Bitcoin’s fall below $100,000 has shifted investors’ attention to altcoins, seasoned traders say.

Bitcoin (BTC) began its bullish momentum following Donald Trump’s victory in the US presidential election last month, rising to an all-time high of $103,900 on December 5th. As profit-taking began, the flagship cryptocurrency fell back below the $100,000 mark.

This has brought increased attention to altcoins.

Mikael van de Poppe, an experienced crypto investor and trader, expects altcoins to “shine again” as Bitcoin faces a correction.

#Bitcoin is literally imitating the price movement of last December.

I’m not sure we’ll get such a deep correction, but I know it’s time for #Altcoins to shine again. pic.twitter.com/MKwUBJR1Am

— Mikael van de Poppe (@CryptoMichNL) December 11, 2024

He noted that Bitcoin’s current price movements are similar to December 2023, as the global cryptocurrency market capitalization has risen from $1.7 trillion to $2.9 trillion in three months.

Ethereum (ETH), the leading altcoin, hit a local high of $4,070 in mid-March. At the time of writing, ETH is trading at $3,700.

Another crypto analyst known as Milky Bull, with more than 81,000 followers on X, expects the upcoming “alt season”—the time when altcoins outperform bitcoin—to last three months.

#ALTSESON lasts about 90 days

This month through March seems logical. pic.twitter.com/6X6KTgBzPD

— Mikybull 🐂Crypto (@MikybullCrypto) December 5, 2024

Milky Bull believes the alternative season will last until March 2025 before a major correction occurs.

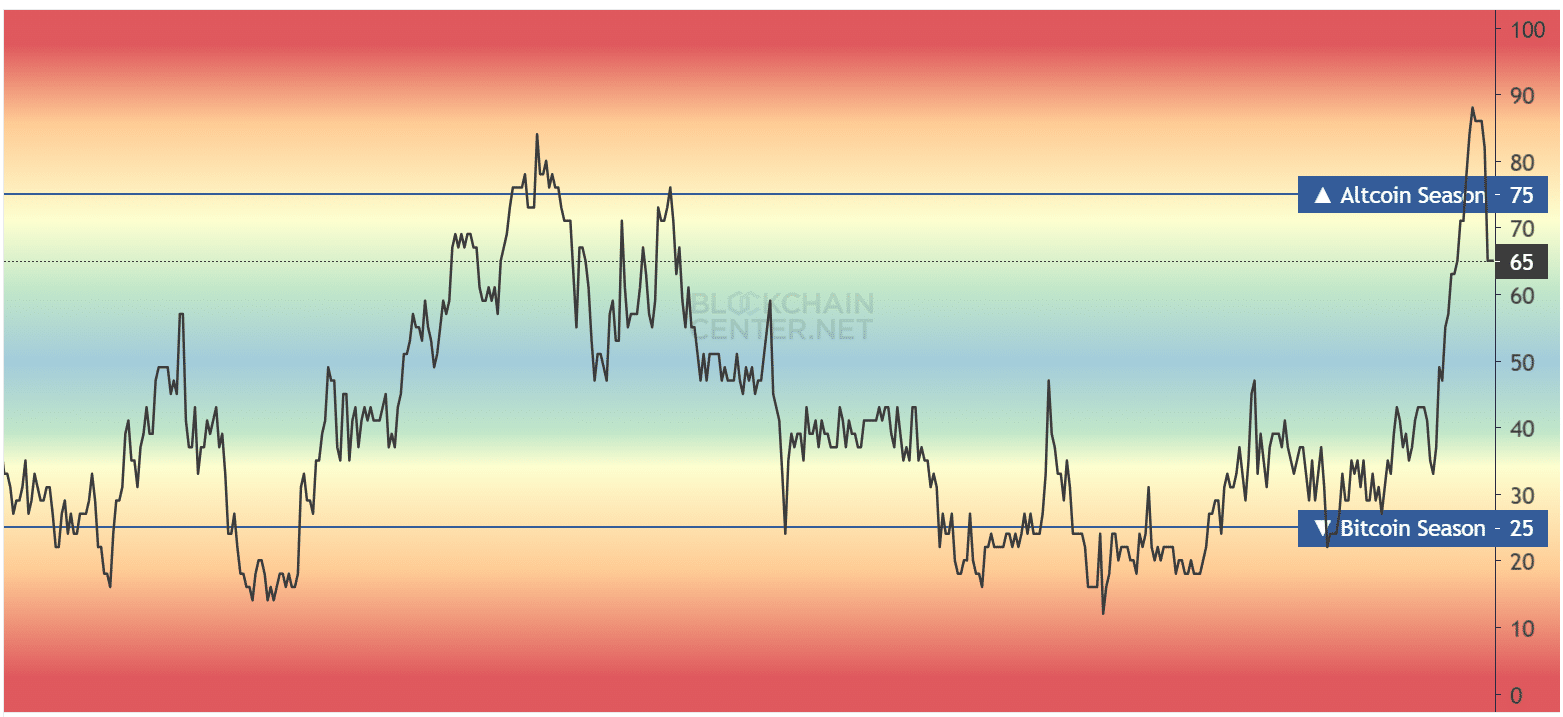

According to Blockchain Center, the Altcoin Season Index is currently hovering at 65. The indicator suggests that investors are currently more interested in altcoins than Bitcoin.

Data shows that 64% of the 50 largest cryptocurrencies, excluding stablecoins and asset-backed tokens, have outperformed Bitcoin over the past 90 days. Hedera (HBAR) leads the pack with a gain of 494% over the period.

For the altseason to take effect, more than 75% of the top 50 digital assets must outperform Bitcoin.

Bitcoin currently has a market dominance of 53.1% with a market capitalization of $1.94 trillion. According to CoinGecko, the market capitalization of altcoins fell from $1.89 trillion on December 9 to $1.68 trillion today amid a general market correction.

Disclosure: This article does not constitute investment advice. The content and materials provided on this page are for educational purposes only.