Luno Exchange Review

Luno is a centralized exchange that occupies #85 on Guru InvestingExchange Tracker. Luno trading volume is US$7,195,333 in the last 24 hours and US$4,734,112,612 in the last 7 days.

Luno currently has 13 cryptocurrencies, 10 paper currencies and 25 markets (cryptocurrency trading pairs). The most popular trading pair on Luno is XBT/ZAR.

Compare Luno next to other exchanges here: Exchange comparison tool.

Luno is centralized cryptocurrency exchange (CEX) which allows users to buy, sell and exchange digital currencies. The exchange was founded in 2013. Its headquarters are in London, and there are regional centers in Cape Town and Singapore.

Crypto exchange Luno has more than 10 million clients. The platform is available in more than 40 countries in North America, Africa, Europe and Asia. According to cryptocurrency exchange Luno, users must verify their identity. KYC and AML requirements before they start trading. People from unsupported regions are allowed to create accounts and use the platform without verifying their identity. However, they cannot buy, sell or exchange digital assets.

The Luno cryptocurrency exchange is available in mobile applications for Android and iOS. Users can also access the platform via the Internet.

Markets

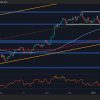

Luno offers instant buy/sell functions. Luno spot trading allows users to purchase cryptocurrencies such as Bitcoin, EthereumAnd Litecoin with your local currency or trade 25 cryptocurrency pairs. Luno trading pairs include popular markets such as ETH/BTC and LTC/BTC.

Luno uses creator/recipient fee structure for traders using the Luno cryptocurrency exchange. Market makers do not pay any commissions, while market takers pay a nominal commission.. Luno exchange fees are determined by the user’s trading volume over the last 30 days. Trading volume for 30 days is calculated by the Luna system every day at midnight (00:00 GMT).

Each supported region has different levels that determine the market taker’s commission:

- Australia and Europe – 8 levels with commission from 0.03% for level 8 to 0.10% for level 1.

- Indonesia – 3 levels with a commission of 0.21% for each level.

- Malaysia – 8 levels with a commission from 0.15% for level 8 to 0.50% for level 1.

- Nigeria – 7 levels with commission from 0.04% for level 7 to 0.10% for level 1.

- Uganda, South Africa and UK – 8 levels with commissions from 0.04% for level 7 to 0.10% for level 1.

In addition, Luno users may incur deposit fee depending on their regions. The platform charges a fee if it incurs costs to receive the deposited money. The platform also charges a fee Withdrawal fee when the user withdraws funds to their bank accounts. The fee for sending cryptocurrency is dynamic and depends on the traffic on the blockchain. Receive Bitcoin and Ethereum for free. Finally, buying and selling cryptocurrency on Luno Exchange also incurs a fee, which is displayed on your screen when you complete the transaction.

Detailed fees for the Luno cryptocurrency are available on the platform’s website.

In December 2022, Luno’s total volume was $13.06 million. Many active traders and large volumes of Luno provide high liquidity on the platform. High liquidity helps maintain a stable price for the Luno cryptocurrency, allowing traders to place trades as close to the price they want to maximize their profits.

other services

Luno offers savings programwhich allows users to earn interest for depositing cryptocurrency into Luno Savings Wallet. A savings wallet is a lending product. Although it is only available for supported cryptocurrencies, which may vary by jurisdiction.

In addition, Luno offers multi-currency crypto wallet it allows users to store their assets securely. Luno itself stores 95% of its cryptocurrency in “freezer“, which is a multi-signature wallet protected by multiple layers of encryption.

Finally, Luno has a powerful API it allows users to create their own applications and integrate payments. In addition, the API offers space for developing secure trading bot.

About company

Luno, formerly known as BitHwas founded Krel van Wyk, Peter Haynes, Marcus Swanepoel and Timothy Stranex in 2013. The company, headquartered in London, has been providing exchange services since its inception.

Luno has raised more than $13 million in four rounds of funding. The company was funded by several investors, including Digital Currency Group (DCG).

In September 2020, DCG announced the acquisition of Luno. Since then, the Luno cryptocurrency exchange has operated as an independent subsidiary of Digital Currency Group (DCG). DCG’s main goal is to develop a better financial system by creating and supporting blockchain and cryptocurrency companies.

In October 2020, Luno announced a partnership with IntoTheBlock, an intelligence company that uses machine learning and advanced statistics to extract cryptocurrency market signals. IntoTheBlock is committed to helping Luno users gain deeper trading insight.

Luno’s highest daily trading volume was recorded on May 20, 2021 at $123.11 million.

An attempt was made in 2021 phishingaimed at Luno users.

Co-founder and CEO Marcus Swanepoel has in-depth knowledge and experience in financial technology coding. Before joining Luno, he was actively involved in the founding of Palo Alto Networks, a Silicon Valley startup. Other co-founders Krel van Wyk, Peter Haynes and Timothy Stranex also have extensive knowledge of technology and cryptography.

Pages related to Luno

Read the hottest Crypto news.

Watch the animated crypt Video explanation.

Learn Cryptocurrency From scratch.