Bitcoin price currently stands at $71,347, showing an impressive rise in the 24-hour intraday range between $70,065 and $71,595. With a trading volume of $25.17 billion and a market capitalization of $1.4 trillion, Bitcoin has gained 4.9% this week, 5.6% over the past two weeks and 14.4 % in the last 30 days.

Bitcoin

Bitcoin’s 1-hour chart reveals a recent recovery after a sharp decline, with a key resistance level at $71,629 and support around $70,116. Higher volume during recent dips indicates strong selling pressure, while subsequent increases in volume suggest strong buying interest.

BTC/USD daily chart via Bitstamp.

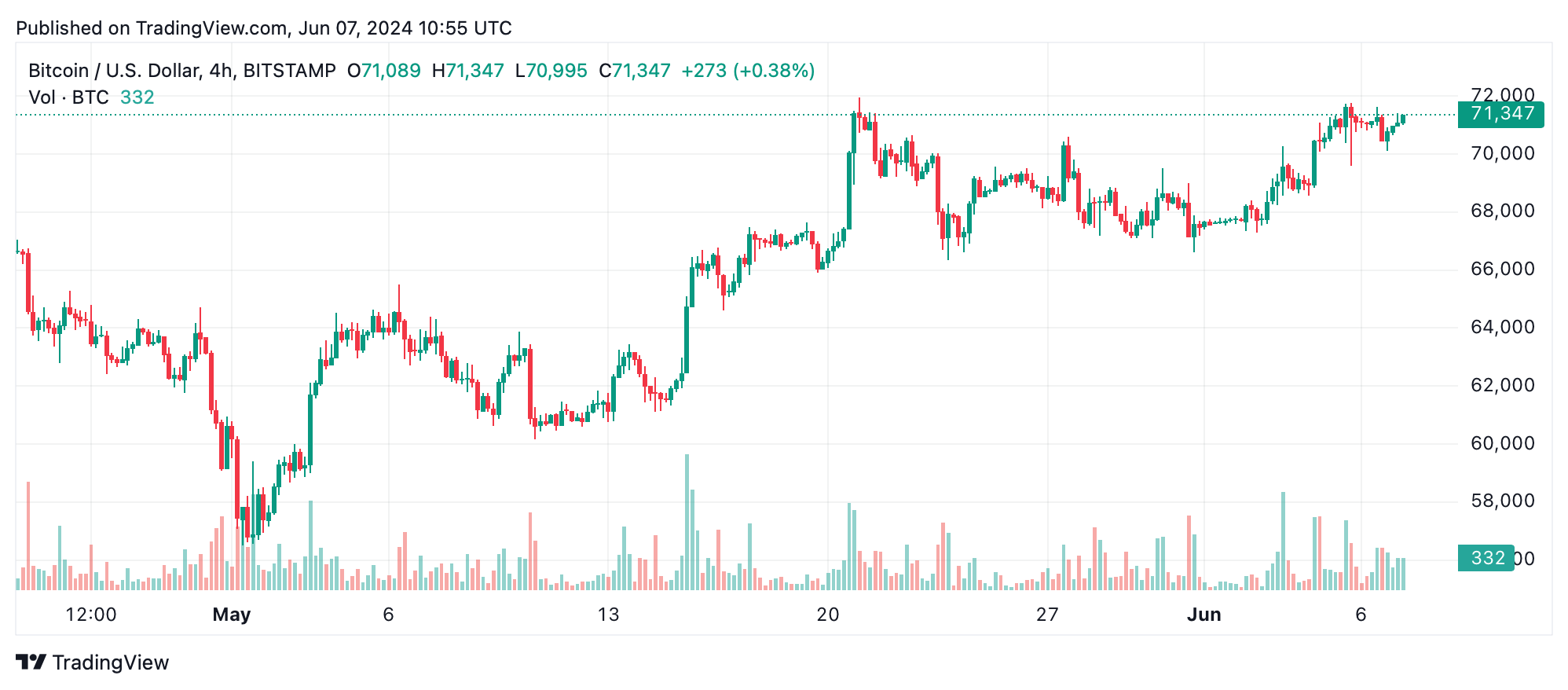

The 4-hour chart maintains an uptrend from around $67,281 to a recent peak of $71,759. Consistent with the 1-hour chart, primary resistance is at $71,759, with support at $70,116. The volume analysis here shows increased activity during upward moves, confirming strong buying interest.

BTC/USD 4-hour chart via Bitstamp.

On the daily chart, Bitcoin shows a sustained uptrend from $60,176 to a recent high of $71,958. Resistance is set at $71,958, while support is stronger at $67,000. Volume spikes during price spikes indicate continued buying interest, while volume declines during consolidations suggest temporary pauses.

BTC/USD oscillator values present mixed but generally positive outlooks. The Relative Strength Index (RSI) at 63 is neutral, and the Stochastic at 86 indicates overbought conditions. The Commodity Channel Index (CCI) suggests bearish sentiment, while the Moving Average Convergence Divergence (MACD) and Momentum indicators signal buying opportunities.

Moving averages (MA) at different timeframes consistently indicate a strong bullish signal, with both exponential moving averages (EMA) and simple moving averages (SMA) above key price levels, reinforcing the bullish sentiment. Longer-term MAs such as the 50-day EMA at $66,713 and the 50-day SMA at $65,634 indicate positive sentiment.

The 100-day EMA and SMA at $63,566 and $66,477, respectively, along with the 200-day EMA at $56,491 and 200-day SMA at $55,282 consistently show buying signals, underlining the positive long-term outlook term for bitcoin. Between these technical indicators and market behaviors, bitcoin’s current trajectory suggests solid resilience to short-term volatilities, underlined by consistent bullish momentum across various time frames.

Bull verdict:

Given the consistent upward trends observed on the 1-hour, 4-hour, and daily charts, along with the strong buying interest indicated by volume spikes and positive moving averages, bitcoin appears poised for further gains. Traders should remain optimistic, watching for key breakouts above resistance levels to capitalize on the ongoing momentum.

Bear Verdict:

Despite the current bullish trends, caution is warranted as key oscillators show mixed signals and potential overbought conditions. If bitcoin fails to break out of critical resistance levels or shows significant selling pressure near support levels, traders should prepare for possible downside corrections and consider protective measures.