A respected stock and crypto analyst on TradingView believes that Cardano could surge 3,000% above $13 if history repeats itself.

The seasoned analyst behind the BasicTradingTV account recently predicted a staggering 3,000% rise for Cardano (ADA)which could potentially push the price higher to over $13. He bases his bullish forecast on historical patterns and technical setups seen in ADA’s market behavior.

Cardano’s price movements have shown noticeable cyclical patterns over the years. The analyst noted that ADA has seen significant spikes followed by sharp corrections over the years.

ADA Historical Data

IN analysis On the monthly ADA chart, the market watcher showed that Cardano experienced a significant surge to its first cyclical high of $0.3885 in May 2018. However, it then experienced a sharp correction that led to a drop to a low of $0.0391 in December 2018.

Cardano recovered from the correction over a six-month period and eventually crashed back to the $0.03 level. The analyst confirmed that ADA formed solid support at this $0.03 low. Cardano retested this support twice. After that, it broke through a key resistance line, leading to an impressive 5,000% rally.

The next cycle saw another significant peak, followed by a correction that brought the price down to around $0.25. After ADA found support again, it began a 250% rally.

Cardano Targets $13+

The current market structure suggests that a similar pattern is emerging. ADA has established horizontal support around $0.42breaking through the previous resistance, which now acts as a support level.

The analyst believes that if ADA follows this historical pattern, it could see another significant rally. The potential for a 3,000% upside from current levels would put ADA at $13.53. While this forecast is ambitious, it is based on a repeat of past market cycles that have seen similar bullish breakouts and corrections.

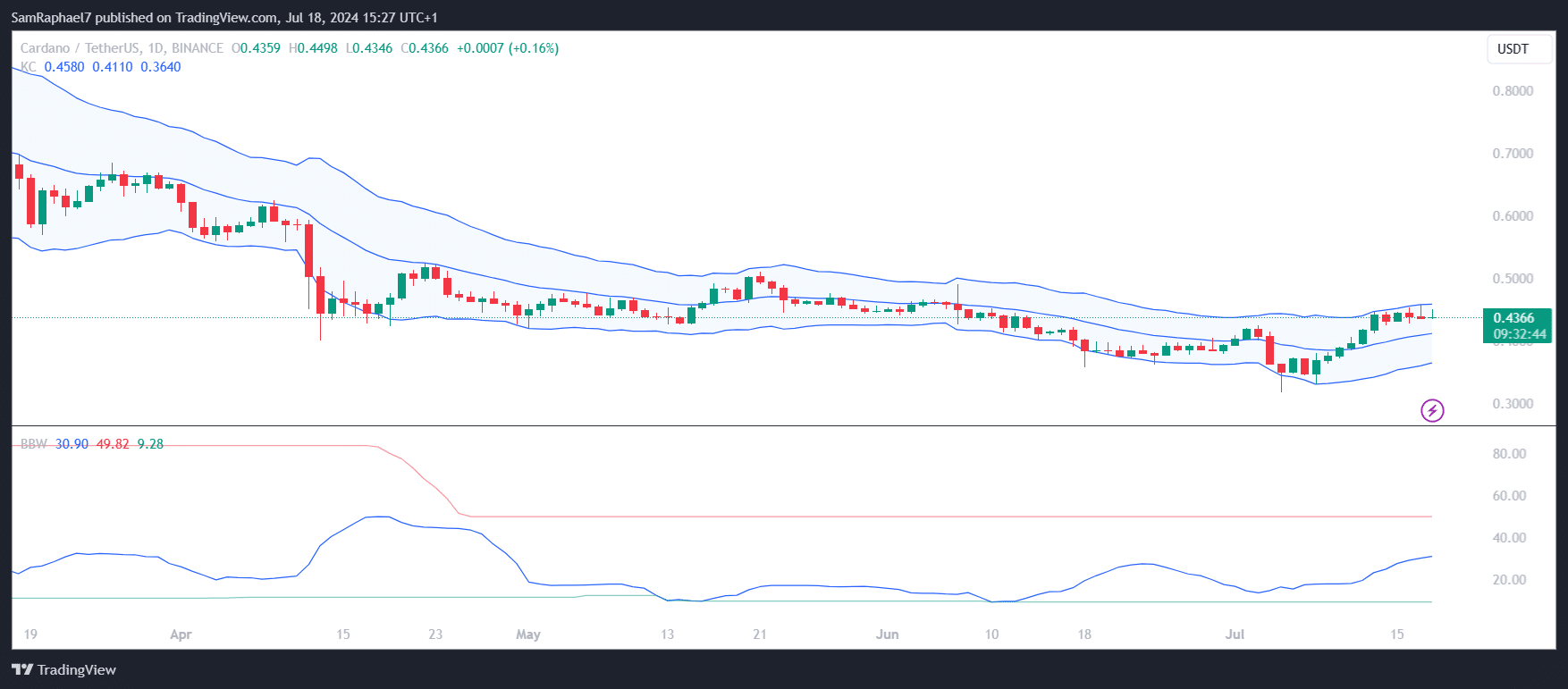

Market conditions for Cardano currently appear favorable. The latest data shows ADA changing hands at $0.4366. The daily chart shows recent bullish momentum, with Cardano up 26% since June 8.

Cardano is in a bullish position

Market data confirms that Price ADA is moving within the boundaries of the Keltner Channel, a set of envelopes based on volatility. Cardano recently touched the upper band of the channel, indicating increased buying pressure.

The Bollinger Band Width (BBW) indicator, which measures the volatility of an asset, is showing a recent widening. This indicates that volatility is increasing, which often precedes significant price moves. The BBW reading is 30.90, which suggests that the market is preparing for potentially high volatility in the near term.

If ADA continues to show strength and maintains its position above key support levels, the bullish case for a significant uptrend remains plausible. Recent price action along with historical patterns support the possibility of a significant uptrend. However, such a move is not inevitable.