With the SEC dropping its investigation into Paxos over its proprietary stablecoin Binance (BUSD) — after it was almost completely shut down — one wonders if this has had any significant impact on Binance.

It turns out, not that much, at least judging by how much cryptocurrency users store there.

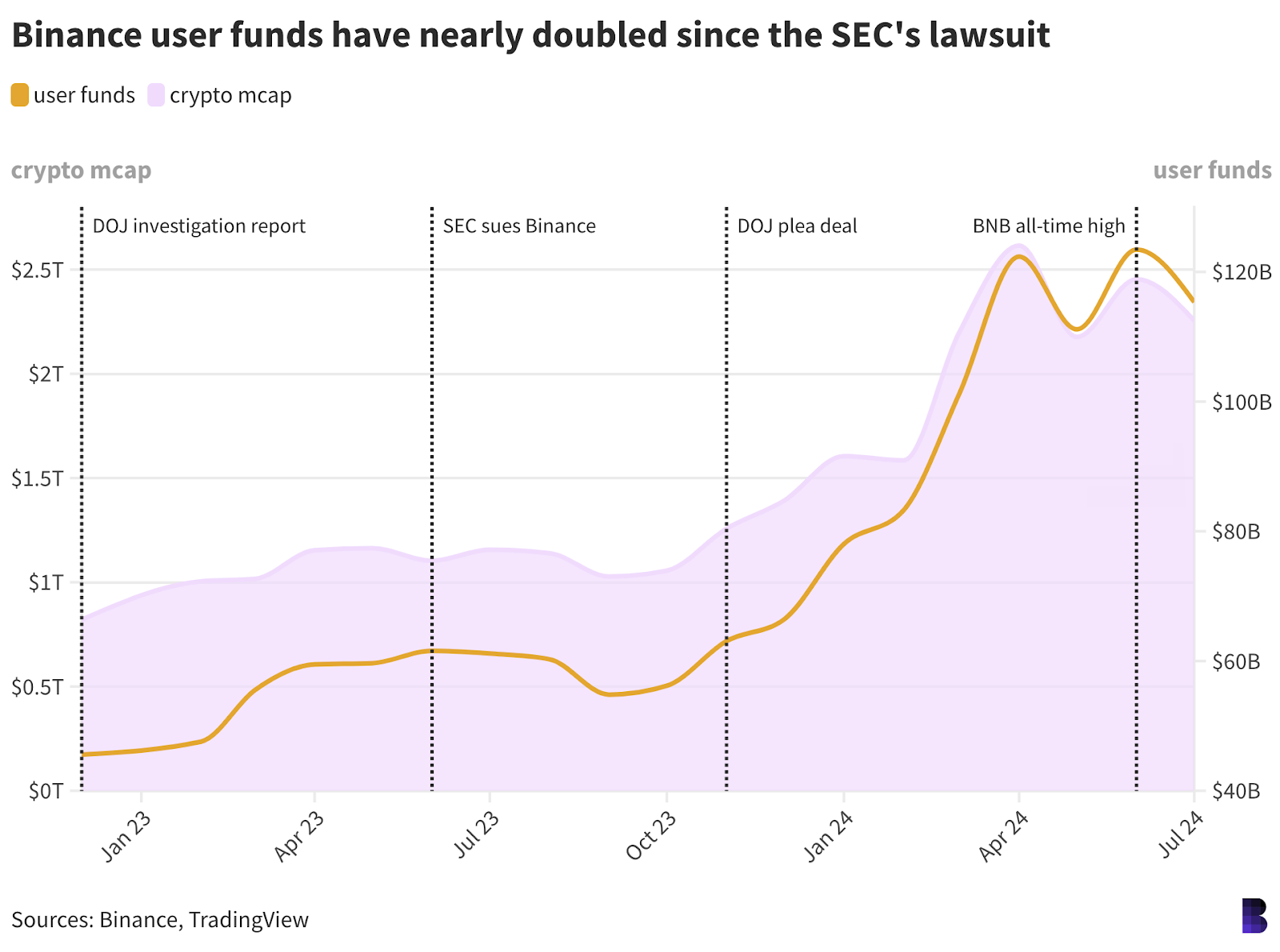

An analysis of Binance’s monthly reserve verification reports shows that the company disclosed $115 billion in user funds in early July, up $61 billion from a year ago.

When reports of the Justice Department’s multi-year investigation into Binance first emerged in December 2022, the stakes were $45.6 billion. That’s a 150% jump as U.S. agencies slammed Binance, then-CEO Changpang Zhao, and apparently at least one company that backed them.

Read more: The IRS and the DOJ are investigating Binance

BUSD was the seventh-largest cryptocurrency by market cap, worth $16.1 billion, before the SEC sent Paxos a Wells Notice in February 2023.

Paxos stopped issuing new tokens, and over the next month, BUSD holders bought up about half of the supply. By January of this year, there were only $100 million in circulation.

Read more: SEC Initiates Billion Dollar BUSD ‘Bank Seizure’

Other stablecoins, including TrueUSD, USDT, and FDUSD, have filled the gap left by BUSD, with the latter two headquartered outside the U.S. TrueUSD, meanwhile, has fallen out of favor, leading to a series of delistings earlier this year.

The dollar value of user deposits is clearly rising along with prices, but the purple area and orange line would have separated if there had been any significant user exodus. It could also be that the US intervention has actually increased confidence in Binance overall.

In any case, as Zhao waits out the remainder of his term, the structure of user funds on the platform is changing, and the data suggests that the general consensus remains.

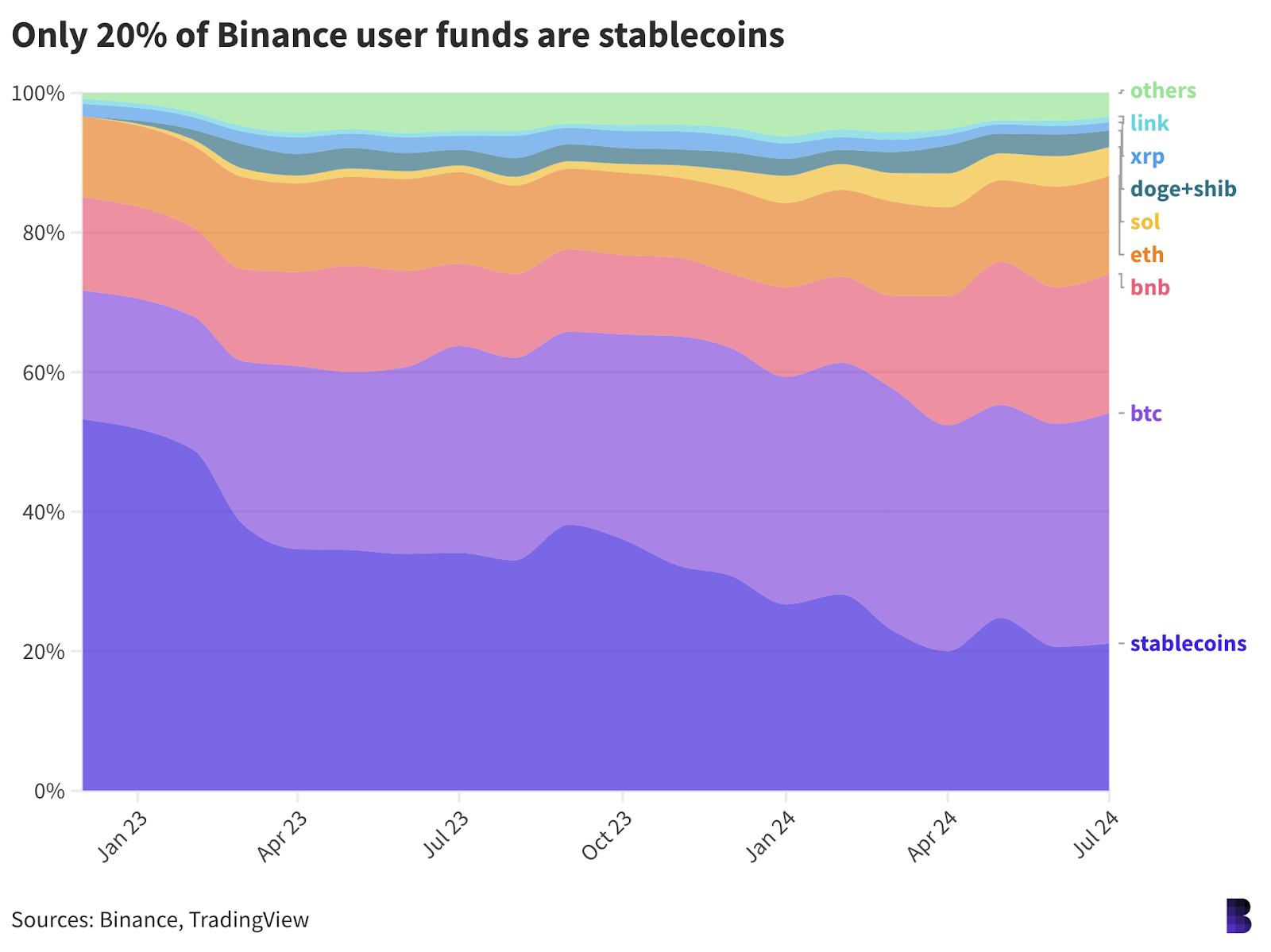

In December 2022, Bitcoin made up 18% of user funds – now it’s more than a third. Similarly, BNB has grown from 14% to 20%, while ETH has remained virtually unchanged at around 14%, presumably due to weak price growth compared to Bitcoin and BNB.

The real figure is that currently only a fifth of all user funds on the platform – $24.4 billion – are represented by stablecoins, while before Zhao’s real problems began, this figure was more than half.

This means that 80% of Binance users’ funds are held in non-dollar-pegged crypto assets, which is almost the highest point in history (which, unfortunately, only started after FTX).

A similar distribution is seen in OKX’s latest reserve confirmation report, dated last month.

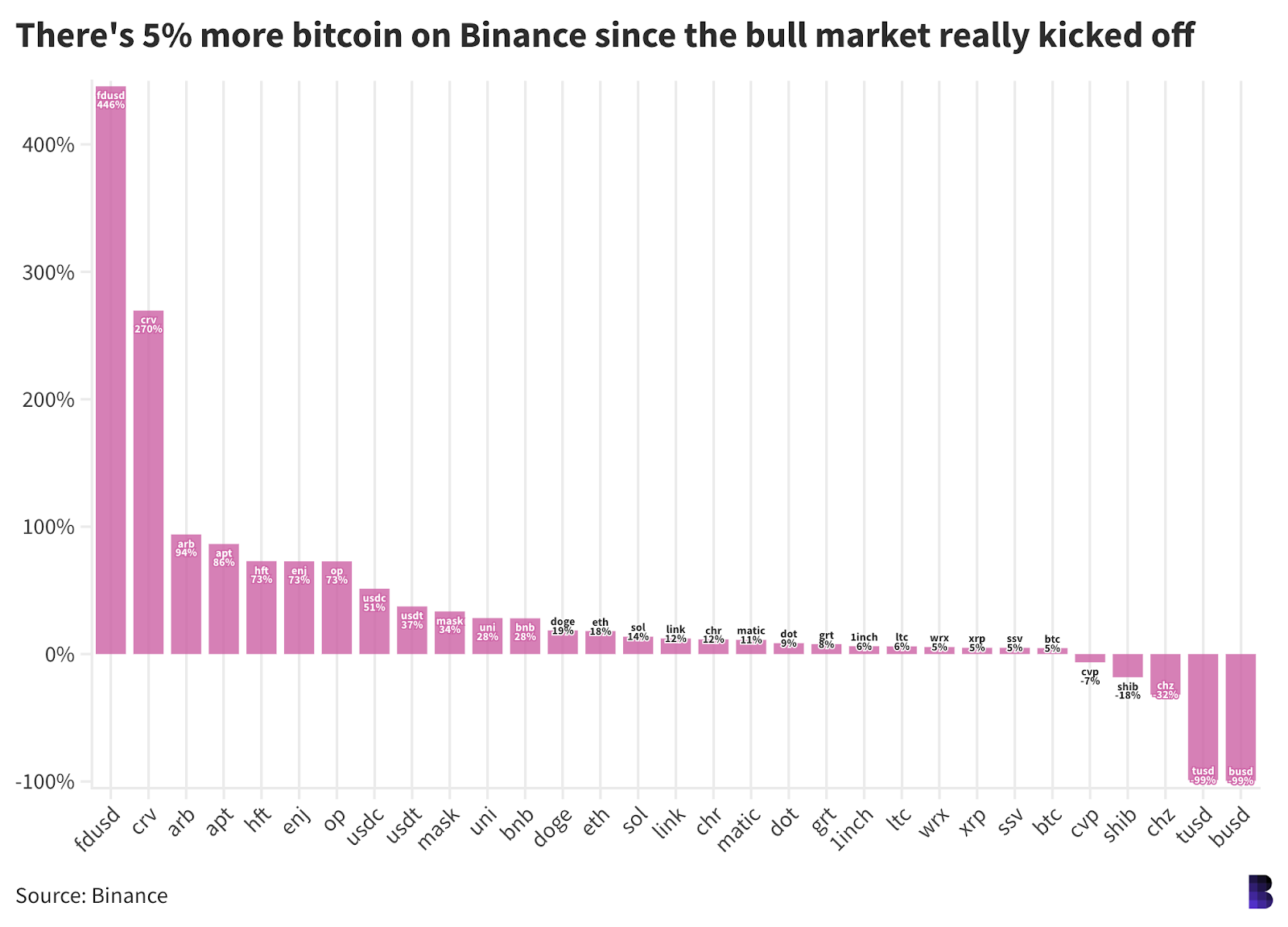

As for which cryptocurrencies Binance users are gravitating towards, comparing the last number of base units (i.e. individual tokens) they owned to how many they had in October 2023 can give some insight. Bitcoin markets actually spiked around that time.

The tokens that showed the biggest balance growth were Curve DAO, Arbitrum, Aptos, Hashflow, Enjin and Optimism, all of which grew by more than 70% (and in the case of CRV, by 270%).

Chiliz and shiba inu were at the other end of the table, down 32% and 18% respectively. USDT and USDC balances, meanwhile, grew by 51% and 37%.

This could also mean that CHZ and SHIB holders have withdrawn their tokens from Binance for long-term cold storage.

In any case, the data suggests that Binance users are confident, following the actions of the SEC and DOJ, that not only is Binance fair, but that prices will continue to rise significantly.

A condensed version of this article first appeared in Friday’s Empire Newsletter. Subscribe Here so you never miss a single issue.