HitBTC Exchange Review

HitBTC is a centralized exchange that occupies #136 on Guru InvestingExchange Tracker. HitBTC has trading volume US$213,197,889 in the last 24 hours and US$260,685,405,022 in the last 7 days.

HitBTC currently has 484 cryptocurrencies, 5 paper currencies and 871 markets (cryptocurrency trading pairs). The most popular trading pair on HitBTC is Bitcoin/USD.

You can read the full expert review of HitBTC here: HitBTC Review.

Compare HitBTC next to other exchanges here: Exchange comparison tool.

HitBTC cryptocurrency exchange was founded in 2013 and launched in February 2014. This is an advanced cryptocurrency exchange. specializing in spot trading of altcoins. It boasts that it was created by experienced system architects, technology engineers and financial experts, although most of the HitBTC team remains anonymous. However, the company was reportedly founded with $6 million in venture capital investment.

Although the platform is unregulated exchangeit corresponds KYC and AML regulations. The HitBTC cryptocurrency exchange has different levels of verification. Unverified accounts start as Snackand those who have been verified receive Account status updated. To be verified, you will need to provide personal information such as your place of residence, proof of identity, and a selfie of you holding your ID document with your date of registration.

Although the HitBTC cryptocurrency exchange is a global company, citizens of the United States of America, North Korea, Sudan, Crimea and Sevastopol, Cuba and Syria cannot access the services offered by the platform. This is due to restrictions on cryptocurrencies in these countries.

Markets

The HitBTC crypto exchange has 8 markets available as trading instruments on the platform. These markets include – Fiat, BTC, ETH, USDT, HIT, USDC, DAI and USDD. In all these markets there is a combination over 800 HitBTC trading pairs. Additionally, in addition to the HitBTC spot trading option, the platform supports margin trading and derivatives.

Trading on the platform includes simple commission structure. There are no fees for deposits in the HitBTC cryptocurrency, but there are fees for placing orders and withdrawing funds from the exchange. Unverified users pay HitBTC cryptocurrency fees of 0.1% to the maker and 0.2% to the taker. Meanwhile, verified users are put into their tiered commission system, which determines trading fees based on the user’s HitBTC trading volume over the past 30 days.

Moreover, there are fixed fee for withdrawals made on the platform. The HitBTC cryptocurrency price for Bitcoin withdrawal is 0.0015 BTC, and for Ethereum it is 0.0428 ETH. Other crypto assets on the platform have different withdrawal fees, but are generally inexpensive and user-friendly.

The platform has its own utility token known as HIT token. The main purpose of the token is to provide users with a seamless and seamless trading experience. One of the main advantages of the token is that it provides its owners discounts up to 45% on trading and withdrawal fees. Additionally, there are no fees when trading the HIT token as a trading pair.

In the future, the HIT token will become a core part of the HitBTC cryptocurrency exchange ecosystem, increasing its value by providing new sought-after features and offering additional benefits to its holders. This includes the use of HIT as collateral for margin and futures trading, higher discounts on referral programs, reduced commissions on futures contracts, higher staking rewards, management rights to future token listings, and more.

other services

The platform offers passive income opportunities to its users through betting programs. They can participate by stake your crypto assets for rewards while maintaining the ability to use their assets whenever they want. Rewards are calculated and paid based on the minimum balance of the digital asset staked.

Additionally, for those new to cryptocurrency trading, the HitBTC cryptocurrency exchange offers the opportunity to try trading cryptocurrencies on its platform. demo platform first. You can register and access the demo platform and test your strategies before trading with real money. This gives you more confidence and helps you make better decisions when trading with real money.

The platform also offers FIX and REST API which give access to order book, market data and more. Trading functionality is also extensive: traders have access to 4 types of orders: market, limit, stop-limit and stop orders.

Finally, HitBTC offers personalized OTC (over-the-counter) trading services for large traders. To qualify for OTC service, you must exchange more than $100,000 per trade. Each trade is subject to a 0.1% transaction fee.

About company

One of the interesting things about the company is that the people behind it – the founders, developers and team – have chosen to remain anonymous. However, the platform is managed by a consortium known as Ullus Corporation.

As of December 2022, HitBTC’s 24-hour volume is 80,804 BTC, equivalent to over $1.2 billion.

It is important to note that the platform has never been hacked until now. Additionally, it stores most of its user funds in cold storage (hardware wallets) away from the prying hands of hackers.

In 2018, the company entered into an agreement with Sequant Capital, a UK FCA regulated broker who has established a strategic partnership with HitBTC for better access to the cryptocurrency market. This was an important milestone for the company, which gained direct access to the cryptocurrency market.

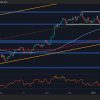

In May 2020, the platform signed a partnership agreement with TradingView, a social network for traders specializing in charting software. The partnership helps HitBTC users streamline their trading process.

HitBTC related pages

Read the hottest Crypto news.

Watch the animated crypt Video explanation.

Learn Cryptocurrency From scratch.