The cryptocurrency market has changed dramatically since the 2020-2021 bull market, which saw significant gains for popular meme coins such as Dogecoin, Shiba Inu, and FLOKI.

Crypto Koryo, a data scientist with extensive industry experience, explains how the meme coin market has evolved, leading to a scenario where investing in these assets is now considered high risk with potentially low returns.

Is it worth investing in meme coins?

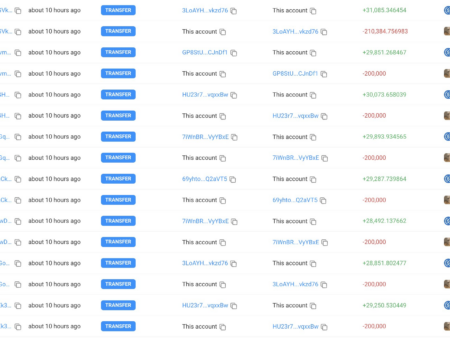

In the past, meme coins benefited from a massive influx of retail investment and limited competition. However, the barrier to creating new coins has lowered substantially, leading to a saturated market.

“Back then, implementing an ERC-20 token wasn’t something the average Joe could do easily. But today anyone can do it,” says Koryo.

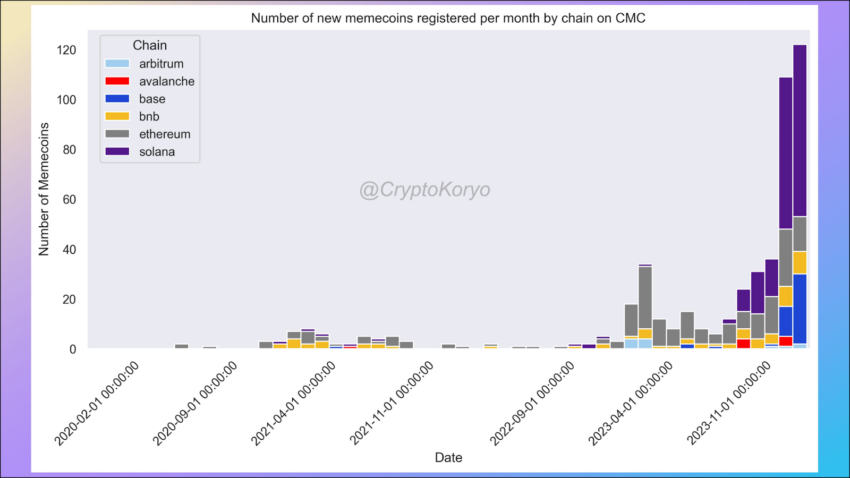

The data backs up his claims. Last month, 138 new meme coins were registered on CoinMarketCap, compared to just 18 in April 2023. This influx has diluted potential returns for individual altcoins. Furthermore, competition has spread across various blockchain platforms, and even Bitcoin now hosts meme-based tokens.

Read more: 7 hot coins and altcoins trending in 2024

New meme coins on CoinMarketCap. Source: Crypto Koryo

Investing in these coins involves navigating a volatile market with many choices. Koryo warns that an investor’s portfolio could collapse to zero without substantial diversification.

“Considering that the vast majority of these new meme coins will end up at $0, a lot of diversification is needed if you want to play that game. If there is too little diversification, your portfolio could go to $0 at any time. Excessive diversification, and even a 20x on one of them, would not have a significant impact on PnL,” explains Koryo.

Furthermore, the shift from a developer-driven to a retail-driven market means that supply and demand dynamics have changed dramatically. In 2021, demand significantly exceeded supply, but the situation has now reversed, creating a market where supply exceeds demand.

The sobering reality is that, while they can still offer substantial returns, the chances of success are much lower and the risks are considerably higher. For most casual investors, the complexities and efforts required to remain profitable are daunting. Koryo concludes,

“Undoubtedly, among the thousands of meme coins launched every year, few will print good numbers. The question is, how does this compare to holding Bitcoin or some bluechip?” Koryo concluded.

As investors navigate this challenging market, these coins should be approached with caution and consider whether the high risk is worth the potential low reward.