Bitcoin is back above $100,000 after a slight correction earlier this week. A 2024 Pew Research Center survey shows that 17% of American adults say they have ever invested, traded or used cryptocurrency. This statistic remains unchanged as of 2021.

Bitcoin’s rise above $100,000 has left many investors fearful of missing out. The Fear and Greed Index, which measures market sentiment, shows “extreme greed.” However, sidelined traders looking to get in on the trade may consider low-cost altcoins as an alternative to the biggest cryptocurrency of this market cycle.

Table of contents

Trump’s Cryptocurrency Plans Catalyze the Rise of Bitcoin and Altcoins

New US President Donald Trump told CNBC’s Jim Cramer on the New York Stock Exchange on Thursday: “We’re going to do something great with cryptocurrency because we don’t want China or anyone else… but others are accepting it and we want to be ahead.”

Trump responded to questions about a potential Bitcoin strategic reserve by saying there would be something great, fueling positive sentiment among crypto traders.

Trump’s earlier stance in favor of cryptocurrencies and the nomination of crypto-friendly candidates for key positions, such as AI & Crypto Czar and US SEC Chairman, have allayed regulatory and political concerns among crypto market participants.

Bitcoin is back above $100,000 after a correction earlier this week; Altcoins have risen along with the largest cryptocurrency since mid-week. As the market recovers from the flash crash, low-cost altcoins are providing an investment alternative for traders who may have missed out on dollar-cost averaging when buying Bitcoin this cycle.

The launch of Google’s new computing chip has raised concerns among crypto traders about the security of their Bitcoin assets. However, there is no significant impact on price. Addressing these concerns, Dario Lo Buglio, head of blockchain and co-founder of Brickken, told crypto.news:

“Google’s recent advances in quantum computing only show what we’ve known for years.

Much of the encryption used in everyday tasks, from banking to data processing, is based on encryption methods that operate on the assumption that quantum computing would take too many years to become a practical problem today. […].

A recent study from the University of Sussex suggests that a quantum computer with 13 million qubits will be needed, and Google has achieved 105 qubits. […].This should remind us to update our system to quantum-resistant encryption schemes as quickly as possible.”

Bitcoin Options Data Suggests Rally May Extend

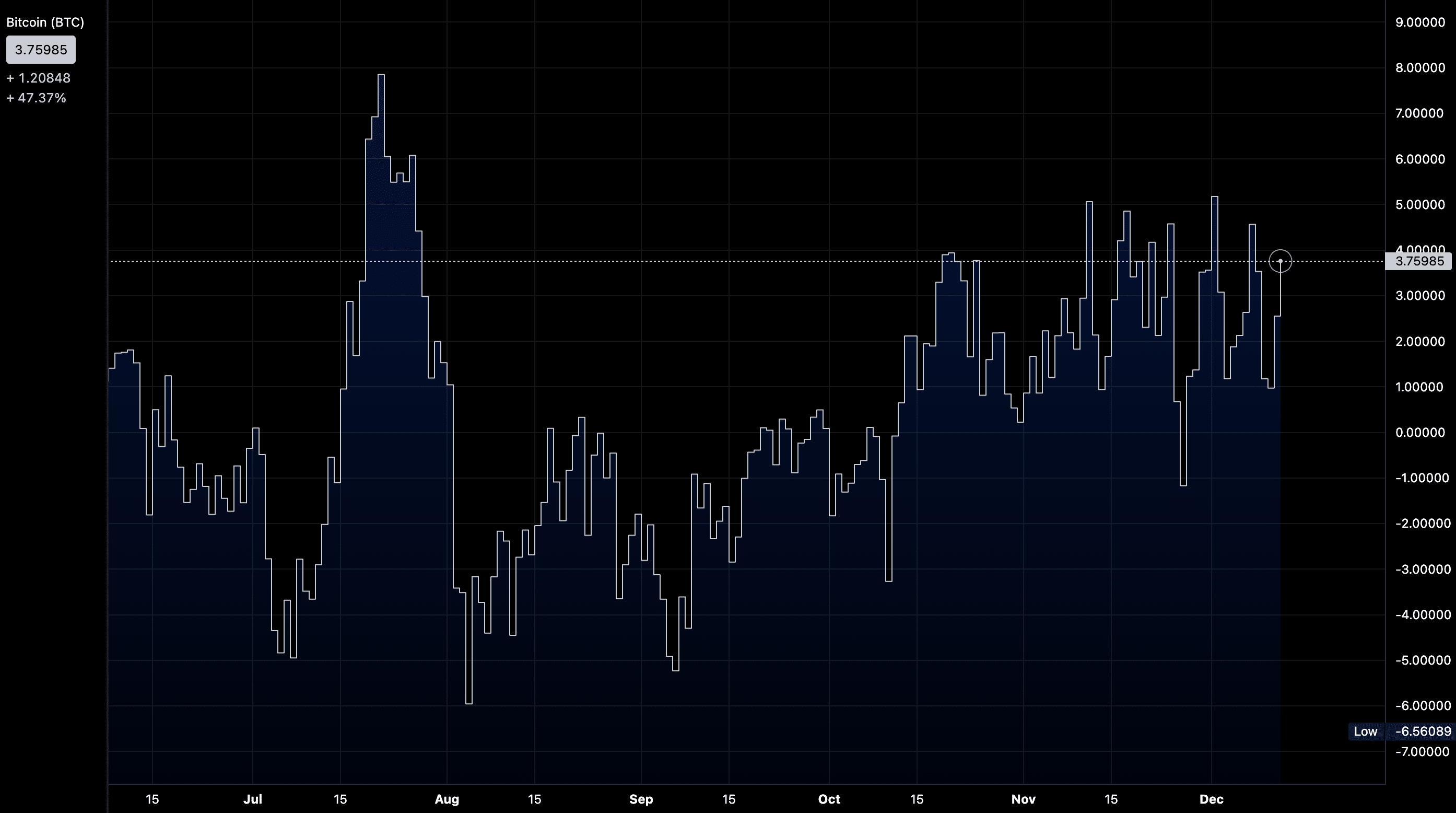

Options data paints a bullish picture for the $2 trillion market cap cryptocurrency. Bitcoin’s 14-day 25-delta risk reversal is 3.75985. This means that the implied volatility of call options is higher than the implied volatility of put options, signaling bullish sentiment. More market participants are betting on a rise in the price of Bitcoin, while BTC is holding steady above $100,000 across all spot exchange platforms.

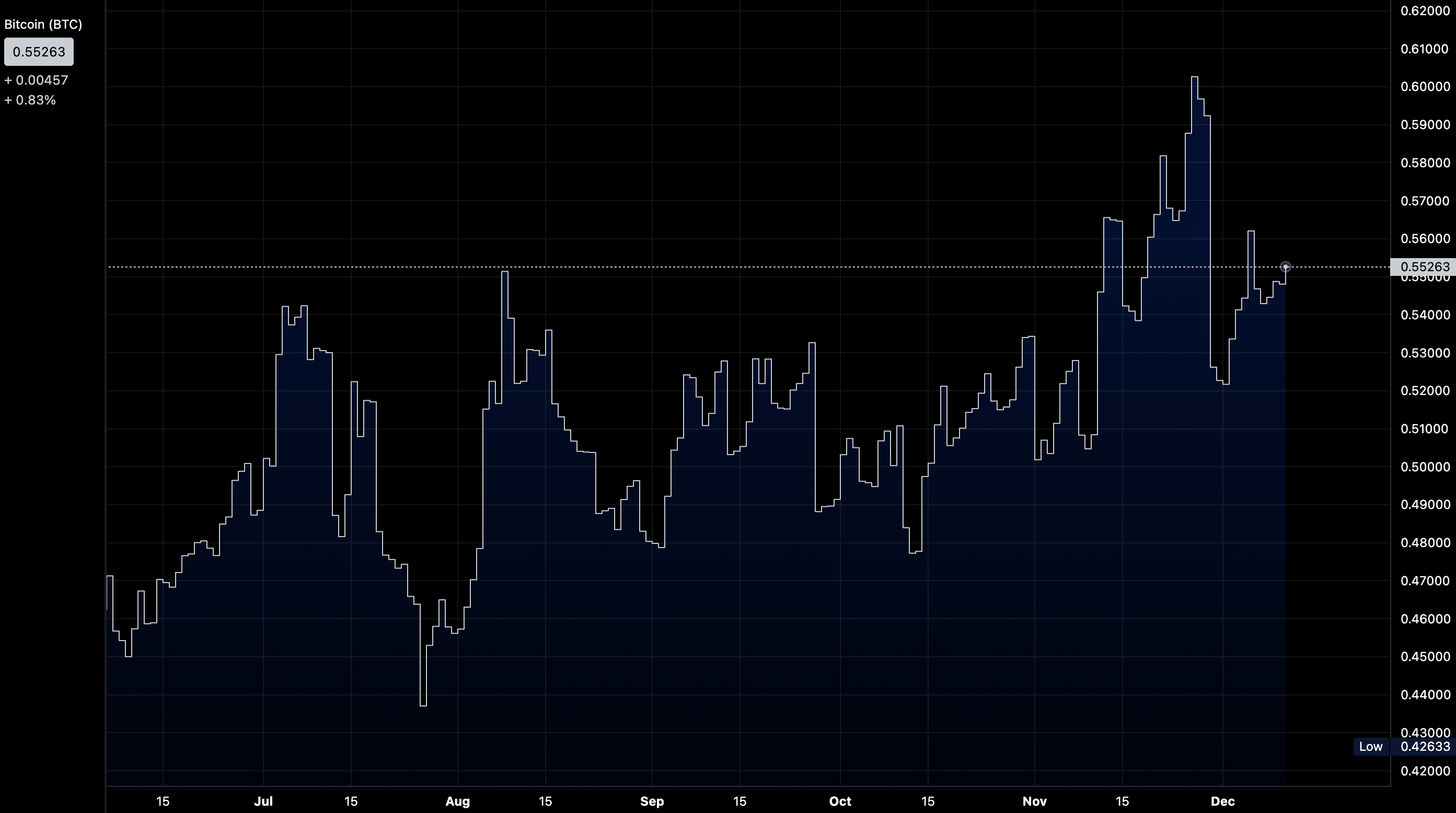

A put-call ratio of 0.55 or lower indicates strong bullish sentiment in the market, with more call options being purchased than put options. Derivatives traders are expecting a bull market, and this confirms the thesis of rising prices for BTC.

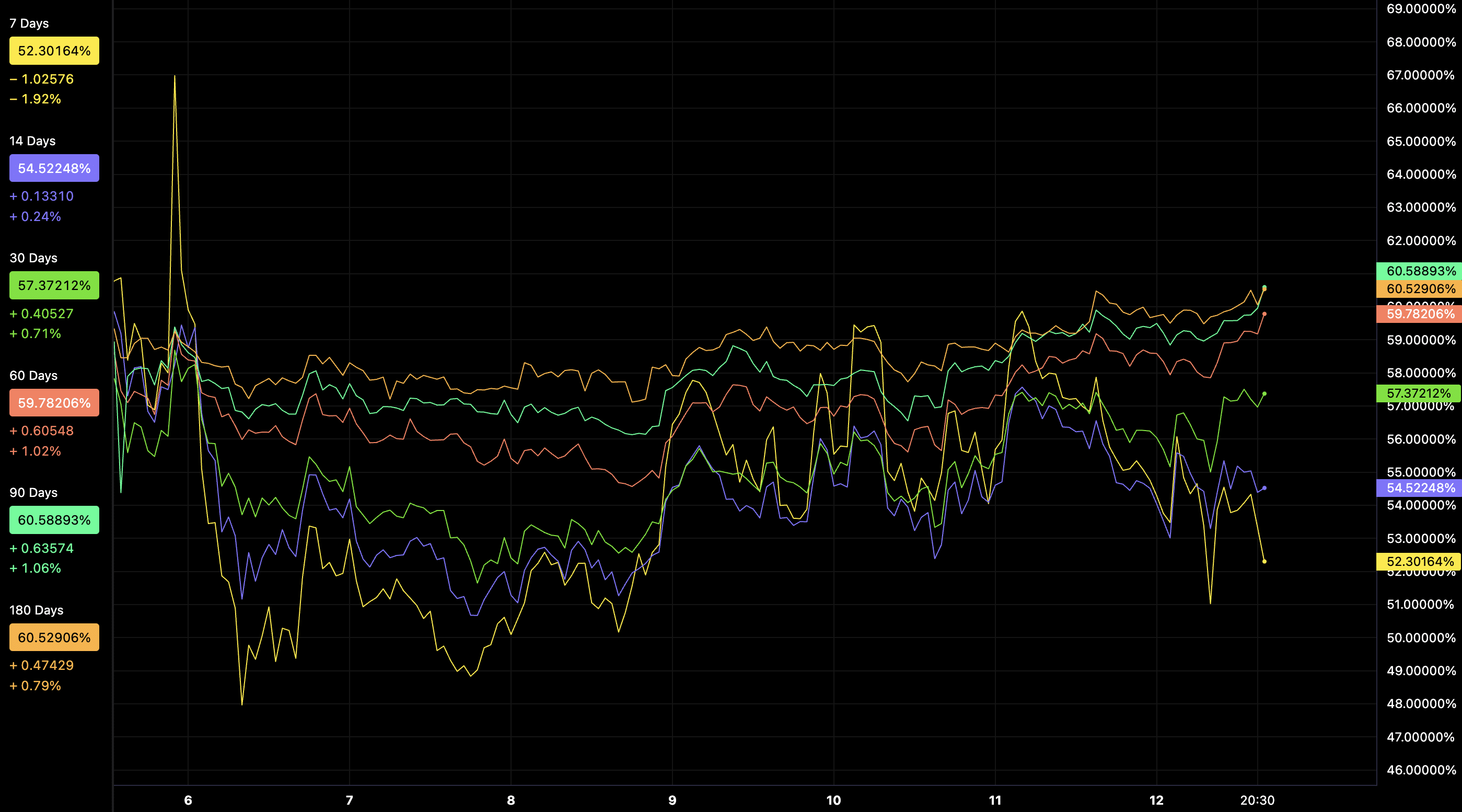

Implied volatility dropped after BTC returned above $100,000 on Wednesday. The hourly chart shows the decline over the last 24 hours.

Typically, a decrease in IV means that traders expect prices to be stable and there is less chance of significant fluctuations. Bitcoin confirms this thesis and remains firmly above a key psychological barrier.

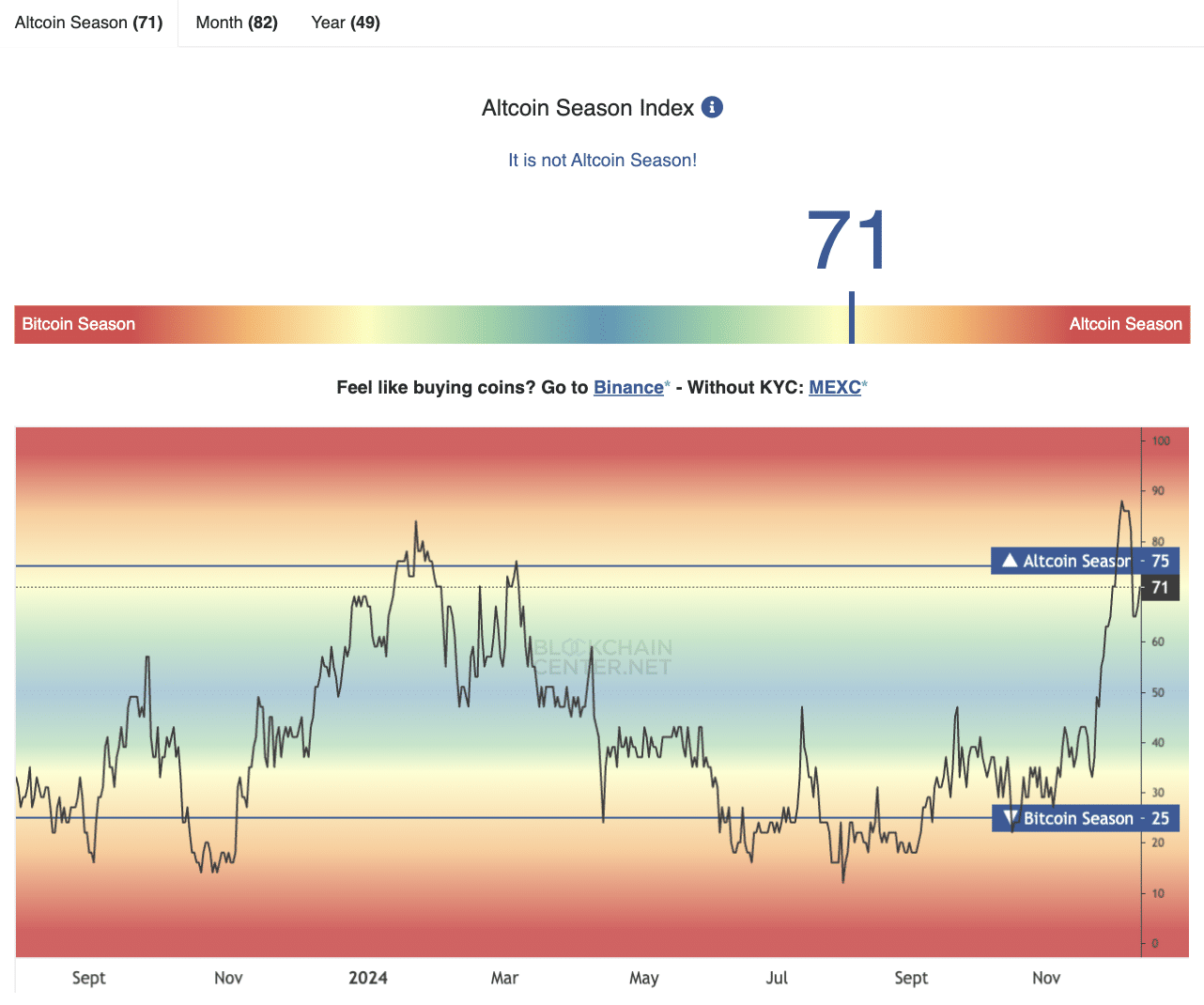

Altcoins could rise with the return of altseason

The blockchain hub’s altcoin season index rose to 71 on a scale of 0 to 100. While a reading of 75 indicates it is altcoin season, the index gained 6 points from December 9 to 12.

Altcoin season is a period of time when 75% of the top 50 altcoins outperform Bitcoin within 90 days. The index shows that the market is approaching the second stage of the altcoin season, which could lead to a rise in token prices in the coming weeks.

Cheap Altcoins to Consider in This Cycle

Three key arguments support a list of cheap altcoins that could help disengaged buyers gain an edge over Bitcoin holders this cycle:

- Ethereum (ETH) could outperform Bitcoin thanks to rising inflows from institutions, retail traders and bullish options performance. This paves the way for Ethereum betas, layer 2 tokens, staking tokens, Ethereum-based meme coins, DeFi tokens such as AAVE, Pendle (PENDLE), Maker (MKR), Ethereum Name Service (ENS), and Pepe ( PEPE), among others.

- Gaming tokens and artificial intelligence tokens may see a resurgence in demand among traders with the growing relevance of AI.

- Bitcoin based meme coins can compete with Ethereum, Solana and XRP based memes.

Alvin Kahn, chief operating officer of Bitget Research, told crypto.news:

“The emergence of new meme coins on platforms such as XRPLedger and Solana is leading to increased competition with established meme coins such as DOGE, SHIB, FLOKI, BONK and WIF. This competition could potentially dilute market attention and capital that would otherwise flow into these legacy tokens.[…]”The introduction of new tokens could stimulate general interest in the meme coin sector, potentially benefiting all meme coins by attracting new investors to the market.”

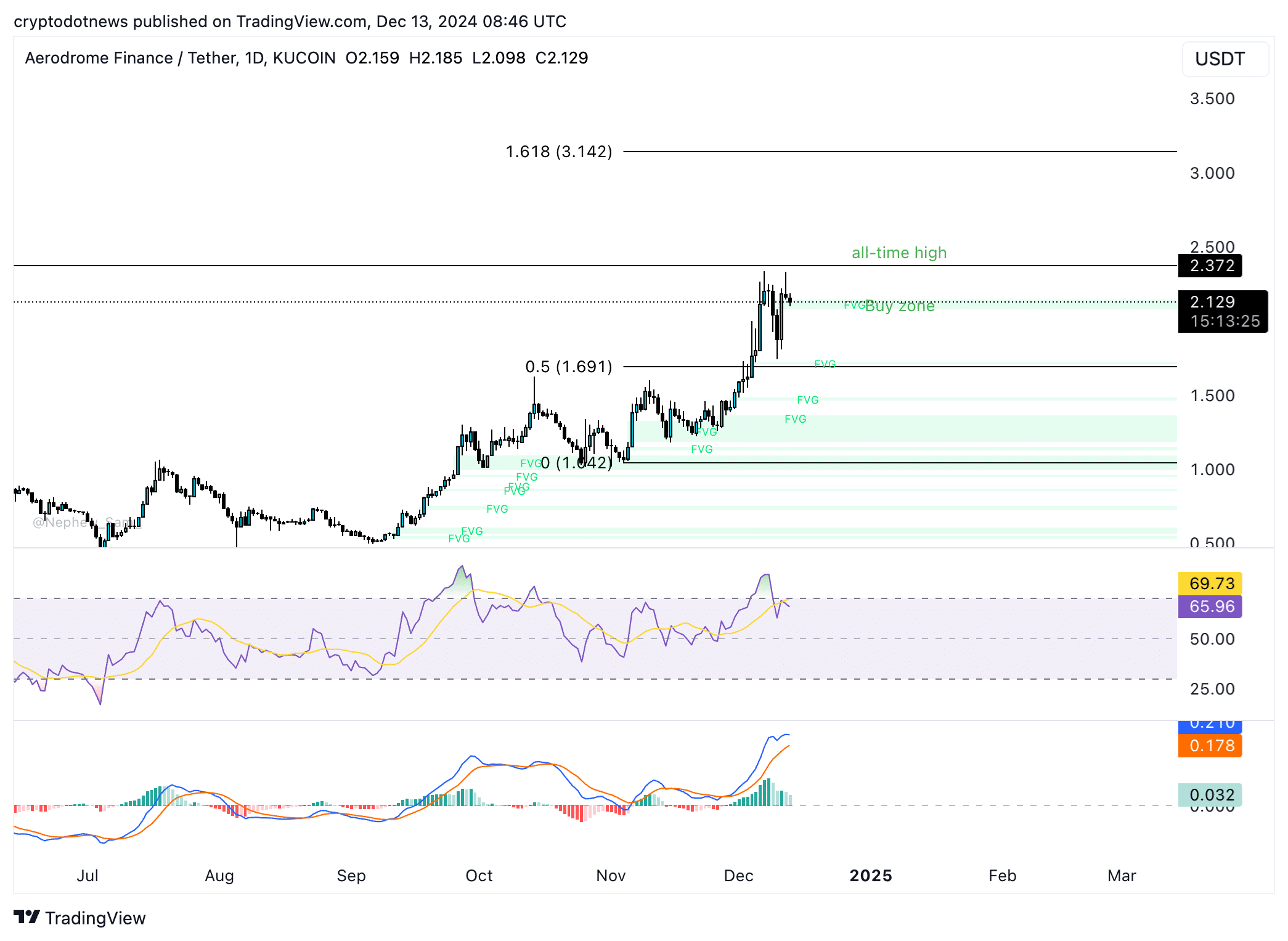

Aerodrome Finance (AERO) is a liquidity hub token in the Base ecosystem. AERO averages over $1 million in commissions per day and is the leading decentralized exchange on Base, a beta version of Ethereum. AERO ranks 92nd by market capitalization.

AERO is trading in a buy zone between $2,080 and $2,146. The previous all-time high for AERO is $2,372, the token is less than 4% below that level. The 161.8% Fibonacci retracement of the rally from the November low to the December high sets the $3,142 price target for this cycle’s opening.

Two technical indicators, Relative Strength Index and Moving Average Convergence Divergence support the bullish thesis for the token on the daily timeframe.

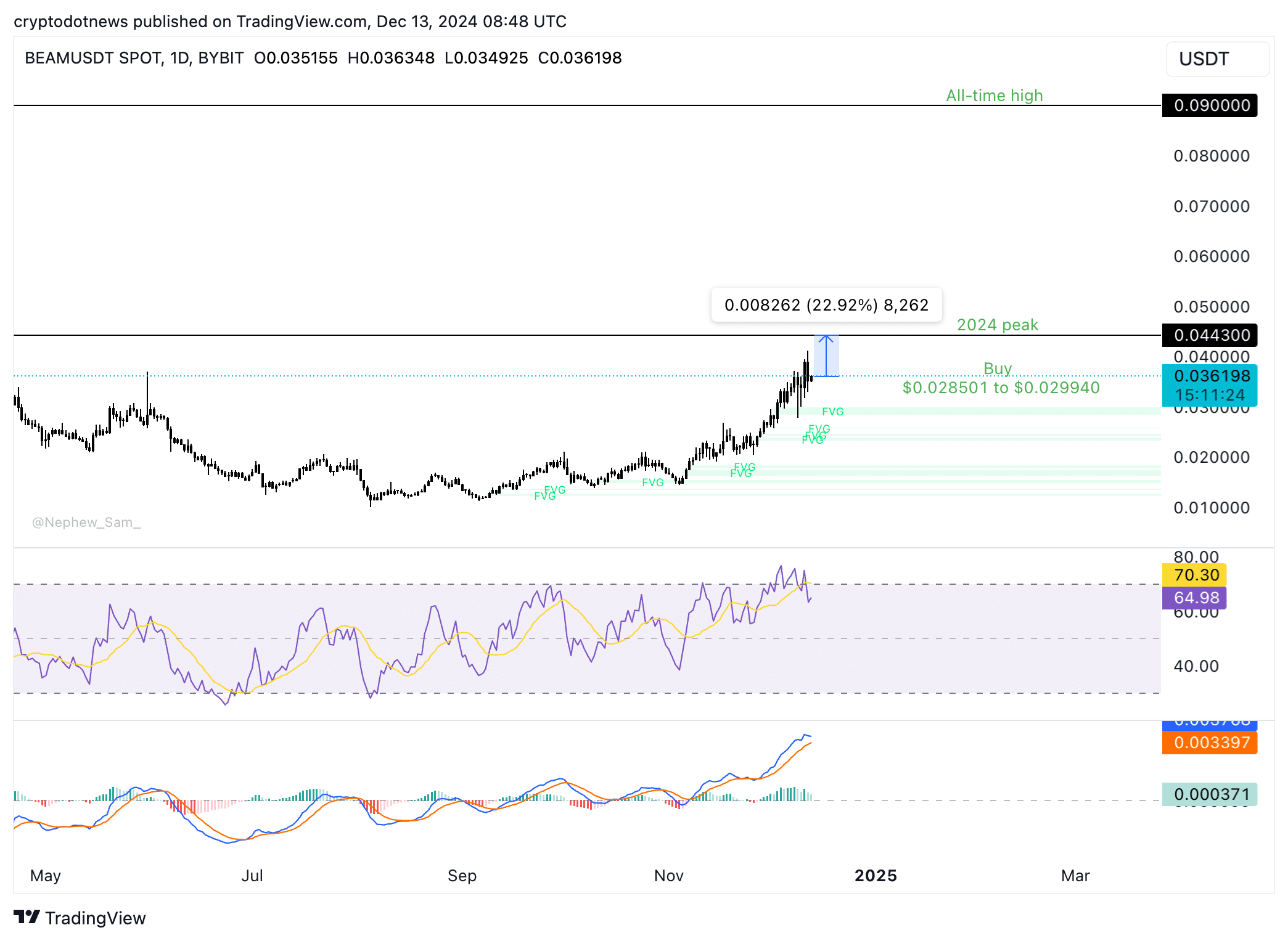

The Beam Token (BEAM) is the native crypto asset for the gaming network powered by the Beam DAO. The ecosystem includes gamers and developers, and this altcoin is ranked 85th by market capitalization on CoinGecko.

BEAM fits into the gaming token narrative of the current market cycle and recently announced the integration of artificial intelligence into its games, supporting innovation.

BEAM is nearly 23% below its 2024 peak of $0.044300. The game token purchase zone is from 0.028501 to 0.029940 US dollars. The MACD is flashing green histogram bars, confirming that BEAM is rising.

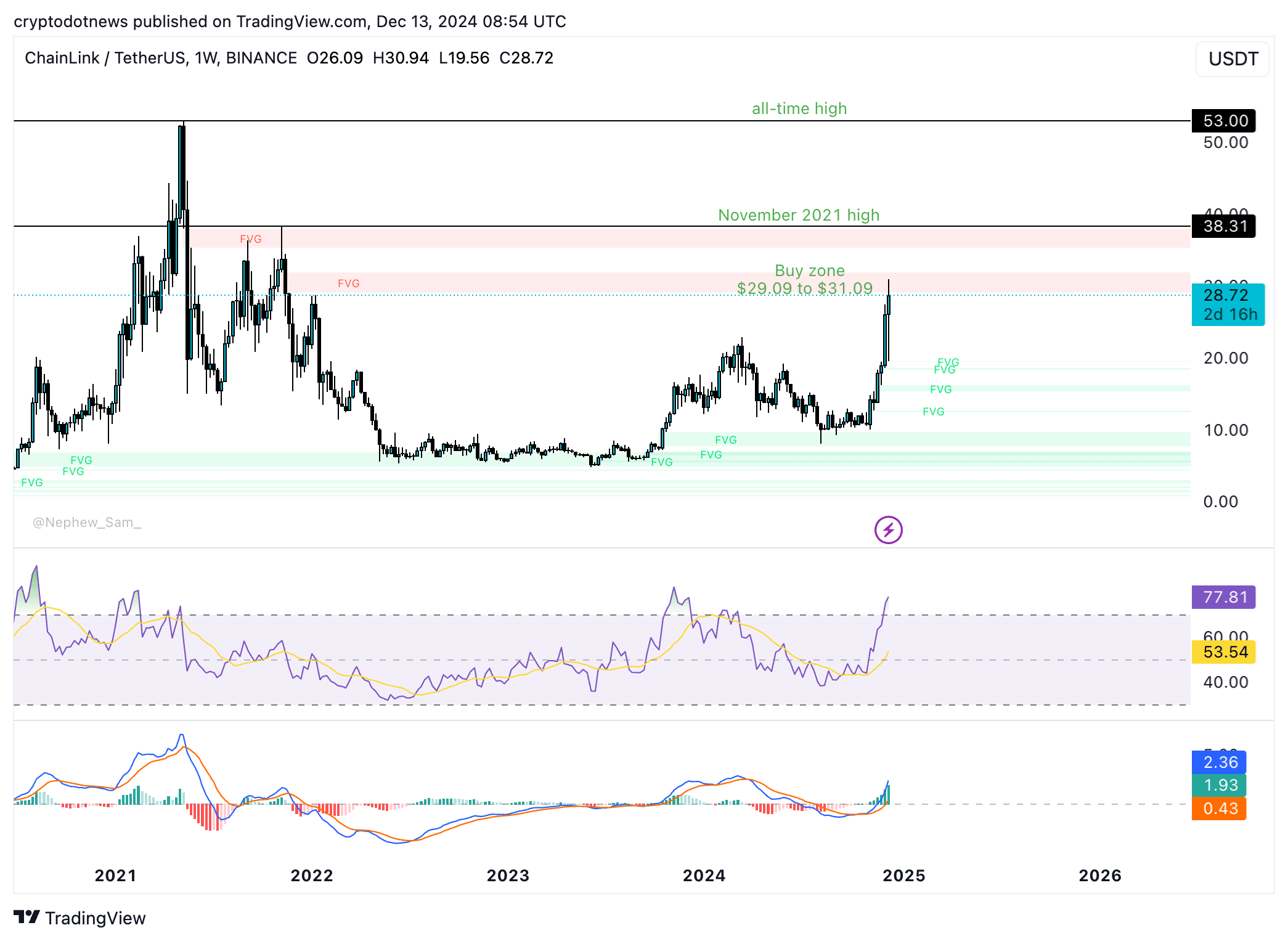

Chainlink (LINK) is the largest oracle network in the cryptocurrency space, providing cross-chain connectivity for several traditional and decentralized financial platforms. LINK is among the top 20 cryptocurrencies by market capitalization.

The LINK buy zone is between $29.09 and $31.09, in the imbalance zone on the weekly price chart. Targets are the November 2021 high of $38.31 and the all-time high of $53.

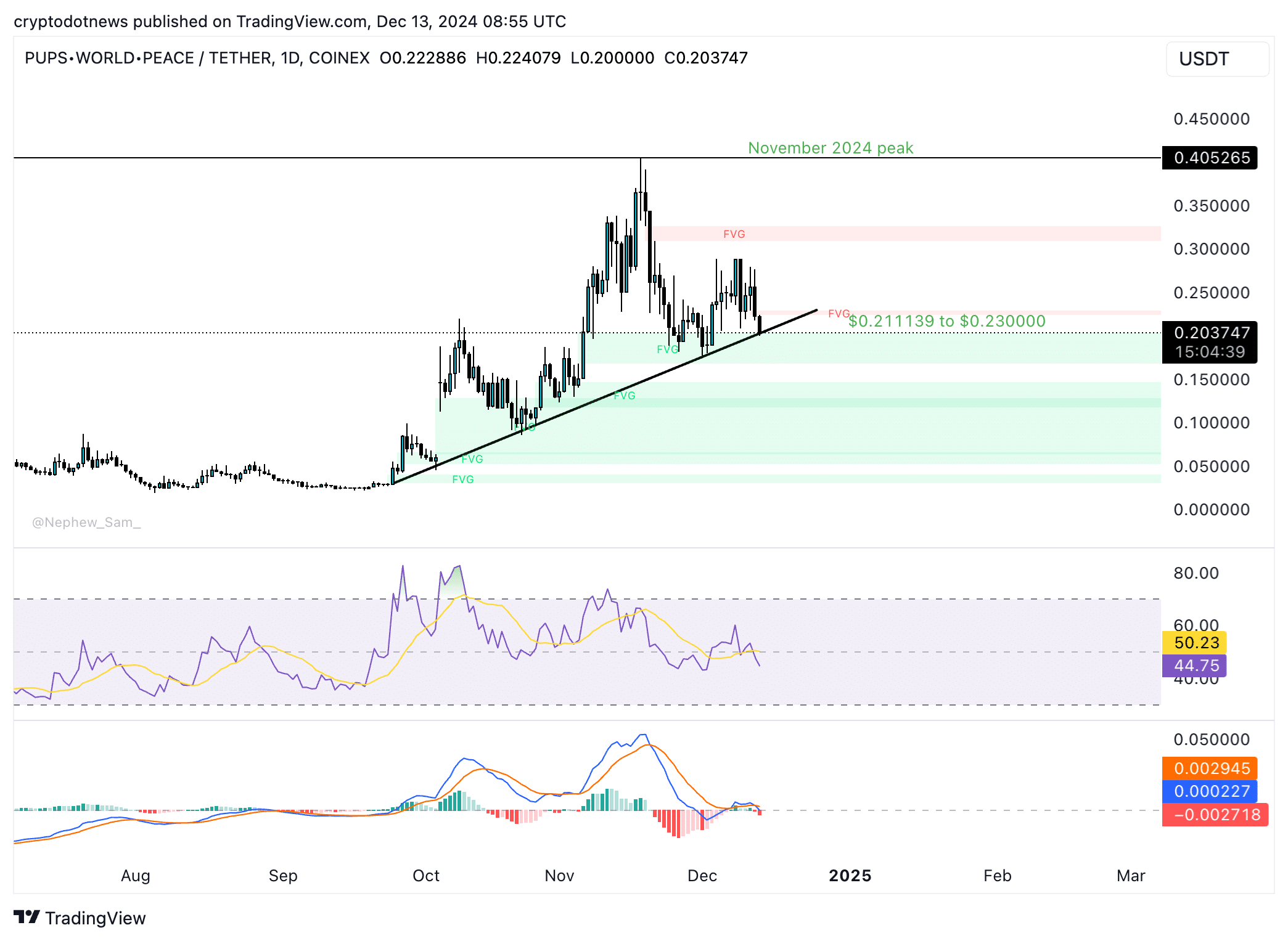

Pups World Peace (PUPS) ranks 379th in market capitalization at over $232 million. Over the past 24 hours, PUPS have lost almost 9% of their value. PUPS fell below the buy zone between $0.211139 and $0.230000.

The meme coin recently reached a high of $0.405265, peaking in November 2024. This is the goal once PUPS recovers from the correction. As of Thursday, the token is in an uptrend.

The RSI is 44, below the neutral 50 level, and the MACD is showing underlying negative momentum for PUPS.

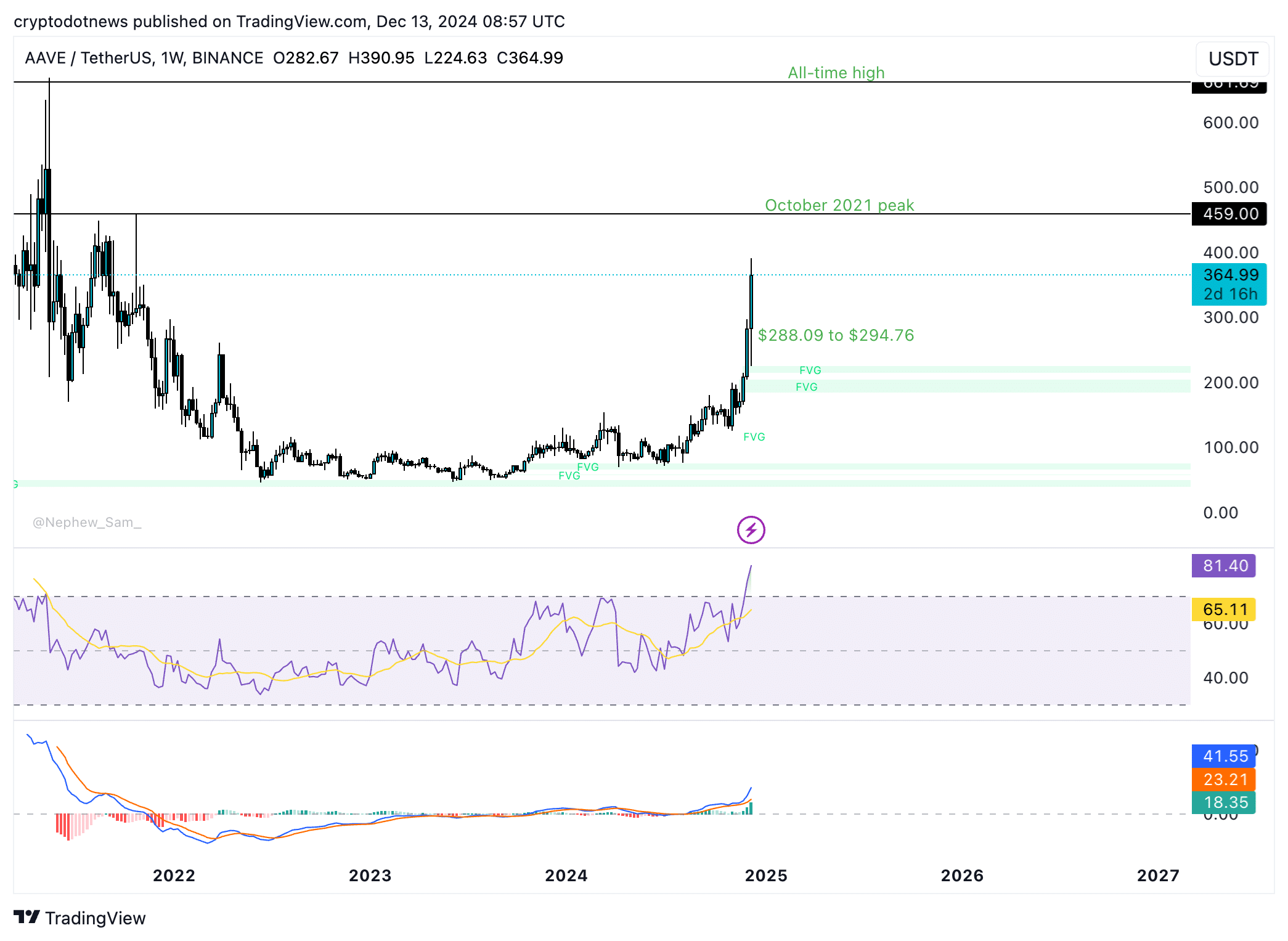

AAVE, a DeFi token that ranks 34th by market capitalization, has seen little change in price over the past day. AAVE’s market capitalization has surpassed $5.43 billion and the token is poised to increase its earnings based on technical indicators.

The AAVE buy zone is between $288.09 and $294.76. AAVE could reach an October 2021 peak of $459. Both momentum indicators support the bullish thesis for the DeFi token.

Strategic Considerations

The cryptocurrency market cycle in 2024 is different from previous bull runs as the majority of institutional capital inflows are directed towards Bitcoin. The “capital rotation” narrative has little relevance in the ongoing bull run.

Options metrics are signaling that Bitcoin’s price could approach the psychologically important $100,000 level. The return of altcoin season could send prices higher, but there is always the possibility of a market correction if Bitcoin sees a flash crash.

Ryan Lee, chief analyst at Bitget Research, told crypto.news:

“Bitcoin’s growing dominance may temporarily divert investment away from altcoins. However, history shows that once Bitcoin stabilizes, altcoins often experience a resurgence. Investors often enter Bitcoin at new highs, anticipating sustained upward momentum that could further boost its price in the short term.”

Disclosure: This article does not constitute investment advice. The content and materials provided on this page are for educational purposes only.