Coinlist Pro Exchange Review

Coinlist Pro is a centralized exchange that occupies #90 on Guru InvestingExchange Tracker. Coinlist Pro has trading volume US$1,282,383 in the last 24 hours and US$368,341,645 in the last 7 days.

Coinlist Pro currently has 52 cryptocurrencies, 1 paper currencies and 77 markets (cryptocurrency trading pairs). The most popular trading pair on Coinlist Pro is USDT/USD.

Compare List of coins Pro next to other exchanges here: Exchange comparison tool.

List of Coins Pro is a centralized cryptocurrency exchange (CEX). It is part of the broader CoinList ecosystem, which also provides token sales, custody and staking services. CoinList Pro, launched in 2020, offers spot market trading.

CoinList Pro is KYC compliant and requires all users to verify their identity. The service is not supported in Iran, North Korea, Syria and Cuba. Residents of several US states, including Alaska, Hawaii and New York, cannot access CoinList Pro cryptocurrency exchange services.

Markets

CoinList Pro Spot Exchange is one of the core financial services offered in the CoinList ecosystem. Margin trading and derivatives markets are not available. The platform is focused on institutional traders who participate in the sale of tokens on CoinList.

The exchange supports both crypto-crypto and crypto-fiat trading. The US dollar is a supported fiat currency. In total, there are over 90 CoinList Pro trading pairs available, consisting of over 40 digital assets. The exchange is known for listing tokens in the early stages of adoption, often before they appear on more established exchanges.

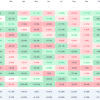

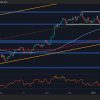

Clients can use one-click trading submit applications to the market. There are several different types of markets, including stop, limit and order placement only. Live CoinList Pro volume data for pairs can be viewed using several chart styles and indicators.

CoinList Pro exchange fees are separate from CoinList.co’s broader transaction fees. While the main platform charges a flat rate of 0.5%, the Pro exchange follows a tiered producer-receiver model.

There are twelve commission levels in total. Your bid is determined by CoinList Pro’s final 30-day trading volume. The lowest level requires up to $20,000 in volume and the maker-taker fees are 0.25% and 0.45% respectively. If the volume exceeds $50 million, the maker’s commission drops to zero.

Minimum order size requirements are based on the trading pairs selected. All CoinList Pro cryptocurrency fees are charged in the quote currency. For example, if the trading pair is BTC/USD, commissions will be paid in US dollars.

There are no deposit fees on the platform. The withdrawal fee rate is fixed and requires a minimum CoinList Pro price to be met. Required values may change depending on market conditions. There is a $10 fee for outgoing bank transactions in the US and a $30 fee for outgoing bank transfers overseas.

other services

Although the CoinList Pro cryptocurrency exchange only offers spot trading, the broader CoinList ecosystem provides other financial services for blockchain users. The most famous service provided by CoinList is the issuance of tokens through initial coin offerings (ICOs). CoiList conducts token sales for new assets before and around their launch date.

OTC Desk CoinList is an over-the-counter trading service for institutions. Traders can receive personalized offers and rates for large-scale transactions. The minimum required order size is US$1 million and a flat fee of 0.5% per trade is charged.

Some of the assets listed on the CoinList Pro crypto exchange may also be at stake, creating a closed ecosystem for token growth and maintenance. Assets subject to staking include WellSyper, FlowAnd Village.

CoinList seed is a demonstration platform for blockchain project teams. It provides social networking tools that connect entrepreneurs with promising crypto projects and help teams gain exposure and financial support.

List of Karma coins is a rewards program for users of the CoinList Pro cryptocurrency exchange. Customers who actively contribute to the exchange and the broader CoinList ecosystem by trading and supporting blockchain projects receive Karma scores that can be converted into special rewards.

Developers can access CoinList API Tools. By creating an API key, they gain access to information such as up-to-date CoinList Pro price lists, auctions, and balances.

About company

CoinList was launched as a cryptocurrency financing platform by a team of co-founders led by Graham Jenkin in October 2017. CoinList Pro cryptocurrency exchange for spot trading was released as one of the company’s trading products in July 2020. The company’s headquarters are located in San Francisco, California.

In 2019, CoinList received backing from investor and former Twitter CEO Jack Dorsey, who backed the company during a $10 million investment round. Before the launch of the CoinList Pro cryptocurrency exchange, the platform processed almost 1 billion dollars the cost of transactions through the issuance of tokens.

In 2021 CoinList.co and CoinList Pro trade volume exceeded $1 billion.. In October, the company achieved tech unicorn status as it was valued at $1.5 billion after a series of investments. At that time the company exceeded 4.5 million users.

Graham Jenkin is the CEO of CoinList. He was previously chief executive of AngelList. Jenkin, along with five other founders, created CoinList as a subsidiary of AngelList. The founders also include Paul Menchov, Brian Tubergen, Kendrick Nguyen, Andy Bromberg and Joshua Slayton.

Pages related to Coinlist Pro

Read the hottest Crypto news.

Watch the animated crypt Video explanation.

Learn Cryptocurrency From scratch.