Fundamental analysis is often ignored in the cryptocurrency market, mainly focusing on short-term or medium-term trades, mostly following technical analysis. However, investment funds such as Cyber Capital focus on long-term value investing through deep fundamental analysis of industry projects.

Cyber CapitalFounder and CIO Justin Bones took to the X thread on August 5 to talk about what he believes to be the “technological Holy Grail of cryptocurrency,” and called on the crypto community to “wake up and realize this development,” which is still largely unknown.

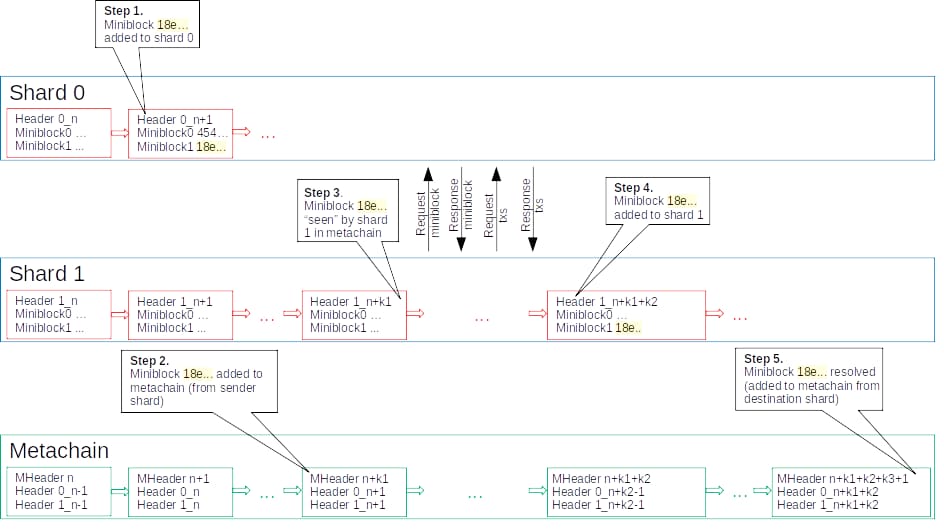

According to Bones, MultiversX (EGLD) stands out because it has successfully implemented sharding technology, ahead of competing cryptocurrencies. As described, MultiversX is capable of exceeding 100,000 transactions per second right now, making it one of the most scalable blockchains to date.

However, the investment expert explained that EGLD is not perfect, pointing to its economics and governance design. Bons believes that they are not perfect from his perspective, citing other projects that are also working with different sharding architectures.

Overall, the post highlights the benefits of sharding and the specific implementation of MultiversX, which could take the market to a new level of development, which he says the crypto community needs to “wake up to.”

Along with EGLD, Cyber CapitalThe founder mentioned Radix (XRD), Toncoin (TON), Tezos (XTZ), and Near (NEAR) as considering sharding, though not yet fully implemented and battle-tested like MultiversX. Additionally, Solana (SOL), Aptos (APT), Sei Protocol (SEI), and Sui Network (SUI) are other layer-one blockchains that offer greater scalability.

“The future is bright. It will take time for more people to realize the true power of these breakthroughs. EGLD is proof that we can, in fact, scale blockchains on-chain through sharding! From a technological standpoint, it is way ahead in terms of scaling, making it a key player. This is what makes EGLD so incredibly important to the entire cryptocurrency movement. Even though the ecosystem and usage of EGLD is tiny compared to its main competitors.”

– Justin Bones

EGLD Price Analysis and Growth Potential

At the time of writing, MultiversX’s native token EGLD is trading at $27.13, down nearly 12% year-over-year. It has been in a short-term downtrend since its local high of $74.71 in March and a medium-term downtrend since its all-time high of $545 (ATH) in 2021.

These market data illustrate poor price performance and a low market cap of around $740 million.

In this context, cryptopediatrist and enthusiast MultiversX DBCrypto posted a thread about the current “unknown” state of the project.

The content creator pointed to the relatively low initial funding, raising a total of $5.15 million over two rounds. In contrast, most of EGLD’s competitors have raised more than ten times that amount, he explained, from retail traders and the community. In June, Justin Bones described the cryptocurrency market as “dominated by predatory venture capitalists,” as reported by Finbold, warning of this dynamic.

1/ MultiversX is possibly the most advanced blockchain in the world 🚀

But lately I often see this question:

“If he’s so good, why haven’t I heard much about him?

This is such a great question and I have the answer!

Read on 🧵 pic.twitter.com/Z0DjIKY74S

— DBCrypto⚡️ (@DBCrypt0) August 6, 2024

Overall, EGLD must first reverse these trends to seek long-term growth, which the presence of the “Holy Grail” of crypto technology cannot guarantee. Cryptocurrencies are highly volatile and unpredictable assets, even if they are backed by strong fundamentals.

However, various experts recognize the potential of MultiversX in providing decentralized, secure and efficient infrastructure for decentralized applications (DApps), decentralized finance (DeFi) and Web3, which may attract the attention of the market in the long term.

Disclaimer: The content of this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.