Enjoy the Empire newsletter on Blockworks.co today. Get news delivered straight to your inbox tomorrow. Subscribe to the Empire newsletter.

Bullish correction?

Bitcoin and Ethereum have recovered from this weekend — and yesterday’s selloff. But the looming question is: What’s next?

Unfortunately, I don’t have a crystal ball. But I asked John Glover of Ledn what he thought of Bitcoin’s current chart. $49,000 — the level I flagged yesterday — remains a “critical” level to watch, Glover said. So far, Bitcoin has rebounded after falling to $49,000.

Another key level is in the range of $68,000 to $72,000.

“If we can get through the $60,000 to $62,000 mark and hold there for a couple of days, that would probably open up the upper end to make a final push and hopefully break through the $72,000 to $73,000 mark. I don’t expect us to have enough weeks to succeed at that. So I think it’s going to happen sometime in September, maybe even early October, but that’s what I’m still looking for,” Glover told me.

This is largely due to the fact that the macroeconomic situation has a negative impact on cryptocurrency: the correlation between stocks and Bitcoin has been restored.

Galaxy’s Alex Thorne wrote in his note that this is more of a “technical and macroeconomic analysis” than a fundamental one, as cryptocurrency fundamentals actually look quite strong at the moment.

“This move down has not been characterized as a capitulation by long-term holders. The proportion of Bitcoin supply held by long-term holders has been growing since mid-April, and long-term holders have increased their position every day since July 22, and today we are seeing the largest positive change in net position since September 2023,” Thorne said.

But there will be an edge, Glover warns. Ledn has seen liquidations and the market has seen quite a few big drops since the weekend.

“I think it will create some tension in the near future as people lick their wounds before jumping into the water again,” he told me.

I’ve been told a lot this week that Bitcoin is an asset class, not “just digital gold,” as Glover put it.

“Bitcoin is a store of value, but it’s also a volatile asset class where people will be much more active in and out of positions than they would be holding gold forever,” he said. “Now that we have a large contingent that is buying and selling more actively, we have to start looking at cryptocurrency alongside other asset classes and [look] view it as a risk asset rather than simply a store of value.”

Thorne noted: “Unlike gold, Bitcoin is not yet widely adopted by sovereigns, central banks or institutional investors. While we see some adoption among these groups, the institutional and sovereign story of Bitcoin is still in its early stages. As such, many investors view Bitcoin as a venture bet on its future as digital gold, hence the higher return profile than gold.”

Fredrico Brokate, head of US business development at 21Shares, told me he thinks we’ll soon absorb much of this news and the market will have a better idea of how to proceed by Friday (barring any new developments).

There is a silver lining for 21Shares, which has a Bitcoin and Ethereum ETF in the US.

“I think any time there’s a downturn or a downturn like this in the market, especially of this magnitude, it’s a real test, especially for a new car or a new asset class like the one we’re dealing with,” he said.

Brokeith noted that the moment reminded him of 2020, when analysts questioned the ETF play and how it would perform in a downturn.

He believes this could be a “fantastic tailwind for the digital asset industry going forward because these products are working exactly as they should and we don’t see any issues, whether it’s with our trading partners, whether it’s with the market makers, whether it’s with the custody solution, everything is running smoothly and working well and trading is taking place at the spreads that we need.”

Now we just have to see how the rest of the week goes.

– Katherine Ross

Data center

- BTC and ETH have stabilized after hitting the local floor just under $50,000 and $2,200, respectively. They have since jumped to $55,150 and $2,460.

- Basic Memcoin BRETT Leads Recoveryhas risen 47% in the last 24 hours. It is still down a third over the last week.

- CEX liquidations exceed $381 million in the last daywith 55% being short positions.

- DEX Volumes Grow 39% per week to $59.58 billion.

- On Monday alone, Uniswap on Ethereum processed $5.689 billion. the most since his record was set in March 2023when, according to DeFiLlama, it brought in $12.4 billion.

The Benefits of Hindsight

Crypto investing is a minefield.

Choosing the right strategy can be a losing battle. In traditional markets, dollar-cost averaging into broad index funds is often recommended for those who don’t want to spend time picking stocks.

This could earn you 10-12% a year, depending on how lucky you are this decade. But I doubt you would actually be here reading this newsletter if you were chasing only the average market return.

Bitcoin maxers play around with the old ways by “sacking” — buying a certain amount of bitcoin weekly or monthly, and perhaps even a little more during downturns.

But is it really optimal? I spent the morning testing several different strategies over the past 18 months to find out.

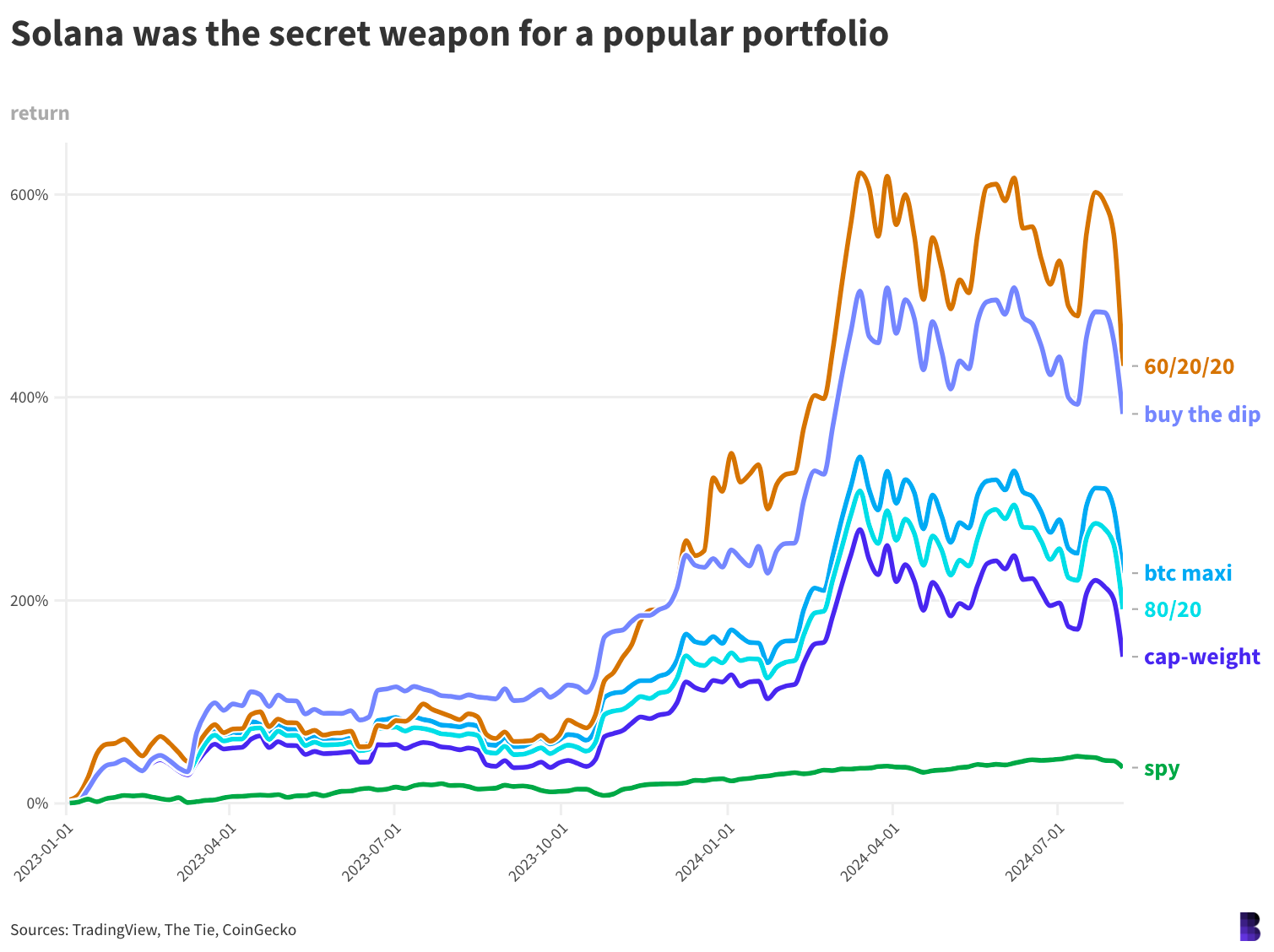

The first was a cap-weighted portfolio allocated across the 20 largest cryptocurrencies by market cap (excluding stablecoins, wrapped tokens, and liquid staking tokens), rebalanced quarterly – no dollar cost averaging, just a one-time initial allocation.

So $10,000 invested in this strategy at the beginning of 2023 would have yielded a return of 144%, which is just under $25,000.

Then there was an 80/20 split between Bitcoin and Ethereum, also rebalancing every quarter. This yielded a little more, just over 190%.

Bitcoin Max, which only bought and held bitcoins over the same period, otherwise rose 226%.

Far better than these three strategies was the “buy the dip” strategy. The idea was to start 2023 with $5,000 worth of Bitcoin and hold $5,000 in stablecoins to buy any dip of more than 10% over any five-day period.

Those who followed a similar path would have turned that $10,000 into a whopping $48,300. The portfolio was up more than 500% at its peak in March.

Outperforming all of these strategies has been another one that has been mentioned frequently over the past year: allocating capital between Bitcoin, Ethereum, and Solana.

The 60/20/20 split has returned up to 620% and is still the winning strategy even after the recent correction.

It seems obvious, but the results show the power of owning the right coins at the right time.

The worst performing portfolio was the one with the highest diversification, raising the question of whether it really carried significantly less risk given how closely the cryptocurrency market is linked to Bitcoin.

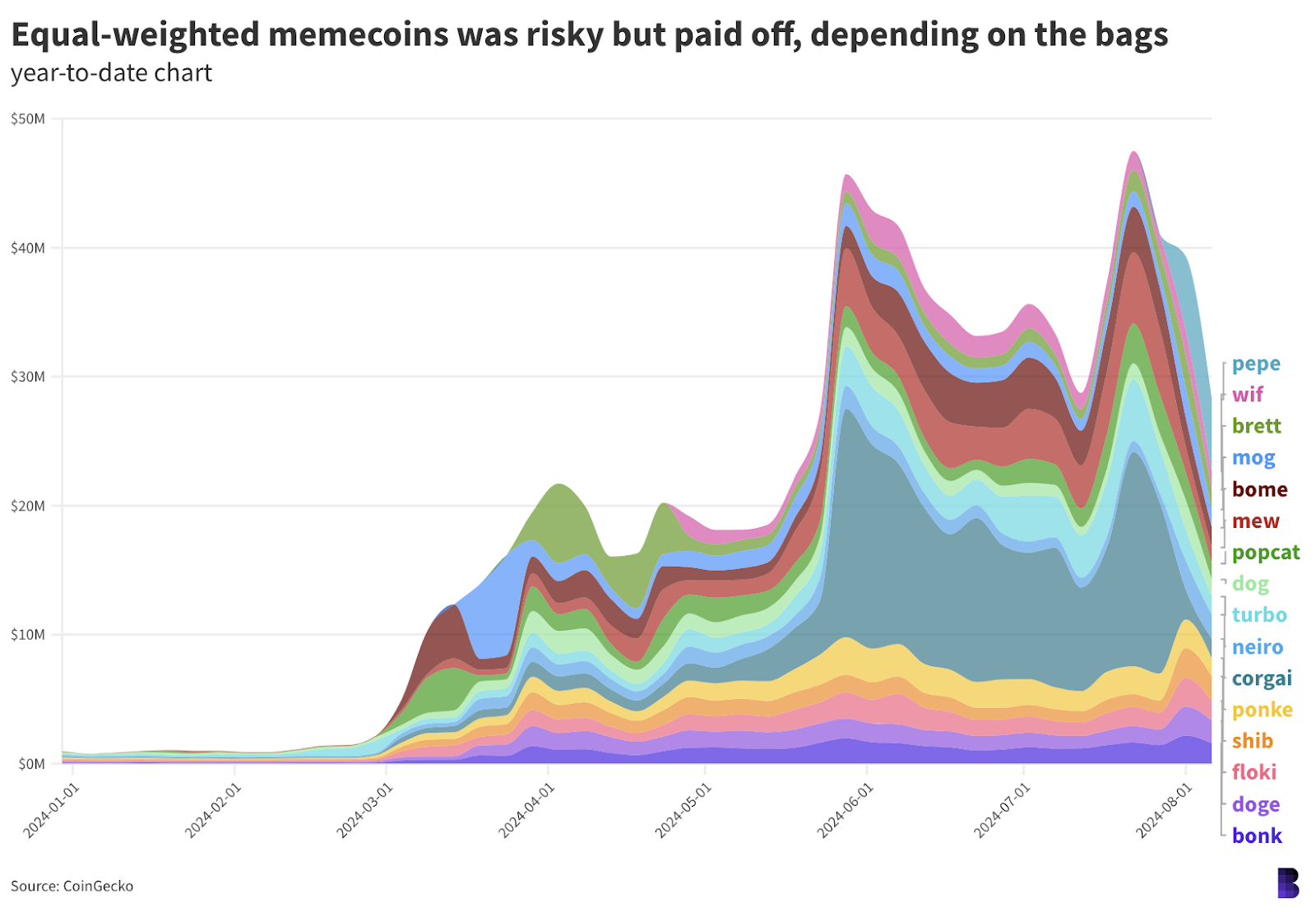

Of course, increase the risk and you increase the probability of huge gains. I also backtested a memecoin portfolio: evenly distributed across the top memecoins and rebalanced whenever a new popular token hits CoinGecko.

This meant that the portfolio now included over a dozen different memecoins, including ponke, neiro, popcat and mog, as well as well-known names like dogecoin, floki and shiba inu.

Admittedly, it is riddled with survivorship bias (the portfolio only ever bought memecoins, which eventually added huge market value).

However, while it didn’t do much for the first year or so, it began to skyrocket in late 2023, eventually turning an initial $10,000 investment into nearly $50 million at its all-time high in July, just five weeks ago. Since then, it has lost nearly half its value.

Perhaps the moral is that there is no such thing as a low-volatility crypto investment. Or that memecoins are still casinos.

In any case, all the proven strategies have still worked over the last 18 months or so, meaning there is still plenty of room for further adjustments before the real panic sets in.

— David Kanellis

Works

- Bitwise CIO Matt Hougan called the weekend stock sell-off a “buying opportunity.”

- Former President Donald Trump reiterated that the US government should not sell cryptocurrency, calling it “a very modern currency.”

- Ronin’s Bridge was suspended following a security incident involving a $9.8 million leak to the MEV bot account.

- India has released Binance tax return notice for $86 million, CoinDesk reports.

- The SEC has asked the court to dismiss the order. Coinbase’s “extensive” subpoena request for production of documents.

Riff

Q: Why was there no cryptocurrency advertising at the Olympics?

It’s anyone’s guess, but this either reflects inflated base advertising costs (which perhaps only AI companies are willing to pay this time around) or that cryptocurrencies are shifting their focus to internal rather than external areas.

The latter is a good place for cryptocurrency. Of course, for prices to rise over a long period of time (like another major bull market), fresh capital may be needed. And that would mean attracting new users, investors, and crypto enthusiasts.

Advertising campaigns aimed at the core audience make sense in this case. But there’s something compelling about cryptocurrency catering to the people who are already here — making their lives better through more infrastructure, apps, better UX, and whatever else comes along with it.

This could be better than any advertising campaign.

— David Kanellis

We may still be a little sad about the Crypto Super Bowl.

Who knows? Unfortunately, I don’t have a brain for marketing, so I’m left to guess along with you. But I’m glad. If we have to watch disgusting ads, let them be based on artificial intelligence, not cryptocurrency.

I don’t think paying someone like Matthew McConaughey to star in a cryptocurrency commercial is really going to boost consumer confidence. Although, to be fair, the idea of connecting people around the world is probably an easy way for crypto to get in on the action. But then again, I’m a journalist, not a marketing executive (sorry, Mom and Dad).

Anyway, let the Olympics be the Olympics. Besides, who pays attention to advertising anyway?

– Katherine Ross