the MACD line crossing the signal line and the zero line, which could indicate a potential reversal or change in market sentiment.

If the sentiment remains bearish, the price of NEAR could drop further and fall below $5.

Read more: Top 8 NEAR Wallets in 2024

Close Analysis. Source: TradingView

However, if the buying pressure increases and the trend changes to up, the price could rise to $5.45.