The trading volume of derivatives in Cardano (ADA) has skyrocketed by a whopping 170% in just 24 hours, according to data from glass coin. This surge has driven perpetual futures on the Cardano token to over $500 million in trading volume during the same period.

The trading volume of derivatives in Cardano (ADA) has shot up a huge 170% in just 24 hours, according to data from glass coin. This surge has driven perpetual futures on the Cardano token to over $500 million in trading volume during the same period.

At the same time, data from CoinMarketCap shows that there has been a 117.88% increase in ADA trading volume in the spot markets on various exchanges, with a total of $554.9 million traded. When the spot and derivatives markets are combined, the total trading volume of the Cardano token reached a remarkable $1.09 billion in the last day.

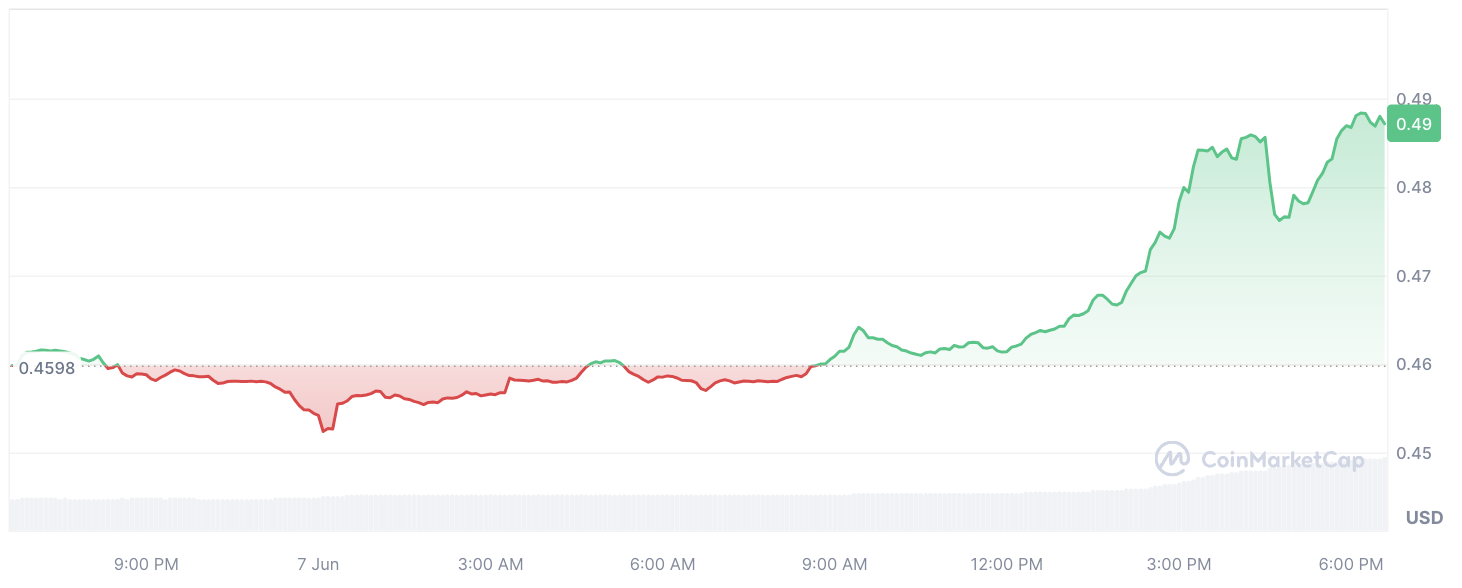

This increase in trading activity comes at a time when the Cardano token price is also rising. Since the opening of the last daily candle, ADA has seen a solid increase of over 6%, reaching $0.49, a level not seen in the last 17 days.

The volume growth is likely due to FOMO among market participants. In recent weeks, the Cardano token price action has severely exhausted investors and traders with its low volatility movement. In this context, jokes even began to appear that ADA at $0.45 is a stablecoin.

The unexpected bomb cardano price it could instead spark fear and greed in market participants left behind, and convert them to Cardano. In any case, the growth in trading volumes indicates increased interest and attention in the popular cryptocurrency, which means increased volatility and drama.

Gamza Khanzadaev

Gamza Khanzadaev