Toncoin (TON) price is up more than 7% in the last 24 hours, showing signs of recovery as it approaches a $16 billion market capitalization. After reaching oversold levels with an RSI of just 18, TON has recovered to 47, indicating potential for further growth.

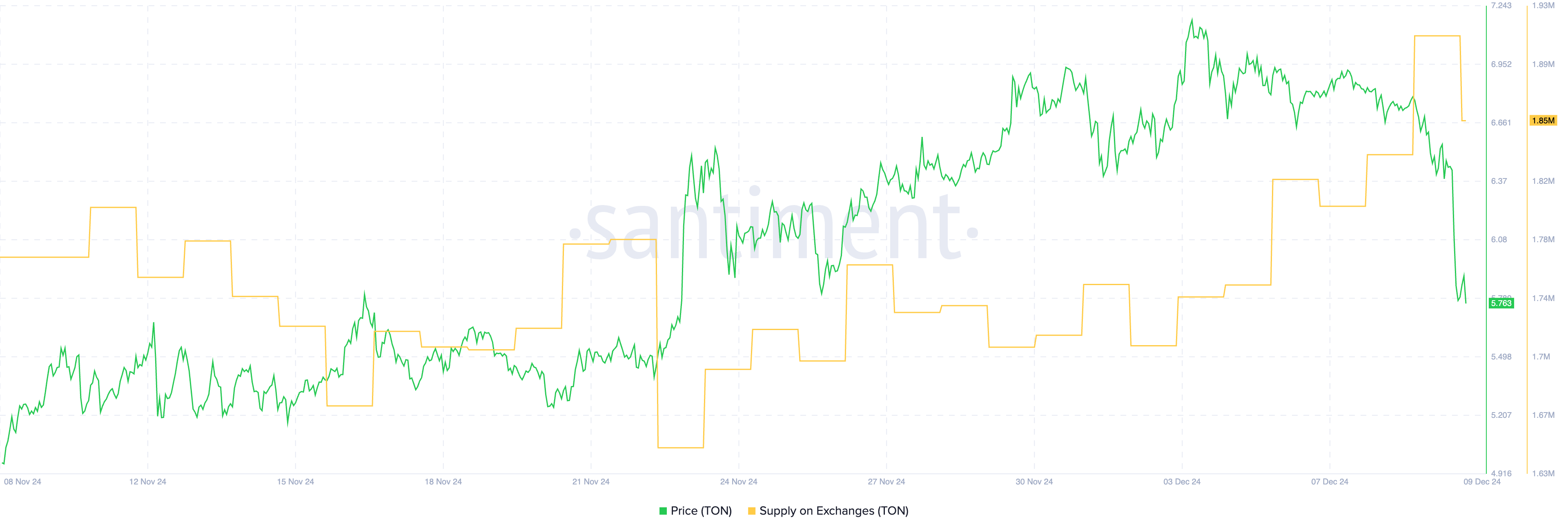

Additionally, the supply of TON on exchanges decreased from 1.91 million to 1.85 million on the last day, signaling a reduction in selling pressure. While the EMA lines have recently formed a death cross, short-term indicators are hinting at a possible reversal if momentum continues, allowing TON to test key resistance levels around $6.3 and above.

TON RSI has left the oversold zone

The Toncoin Relative Strength Index (RSI) has recovered significantly and is currently at 47 after falling to 18 between December 9 and 10. This move marks a recovery from the extreme oversold conditions that often precede a price recovery.

The TON price has risen over 7% over the past 24 hours, reflecting renewed buying interest as the RSI approaches the neutral zone. This upward momentum suggests that the TON price may continue to rise, provided that buying pressure continues.

RSI is a momentum oscillator that ranges from 0 to 100 and measures the speed and magnitude of price movements. Readings below 30 indicate oversold conditions, signaling the possibility of a reversal, while readings above 70 suggest overbought conditions and the possibility of a pullback.

Since TON’s RSI is now 47, it has exited the oversold zone and moved closer to neutral territory. This level suggests that the current rally may have more room to grow as TON still has some room to reach overbought levels.

Toncoin supply on exchanges dropped to 1.85 million

The supply of tokens on exchanges has grown steadily since December 3, when it stood at 1.71 million, and now stands at 1.85 million. This trend suggests increasing selling pressure as more tokens enter exchanges, which is usually a bearish signal indicating that holders may be preparing to sell.

However, over the past 24 hours, the number of TONs on exchanges has dropped from 1.91 million to 1.85 million, signaling a potential change in sentiment. This decline may indicate that users are withdrawing tokens from exchanges, perhaps for long-term storage or staking.

The movement of coin supply on and off exchanges is a key indicator of market sentiment. Increased supply on exchanges often precedes selling activity, putting downward pressure on the price. Conversely, decreased supply on exchanges suggests users are moving coins into private wallets, which could reduce immediate selling pressure and support bullish momentum.

While the recent drop in TON supply on exchanges is promising, it is important to monitor whether this trend continues, as a sustained decline could indicate greater confidence in the coin’s price recovery.

TON Price Prediction: Can It Reach $7 Again in December?

Toncoin’s exponential moving average (EMA) lines formed a death cross yesterday, with short-term EMAs crossing below long-term EMAs, signaling a bearish trend.

Despite this, the TON price has since shown signs of recovery, with short-term EMAs beginning to turn upward. This suggests that although a bearish signal is present, the possibility of a reversal remains if momentum continues to build, making Toncoin one of the best altcoins to invest in December.

If the downtrend continues, the TON price may test the support at $5.68. A break below this level could lead to further declines, potentially reaching $5.19. However, as the RSI indicates, there is still room for growth.

TON could benefit from this recovery to challenge the resistance at $6.3. If it successfully breaks this level, further targets include $6.6 and $6.99, the latter of which has acted as a strong barrier in recent days.