Bitcoin bears could be in danger as open interest on the short side is slowly rising in tandem with spot buying volume. This divergence often leads to brief contractions which, in the case of Bitcoin, will most likely lead to an advance and a move. toward $100,000.

Bitcoin bears could be in danger as open interest on the short side is slowly rising in tandem with spot buying volume. This divergence often leads to brief contractions which, in the case of Bitcoin, will most likely lead to an advance and a move. toward $100,000.

The point cumulative volume delta (CVD) is the first thing to notice. In the spot market, this metric shows the total net buying or selling. In this case, there is a rising spot buy delta and the spot CVD leads the price. According to this, the recent rally in Bitcoin prices is being driven by the spot market. Simply put, as more people buy Bitcoin on the spot market, the price increases.

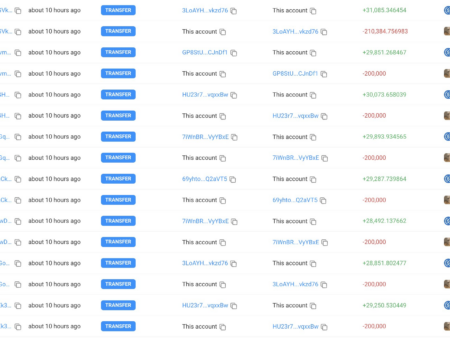

Perpetual contracts, on the other hand, offer a slightly different narrative. Futures traders may feel bearish as the CVD Perp is falling more than the price. Additionally, there is an increase in criminal sales. This implies that while there is buying pressure in the spot market, they are more likely to sell in the futures market.

Buying in the spot market appears to be the main driver of Bitcoin’s recent price surge. An increase in spot CVD along with price suggests a high level of buying interest.

Negative Futures Market Action: Even though the futures (delinquents) market is showing bearish sentiment, with delinquents CVD falling and selling pressure increasing.

The increasing spot buying delta indicates that there may be a buying impulse. If you are a spot trader looking to buy or hold Bitcoin, this could be encouraging.

Futures Market: The decline in Perp CVD suggests bearish sentiment, which may indicate caution for those trading futures. Selling is the predominant trend in the futures market, which can lead to price adjustments or increased volatility.

Alex Dovbnya

Alex Dovbnya