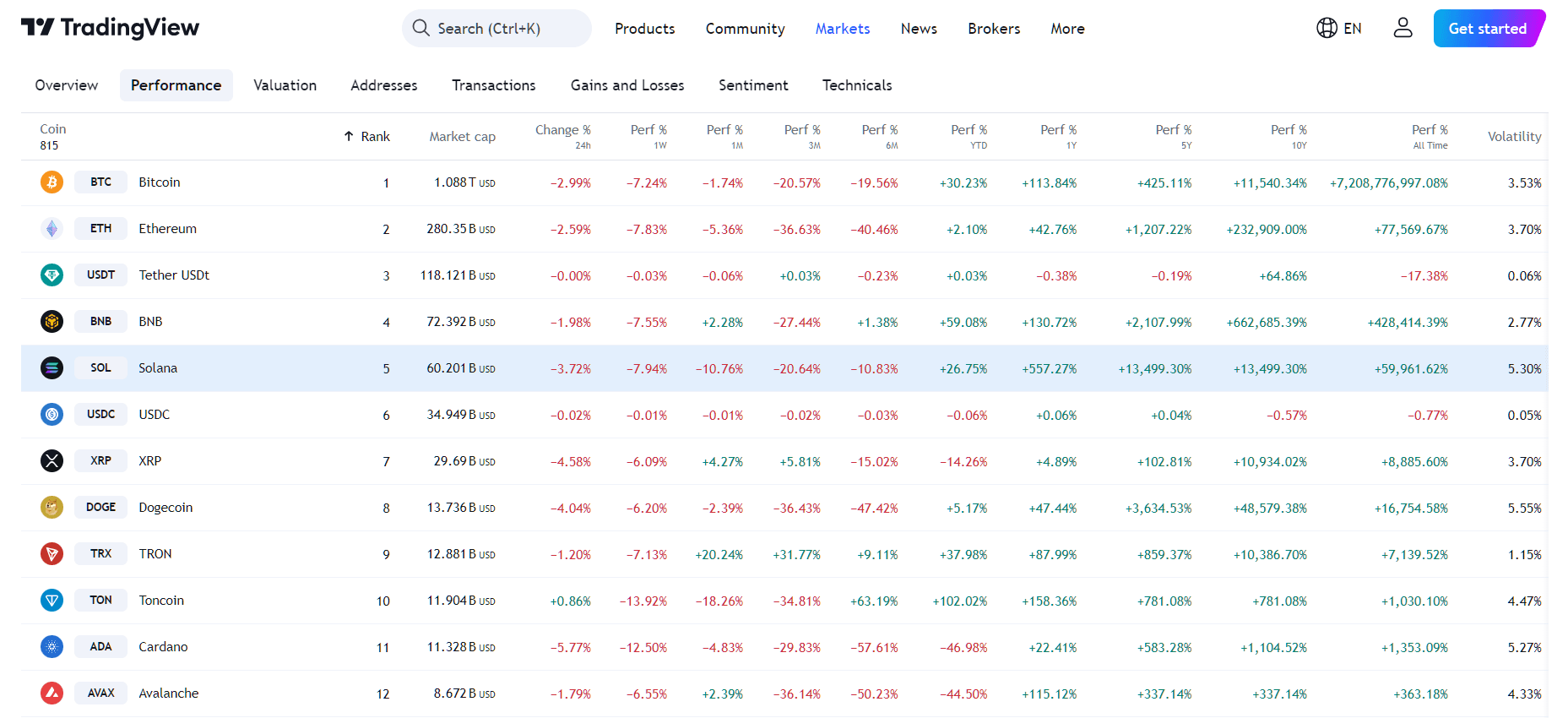

Solana (SOL) Solana is going through a turbulent time in 2024, with significant price volatility and chart patterns pointing to potential further declines. As September approaches, traders are keeping a close eye on critical support levels, particularly the $122 and $127 zones. This article combines recent price analysis and forecasts to explore whether Solana will fall below $100 as some have expected, and if so, what that could mean for its future.

Solana’s Price Fight

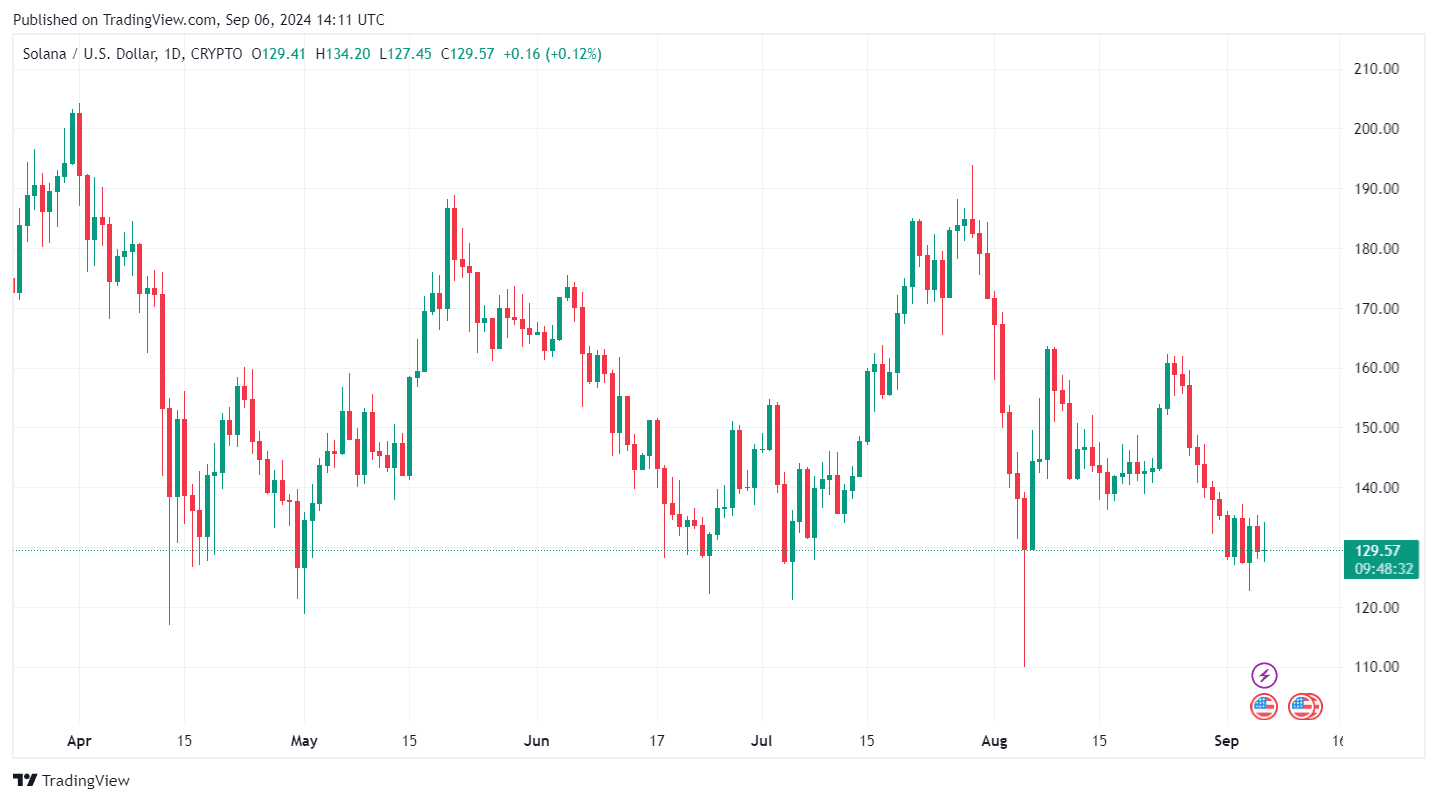

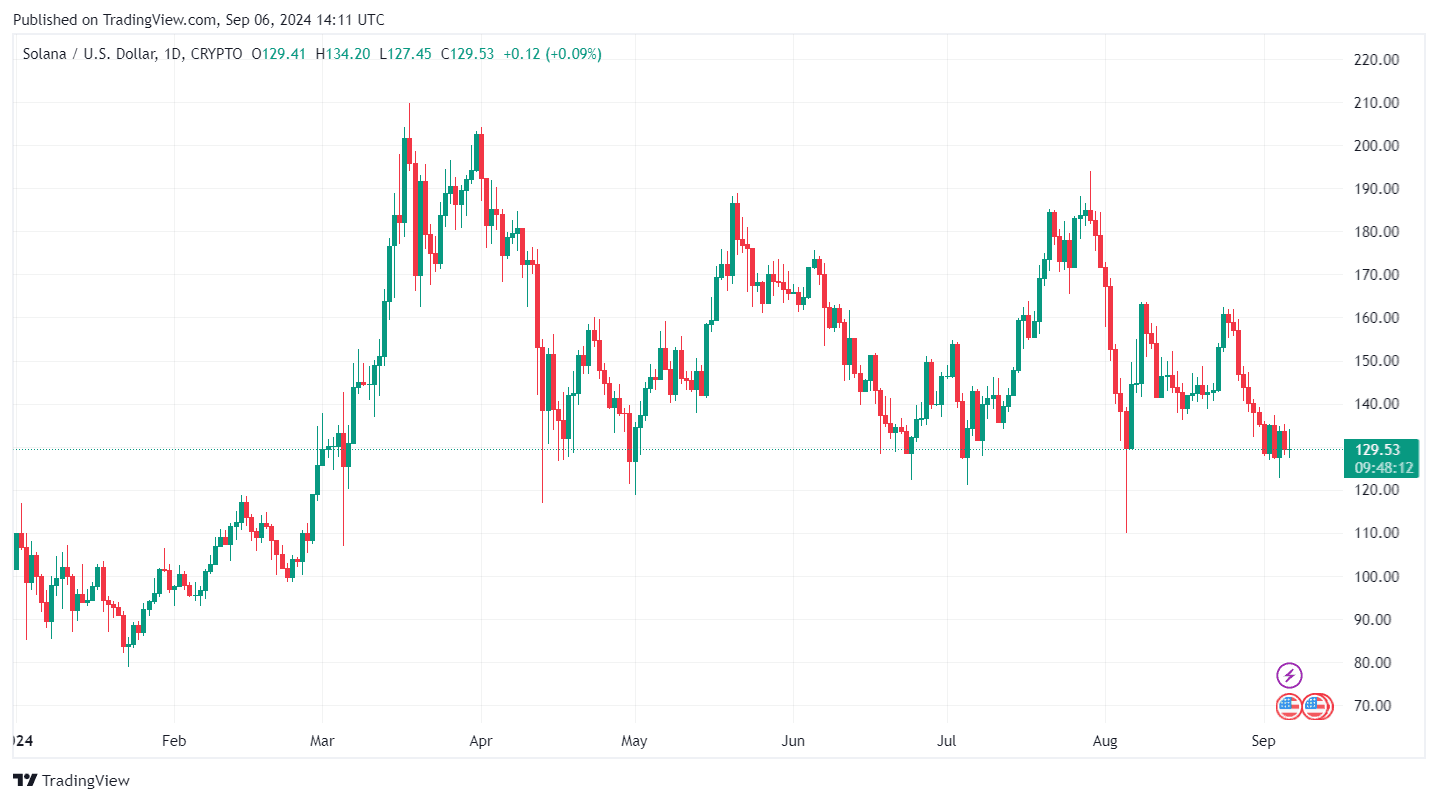

Solana’s price performance has been worrisome, especially after closing August 2024 with the second-worst weekly performance of the year, falling 19.14%. This followed a sharper 25.19% drop in July. Solana’s price has been hovering dangerously close to key support levels in recent weeks, raising concerns of further corrections.

The derivatives market is seeing a 20% increase in Solana open interest (OI) coupled with a negative funding rate, signaling bearish sentiment. As futures traders increase short positions, this is putting downward pressure on SOL. The funding rate has been in negative territory for over a week, the longest negative streak since October 2023.

Key support levels for Solana price: $127 and $122

The $127 price level is a critical support level for Solana price. Since April 2024, the coin dropped below this level six times but managed to rebound. However, the situation looks more precarious in September. The loss of support at $127 will push SOL to a significant liquidity jump around $110. If the bearish momentum continues, SOL may even test the $98-$104 zone, a critical demand area. This drop would represent a 22% correction, marking a new lower low for 2024.

On the other hand, $122 remains another important support level in the medium to long term. Historically, whales have identified $122 as a key price point, and any sustained drop below this level – especially over a period of more than 5-8 days – could change the entire structure of the market. A drop below $122 could signal further declines towards $90, where further Fibonacci levels and ascending trendlines could come into play.

Solana Stock Price Analysis: Bearish Now, Bullish Later?

While Solana’s price action in August and September looks extremely bearish, a deeper correction could set the stage for a bullish outcome in 2025. Analysts predict that if SOL declines in the short term, it could lead to a classic bullish cup-and-handle pattern that could lead to a strong rally in 2025.

This theory is based on the fact that SOL respects its dominant chart structures and key Fibonacci levels. A short-term price drop to $90 would still keep Solana in these critical zones, allowing the altcoin to regain momentum later. However, a deeper break below these levels could signal a longer bearish trend.

What to Expect from SOL Price in September and October 2024

September could be a crucial month for Solana price as key support levels are tested and the overall crypto market continues to experience uncertainty. Patience will be key as traders keep an eye on these levels. If Solana price holds above $122, it could quickly recover in Q4 2024. However, if it falls below $100, a long-term bearish scenario could unfold.

October is expected to be a pivotal month for the entire cryptocurrency market, including Solana. Traders should remain cautious and be prepared for further volatility as the market navigates this critical period.