After Thursday’s approval of Ethereum spot ETFs, a cryptocurrency tied to the tokenization of real-world assets (RWA) is surpassing its previous all-time highs, says the CEO of a BlackRock-backed RWA firm Decipher that the endorsement is bullish for the premise of asset tokenization on Ethereum.

The Ondo Finance governance token is up 16% at $1.10 in the past 24 hours, leading the top 100 cryptocurrency market coins by market capitalization in terms of daily gains, as of this writing, second CoinGecko.

The project specializes in offering institutional-grade financial products and services, such as tokens that offer US dollar returns or exposure to US Treasury securities. In 2022, Pantera Capital and Peter Thiel’s Founders Fund driven a $20 million Series A funding round into the project.

Seemingly affirming Ethereum’s regulatory status as a commodity, the approval of several spot ETFs has huge consequences for companies focused on building digital representations of assets that trade on-chain and via associated infrastructure, Securitize CEO Carlos Domingo said Decipher.

“The most important thing here is not that you can trade an ETF on Ethereum,” he said, referring to Thursday’s approvals. “Ethereum, at least from an institutional point of view, is 1717817011 completely safe to use because there is no risk that the gas token, ETH in this case, is actually a security.”

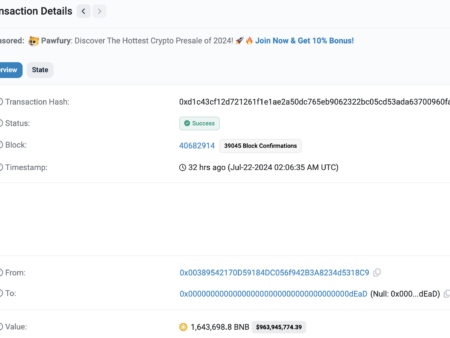

In March, Ondo She said would move $95 million of funds backing its U.S. Treasury-backed token (OUSG) to BlackRock’s tokenized BUIDL fund. Established via Securitize, shares of BlackRock’s BUIDL fund are represented by an Ethereum-based token, pegged at a price of $1, and fund subscribers receive a return in the form of multiple tokens.

Trivia of the day👇$ONDO alone contributed $195 million of BUIDL’s $448 million in assets under management.

To put this in perspective..

Blackrock’s first onchain fund saw nearly 50% of its growth come from Ondo’s efforts.

There are levels to this and your size is not the size.

— JTrades⚔️ (@_JTrades_) May 24, 2024

Ondo’s move to BlackRock’s BUIDL fund was all about efficiency, Domingo said. The CEO explained that previously, while backing his OUSG token with BlackRock’s iShares Short Treasury Bond ETF, managing the product was relatively complicated.

“They didn’t have good control over the underlying asset in terms of fast issuance, fast redemption, [and] on the visibility of the chain: that the money is there,” Domingo said. “One of the use cases for BUIDL is that it becomes a base layer for people to build products on top of.”

Ondo did not immediately respond to a request for comment from Decipher.

BlackRock CEO Larry Fink highlighted tokenization as “next generation for the markets” from 2022, believing that crypto technology could offer financial market participants “reduced fees” and “instant settlement.”

Describing Ondo as “very innovative,” Domingo said Ondo’s use of BUIDL reduces five distinct steps – between broker-dealers and custodians who safeguard the assets – in the redemption of Ondo products. Previously, he said, it would have taken “two or three days to get the money.”

In light of the approval of Ethereum spot ETFs, Domingo said he expects more serious financial firms to branch into the tokenization space with a cloud of regulatory jitters recently dissipating.

“In my opinion, [this] it is more relevant for tokenization than the Bitcoin ETF,” he said. “As I said, this is very clear [Ethereum is] it is not a commodity and therefore using the public Ethereum blockchain is safe from a regulatory perspective.”

Edited by Andrew Hayward