Crypto.com exchange review

Crypto.com Exchange is a centralized exchange that occupies #17 on Guru InvestingExchange Tracker. Crypto.com exchange has trading volume US$1,273,393,816 in the last 24 hours and US$209,473,199,107 in the last 7 days.

The Crypto.com exchange currently has 320 cryptocurrencies, 2 paper currencies and 667 markets (cryptocurrency trading pairs). The most popular trading pair on the Crypto.com exchange: ETH/USD.

Read the full expert review of the Crypto.com exchange here: Crypto.com exchange review.

Compare Crypto.com exchange next to other exchanges here: Exchange comparison tool.

Crypto.com is a centralized cryptocurrency exchange based in Singapore. Launched in 2019, it offers spot and futures markets, margin and over-the-counter (OTC) trading, betting and lending, and trading bots. In addition, users of the Crypto.com cryptocurrency exchange can access additional features and services such as NFT Marketplace and Digital Wallet.

Platform KYC compliant. Crypto.com crypto exchange can be accessed in more than 100 international markets. It is available in most US states. However, it does not have a BitLicense to operate in New York State.

Markets

The Crypto.com spot market offers over 200 different assets, including major cryptocurrencies and stablecoins. There are over 350 Crypto.com trading pairs in total. One of the available assets is Kronos (CRO), formerly known as Crypto.com coin. CRO holders are entitled to preferential commission rates.

Margin trading Crypto.com allows users to borrow digital assets that can be used as collateral. Margin trading is conducted on the Crypto.com spot market. In futures markets, users can trade with leverage up to 100x.

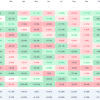

There are two types of trading commissions: regular and VIP. There are five levels of regular Crypto.com exchange fees. The “producer-receiver” model is used. For regular users, the amount of CRO held determines the discount rates for makers and takers, as well as the discount rates for makers.

Five levels of spot and margin fees are determined by Crypto.com’s 30-day trading volume in USD. At Level 1, trading volume is less than $250,000 and the maker-taker fee is 0.0750%. At Level 5, 30-day volume exceeds $10 million. The taker fee is 0.0500%, and makers are not required to pay any exchange fees to Crypto.com.

There are five levels of VIP traders on the Crypto.com spot exchange. There is no maker fee and the taker rate ranges from 0.025% to 0.040%. The price of Crypto.com cryptocurrency is not affected by CRO assets.

Futures trading became available in 2021. Crypto.com’s derivatives markets offer traders quarterly and perpetual futures contracts. Over 120 Crypto.com trading pairs are available to futures traders.

Derivatives fees for regular users follow the same five-tier structure as the spot market. At Level 1, Crypto.com’s 30-day derivatives volume does not exceed $1 million. Maker-taker fees are 0.0170% and 0.0340% respectively.

At the fifth level, the maker’s commission is reduced to zero, and the taker’s commission is 0.0260%. CRO token holders are subject to discounts and discounts on manufacturer fees. VIP futures traders are not required to pay a commission to the maker. The Crypto.com taker commission at five levels ranges from 0.015% to 0.024%.

Shopping Arena it is a gamified trading platform. This allows clients to receive rewards for participating in specific trading tasks. Eligibility criteria may vary depending on the Arena competition.

Crypto.com supports all popular payment methods including ACH and SEPA bank transfers, SWIFT, debit and credit card payments, PayPal and other cryptocurrencies. There is no deposit fee. All withdrawal fees depend on the asset.

other services

DeFi wallet Crypto.com is a non-custodial digital wallet. It can be used to store over 700 assets. Users can deposit and store non-fungible tokens (NFTs), trade assets and get discounts on various stablecoins and other tokens. It also provides a directory decentralized applications (dApps).

NFT marketplace Crypto.com was launched in 2021. It is a platform that allows clients to mint, buy, sell and trade non-fungible tokens. NFT marketplace supports ERC-721 tokens. Crypto.com does not charge additional cryptocurrency fees for purchasing products. Sellers pay a 5% processing fee for operating costs.

Crypto.com Payment is a payment and settlement system. It allows users to make purchases on e-commerce platforms or buy NFTs using over 30 tokens. There are no gas fees. Users are eligible to receive up to 10% CRO in exchange for Crypto.com Pay transactions.

Crypto.com Earnings is a platform betting service. This allows clients to stake their tokens and receive passive rewards. Reward rates depend on the duration of the bets and the selected asset.

Syndicate is a blockchain platform for fundraising. This allows awarded project teams to list their assets on the crypto exchange Crypto.com. Syndicate is not available to users in the US, China, or Hong Kong.

Crypto.com Card This is a prepaid Visa card. Customers who have staked CRO tokens for at least 180 days and have passed KYC verification are eligible to apply for the card. The Crypto.com card has five tiers with varying levels of CRO rewards and other benefits.

About company

Crypto.com was founded in 2016 in Hong Kong as Monaco. It was renamed in 2018 after the company bought the domain Crypto.com from the famous cryptography researcher Matt Blaze. The company’s founders include Chris Marszalek, Bobby Bao, Rafael Melo and Gary Ohr. The current headquarters is in Singapore.

The beta version of the Crypto.com cryptocurrency exchange was officially launched in November 2019. The full version was launched a month later. In January 2020, the first trading battle for a prize fund of 50,000 started on the Trading Arena. USDT.

The company reportedly had a customer base of over 10 million users in February 2021. That year, Crypto.com’s average daily spot volume was estimated at $5.5 billion. The company began cooperation with famous brands, including the Aston Martin Formula 1 team.

In January 2022, the Crypto.com platform was hacked by hackers who stole Ethereum (ETH) funds. During the attack, users reported suspicious activity on their account, which led to the suspension of withdrawals to the exchange. The value of the stolen Crypto.com cryptocurrency was approximately $15 million.

In February 2022, cryptocurrency exchange Crypto.com was featured in one of the Super Bowl LVI commercials. Reportedly The 30-second appearance cost the company $6.5 million..

In May 2022, it was reported that the Crypto.com exchange had collected more than 50 million users. The company expected to reach 100 million users by the end of the year, according to the CEO.

Chris Marsalek is the CEO of Crypto.com. He is a Polish entrepreneur who was involved in the development of several other fintech companies, including Ensogo and BeeCrazy, before founding Crypto.com.

Bobby Bao is the Managing Director of Crypto.com. He is a venture capitalist and entrepreneur. In 2018, Bao was included in the Forbes Asia 30 Under 30 list. He worked on the company’s corporate strategy. In 2021, he launched the cryptocurrency startup funding platform Crypto.com Capital.

Rafael Melo is the CFO of Crypto.com. Has more than 15 years of experience in the financial sector. Melo also served as CFO of Mastercard Mobile Payment Solutions. He held the same position at social commerce platform Ensogo.

Gary Ohr is the former CTO of Crypto.com. He is a computer scientist and software architect. After leaving the cryptocurrency exchange Crypto.com in December 2020, Or founded the startup accelerator Particle B.

Pages related to the Crypto.com exchange

Read the hottest Crypto news.

Watch the animated crypt Video explanation.

Learn Cryptocurrency From scratch.