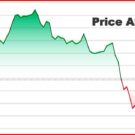

Real-time CVX price analysis

The current price of Convex Finance in real time is $4.98and its trading volume is equal to US$11,492,047 in the last 24 hours. CVX price has grew by

7.77%

on the last day and increased by

37.79%

in the last 7 days. It is important to note that Convex Finance’s current market capitalization is US$466,552,518and the maximum offer is 100,000,000 CVX coins. Speaking of negotiable supply, CVX has 93 766 026 coins. Convex Finance’s current market rating is #136.

Convex finance price today

92.06%

below

always on top and that’s it

585.81%

higher

always at a low level.

All data and prices are updated in real time. The most active and popular exchanges for buying or selling CVX are Binance, Kucoin & Kraken. Find more cryptocurrency exchange options on our Cryptocurrency exchange tracker. The most secure hardware wallets to store your cryptocurrency: Ledger And Trezor.

What is Convex Finance (CVX)?

CVX is a native token Convex Finance platform. Convex Finance is a decentralized protocol powered by Blockchain Curve Finance (CRV) and expands the services and rewards provided to Curve stakeholders and liquidity providers (LPs).

Using CVX tokens, Curve Finance liquidity providers can earn increased reward for the assets at stake. Its goal is to help LPs accumulate as many CRV tokens as possible to maximize their earning potential. You can see Convex’s price performance and the market trends it follows in the chart above.

What is the history of convex finance?

Unlike Curve Finance, the developers of Convex Finance remain anonymous. The goal was to leverage the staking system used by the Curve Finance protocol to maximize the rewards that stakeholders and liquidity providers can earn.

Curve Finance is a decentralized exchange focused on trading stablecoins – crypto-assets whose value is tied to another asset, for example, the US dollar or euro. It allows users to earn additional rewards by staking their assets and provides them veCRVor CRV tokens deposited as a result of voting.

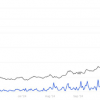

Convex Finance officially launched in May 2021. At the time of release, the price of CVX was around $6. Since then, the token has been volatile and its value has generally followed the same trends as the CRV token.

Given the limited supply of tokens and the high chances of making money on staked assets, many protocols, including Convex Finance, have been designed to maximize profits for liquidity providers.

A significant peak was reached on January 1, 2021, when the price of CVX crossed $50 for the first time and even reached $62.69. A year after the official launch, in May 2022, the asset began to decline, although its price was recorded at over $12, which is double the price recorded at launch. Shortly after, Convex was impacted by the crash of the cryptocurrency market, which dropped to $4 in June.

Since CVX’s launch, there has been one major protocol incident. In March 2022, a bug was discovered in one of the smart contracts it uses. The smart contract with vote blocking had to be redeployed on the network. This caused the price of Convex Finance to fall briefly, although it recovered towards the end of the month.

What are the features of convex finance?

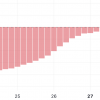

Convex Finance’s offering of cryptocurrency assets has a hard limit of 100 million. That’s why, the asset is deflationary The price of CVX is expected to rise as it becomes increasingly rare. This counts volatile asset and experiences frequent fluctuations.

As stated in the documentation, half of CVX’s total supply is allocated as rewards for liquidity providers in the network, with a quarter allocated to liquidity mining. Almost 10% of each of them is dedicated to the Treasure and the development team. Investors are allocated just over 3% and veCRV holders are allocated 2%.

Although the protocol was created on top of Curve Finance for the specific purpose of leveraging platform rewards, The price of Convex Finance is in no way linked to the value of CRV. Each time CRV is staked, a new cvxCRV token is created with a 1:1 ratio.

Convex Finance helps users maximize your productivity by optimizing the boost on Curve Finance. Liquidity providers receive a veCRV token for their contribution. By placing bets through Convex, the rewards increase significantly. The goal is to maximize the total value locked (TVL).

There are four types of rewards that stakeholders and liquidity providers can earn using Convex Finance – an interest rate proportional to the liquidity the user provides, a portion of the distributed trading commissions, the booster provided by Convex, and the Convex Finance tokens themselves.

By using the Convex Finance coin, liquidity providers can be eligible to earn trading commissions. In addition, they can receive enhanced CRV. To simplify the process, liquidity providers do not need to lock CRV in a smart contract to start receiving increased rewards.

Convex Finance offers its users zero commission for deposits and withdrawals, which makes the service more cost-effective. Users do not need to lock CRV tokens and their assets can be redeemed at any time they choose.

CVX resources can also serve control tokens for the record. Token holders have the right to vote on proposals such as protocol changes and upgrades. In turn, the CRV tokens they earn or exchange can be used to operate the Curve DAO.

Although the Convex Finance crypto protocol only applies to bets on Curve Finance, the team plans to expand to other platforms, such as Frax Finance. However, it has not been established whether the protocol will be blockchain independent.

What is Convex Finance’s trading volume in the last 24 hours?

CVX has trading volume US$11,492,047 in the last 24 hours.

What is the highest price in the history of Convex Finance?

CVX has the highest price $62.69which was achieved at January 01, 2022 (2 years 1 month ago).

What is the lowest price on Convex Finance?

CVX has the lowest price $0.7255which was achieved at December 11, 2022 (1 year 2 months ago).

Which exchanges are best for buying and selling CVX?

Currently the most active and dominant exchanges for buying and selling Convex Finance are Binance, Kraken & Kucoin. The most popular Convex finance trading pairs CVX/USDT

(on

Binance

),

CVX/VETH

(on

Curve Finance

),

CVX/USDT

(on

Deepcoin

). Go to Catalog of crypto trades to access customized and exclusive discounts, vouchers and welcome bonuses from the most popular exchanges.

Which hardware wallets are the most secure for storing CVX?

According to the process of in-depth analysis and testing, Ledger And Trezor are one of the most secure and popular hardware wallet options for storage Convex finance. For exclusive discounts and promotions on the best crypto wallets, visit Catalog of crypto trades.

Convex finance related pages

Read the hottest Crypto news.

Watch the animated crypt Video explanation.

Learn Cryptocurrency From scratch.