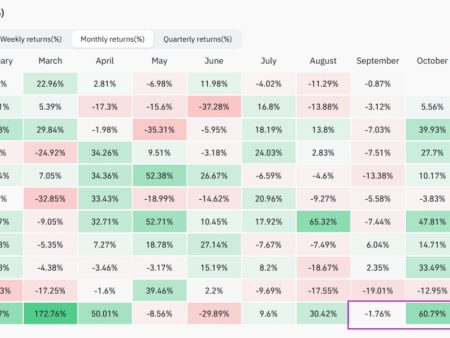

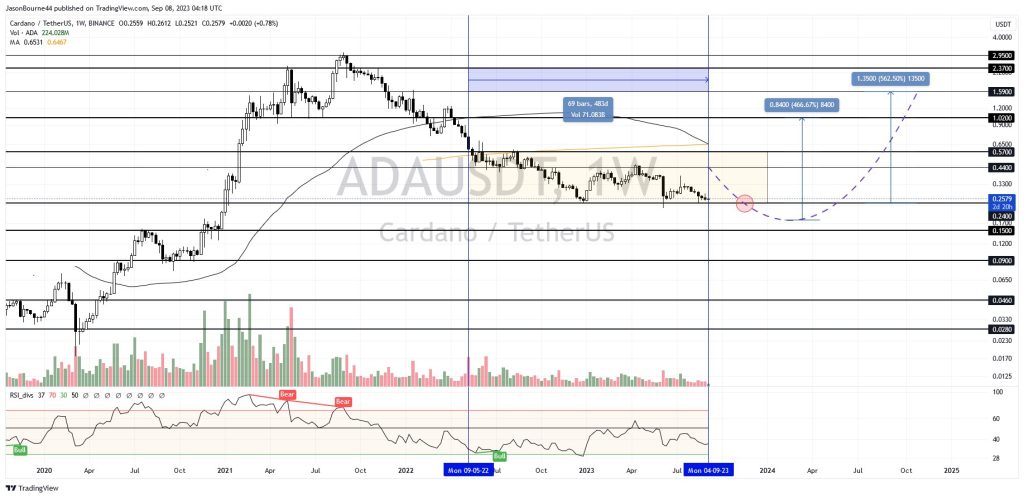

Cardano price prediction 2023

The asset has gradually completed the falling phase, found support near the price level of $0.24 and moved into the accumulation phase, lasting about 500 days.

The price of the asset is moving within the sideways range of 0.24-0.57$. Currently, the price is under MA100 on the weekly timeframe, and the RSI indicator is in the bearish zone.

Given the current phase of the market cycle, it is interesting to consider the asset set as a medium to long-term investment. It is better to start the first purchases near the lower boundary of the accumulation range of $0.24. The next part of the position can be gained in case the price deviates beyond the lower boundary of the range closer to the price mark of $0.18.

Potential targets for price growth 0.57 1.02 1.59$

What is Cardano(ADA) ?

Cardano is a blockchain platform and cryptocurrency that was created to provide a secure and scalable infrastructure for the development of decentralized applications (DApps) and smart contracts. It was founded by Charles Hoskinson, one of the co-founders of Ethereum, and the project is often associated with the company Input Output Hong Kong (IOHK).

Cardano distinguishes itself from other blockchain platforms, like Ethereum and Bitcoin, through its use of a research-driven approach and a layered architecture.

Here are some key features and aspects of Cardano:

Layered Architecture: Cardano’s development is divided into two main layers: the Cardano Settlement Layer (CSL) and the Cardano Computation Layer (CCL). The CSL handles transactions and ADA (Cardano’s native cryptocurrency), while the CCL is designed for smart contracts and DApp development.

Proof-of-Stake (PoS) Consensus: Cardano uses a PoS consensus mechanism called Ouroboros, which aims to be energy-efficient and secure. ADA holders can participate in the network’s consensus by staking their tokens and earning rewards.

Peer-Reviewed Research: The development of Cardano is heavily influenced by academic research and peer-reviewed papers. This approach is intended to ensure that the platform’s design is sound and secure.

Interoperability: Cardano aims to promote interoperability between different blockchain networks and legacy financial systems. It intends to serve as a bridge between different blockchain platforms and traditional financial infrastructure.

Sustainability: Cardano focuses on long-term sustainability, both in terms of its technology and governance. The platform incorporates a treasury system that allows the community to fund projects and improvements.

Smart Contracts: Smart contract functionality was introduced through Cardano’s Alonzo upgrade, enabling developers to create decentralized applications and automate various processes on the network.

Decentralized Governance: Cardano employs a decentralized governance model through Project Catalyst, allowing ADA holders to participate in decision-making and the allocation of project funding.

Scalability: The platform is designed with scalability in mind, with plans to optimize its performance as more users and applications join the network.

Cardano has gained significant attention and support within the cryptocurrency and blockchain communities due to its academic approach, commitment to research, and the potential it offers for building a wide range of decentralized applications. ADA, the native cryptocurrency of the Cardano network, is used for various purposes, including staking, transaction fees, and participating in the governance of the platform

A cryptocurrency exchange is an online platform where you can buy, sell, or trade cryptocurrencies like Bitcoin, Ethereum, and others.

Safety varies by exchange. Look for platforms with strong security measures, like two-factor authentication and cold storage for funds.

Consider factors like security, fees, available coins, user interface, and customer support.

Centralized exchanges are managed by a company, while decentralized exchanges operate without a central authority.

Many exchanges require Know Your Customer (KYC) verification for security and regulatory compliance.

Trading fees vary but typically include maker fees (for adding liquidity) and taker fees (for removing liquidity).

Yes, most exchanges offer cryptocurrency-to-cryptocurrency trading pairs.

Withdrawal times depend on the exchange and the cryptocurrency. Some are instant, while others may take hours or even days.

A wallet address is like a bank account number for cryptocurrencies. It’s required to send your crypto to the right place.

Yes, depending on your country’s tax laws, trading cryptocurrencies may have tax consequences. Consult a tax professional for guidance.

Yes, many cryptocurrency exchanges operate 24/7, allowing you to trade at any time.

A market order buys or sells at the current market price, while a limit order sets a specific price at which you want to buy or sell.

Yes, each exchange sets its own minimum and maximum trading limits, which can vary widely.

It’s not recommended. For security, it’s better to use a cryptocurrency wallet, especially for significant holdings.

Exchanges typically have account recovery processes, including password reset options and support for forgotten usernames.

Some exchanges offer insurance, but coverage can be limited. It’s essential to check an exchange’s insurance policy.

Use strong passwords, enable two-factor authentication, and be cautious of phishing scams and suspicious emails.

Yes, but it’s recommended to learn the basics of trading and understand the risks involved before you start.

Stablecoins are cryptocurrencies pegged to the value of a fiat currency like the US dollar. They provide stability and are commonly used for trading and transferring funds on exchanges.

Yes, regulations vary by country. Many countries have implemented or are considering regulations to govern cryptocurrency exchanges for consumer protection and financial stability.