Corbit Exchange Review

Korbit is a centralized exchange that occupies #118 on Guru InvestingExchange Tracker. Korbit has trading volume US$93,039,347 in the last 24 hours and US$8,167,011,553 in the last 7 days.

Corbit currently has 137 cryptocurrencies, 1 paper currencies and 136 markets (cryptocurrency trading pairs). The most popular trading pair on Corbit: XRP/KRW.

Compare Corbit next to other exchanges here: Exchange comparison tool.

Korbit is a South Korean centralized cryptocurrency exchange (CEX). Considered the first in the world Bitcoin (BTC)-Korean Won (KRW) exchange offers spot market, virtual deposits, staking and NFT marketplace.

Korbit cryptocurrency exchange adheres to KYC regulations set by the South Korean financial authorities. Non-national trading activities are limited. It is available on desktop and mobile devices.

Markets

The main service provided is Corbit. spot market. Margin or leverage trading is not available. There is also no derivatives market. Although KRW is the only fiat currency supported, USDC stablecoin has been listed.

The exchange follows the financial rules of South Korea. Therefore, Korbit’s list of approved trading pairs is significantly smaller than other platforms. He supports crypto-crypto and crypto-KRW trading.

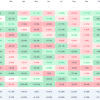

All Korbit exchange commissions for traders use a multi-level maker-taker model. Price indices are expressed in KRW. In general, there is nine tiers with varying commission rates. Corbit does not provide special discounts or offers. There is only one account type for all users.

Commission levels are determined by Korbit’s 30-day trading volume. At Level 1, the required volume is up to 100 million won, and the maker/taker fees are 0.08% and 0.2% respectively. The taker fee is the same at the first four levels.

At Level 5, Korbit’s required volume is between 2 and 10 billion won. The maker fee is 0.01% and the taker fee is 0.15%. At levels 5–9 there is no manufacturer fee. At level 9, takers must pay a 0.015% fee for Korbit cryptocurrency.

Deposits and withdrawals apply to both cryptocurrency and fiat currency. The deposit/withdrawal price of Korbit cryptocurrency is expressed in KRW. Deposits are free. Withdrawal fees vary by asset.

The platform supports debit and credit card deposits, as well as bank transfers. When using fiat currency deposit/withdrawal services, bank fees may apply.

other services

Staking included for Korbit Spot Exchange users. Platform supports Ethereum (ETH) staking after merger. Clients can earn passive income by investing their assets. Additionally, the virtual deposit feature allows users to earn rewards based on the value of the Korbit cryptocurrency they deposit.

NFT Marketplace is a platform where Korbit users can mint, buy, sell and trade non-fungible tokens (NFTs). It supports ERC-721 tokens and uses ETH as the main payment method. All NFTs can be stored in user accounts.

About company

Korbit cryptocurrency exchange was founded in 2013 Tony Liu, Louis Jinhwa Kim and Kangmo Kim. It is known as the world’s first BTC-KRW exchange. The company’s headquarters are located in Seoul, South Korea. Current CEO Sejin Oh.

In September 2017, South Korean media conglomerate Nexon signed a deal with Korbit to acquire 65% of the cryptocurrency exchange. The deal was valued at $80 million, making Nexon’s parent company NXC Korbit’s largest shareholder.

In 2019, the platform strengthened its KYC policy following changes in national regulations. Users could no longer trade or invest anonymously. Additional regulatory restrictions apply to non-Korean citizens using Korbit.

In May 2021, Corbit launched South Korea’s first NFT marketplace. It was announced that all transactions will be carried out using Ethereum (ETH) and auction features will be offered.

In December 2021, South Korean industrial conglomerate SK Group bought a 35% stake in the Korbit crypto exchange. The purchase price was more than $75 million, making SK Square, an SK Group company, the exchange’s second-largest shareholder.

In 2022, Corbitt said employees will receive NFTs as identification. Employee tokens were minted in June. The goal of moving to NFT IDs was to create a sense of community within the company.

In June 2022, following the collapse of Terra and Luna cryptocurrencies, Korbit became one of five South Korean exchanges that formed an advisory body on the healthy development of the crypto industry. The Korbit cryptocurrency exchange is a crypto market monitoring body.

Tony Liu is a venture capitalist and former CEO of crypto exchange Korbit. He is currently a Venture Partner at Softbank Ventures Asia. Liu left Korbit in 2018. He was succeeded by Jason Park, who remained CEO until December 2019.

Since January 2020, Sejin Oh has been the CEO of Korbit. Prior to taking this position, he served as the company’s chief strategy officer. O is a financial expert who has worked with world renowned companies such as HSBC and Barclays.

Louis Jinhwa Kim is an entrepreneur and former director of Korbit. Kim is known as the author of the book Next Money in Bitcoin, which is considered one of the first books on Bitcoin in South Korea. Over the years, he has co-founded several social and financial services companies. In 2017, Kim co-founded the Korea Blockchain Association.

Kangmo Kim is a software developer and former CTO of Korbit. He has over twenty years of software development and design experience. Kim left the Korbit cryptocurrency exchange in 2015. He also served as acting CEO of ScaleChain until 2021.

Corbit related pages

Read the hottest Crypto news.

Watch the animated crypt Video explanation.

Learn Cryptocurrency From scratch.