Ripple has transferred its entire December reserves of 200 million XRP, worth $500 million, as XRP recovers from the crash. This selling pressure could influence the recovery and further increase prices, absorbing a significant portion of incoming demand.

It is noteworthy that the asset has undergone an aggressive correction after an impressive rise to the 3rd position in market capitalization. The XRP Ledger’s native token (XRPL) began to fall last week after debunking rumors and technical indicators, reaching the 4th position.

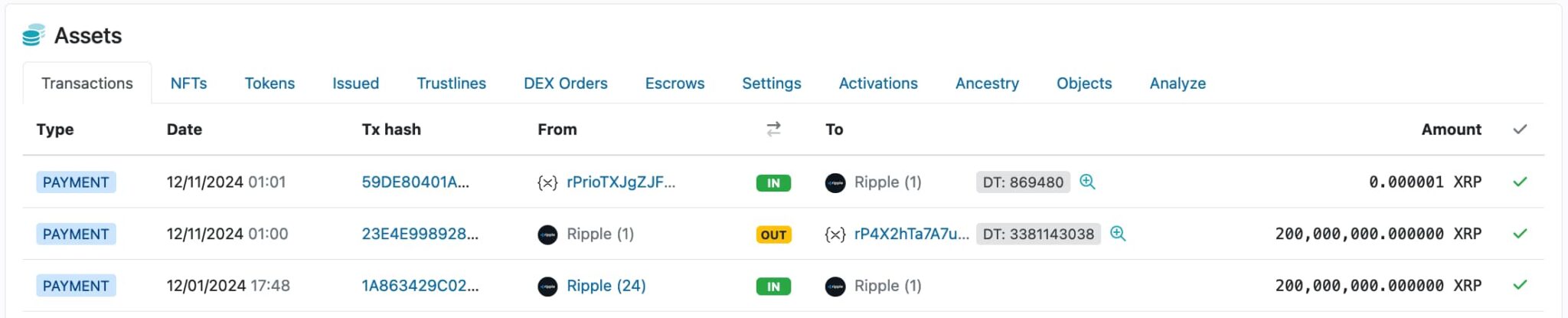

Now that XRP is once again competing for Tether’s USDT, its largest token holder, Ripple, has launched a massive divestment operation. On December 11, the company transferred all 200 million XRP reserved for the December budget, following Finbold’s warning last week.

Repeating the previous month’s pattern, Ripple (1) sent tokens to the address “rP4X2h(…)”, which serves as an intermediate address for sales. This account also received 380 million XRP from Ripple (29) and transferred 200 million tokens to Ripple (50).

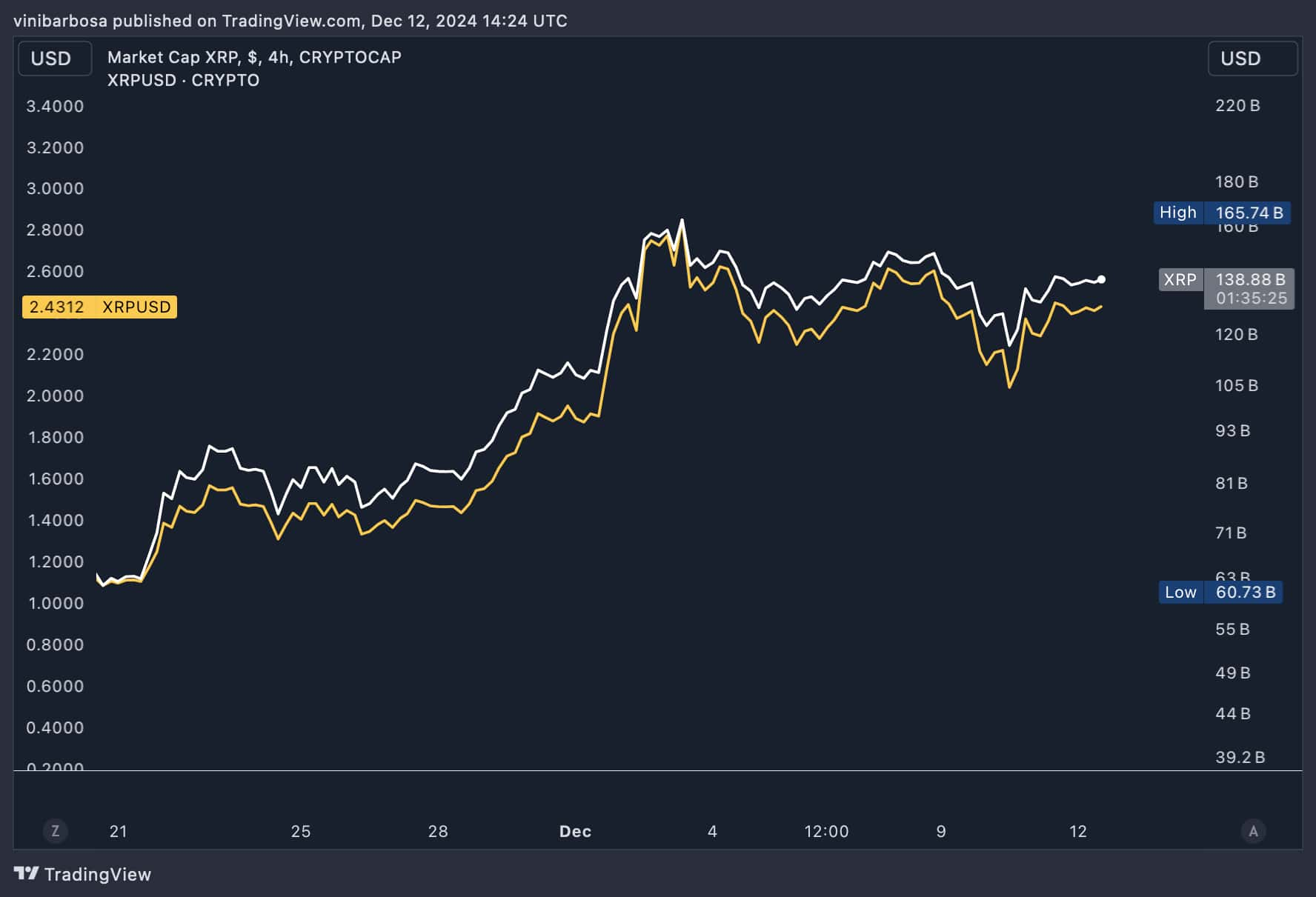

Analysis of XRP prices against the backdrop of potential Ripple sales activity

At current prices, Ripple’s potential sale of 200 million XRP would be nearly half a billion dollars. More precisely, if the company were to sell its entire supply at $2.43 per XRP, Ripple would receive $486 million.

As Finbold reported, XRP crossed the $100 billion market cap level on November 29, threatening to surpass Solana (SOL). A few days later, the Ripple token reached a record high capitalization of $165.74 billion at a price of $2.90 per XRP. This allowed the asset to take 3rd place, surpassing Solana and USDT Tether in all crypto market indices, which was an unprecedented step.

On December 4, Finbold warned that technical indicators such as the relative strength index (RSI) were pointing to a potential collapse for XRP. The prediction was confirmed and the token fell to $2.00, primarily due to Ripple denying rumors related to RLUSD.

Despite some speculation, $RLUSD is not launching today. We are working with NYDFS on final approval and will share updated information as soon as possible.

We are fully committed to running the project under NYDFS oversight and maintaining the highest regulatory standards. Stay tuned…

— Ripple (@Ripple) December 4, 2024

At the time of writing, XRP’s market capitalization is $138.8 billion, slightly behind USDT, which has just over $139 billion. If XRP continues the strong momentum it has been showing since November, the digital asset could regain its No. 3 position in crypto indices.

However, the general influx of capital into the cryptocurrency ecosystem could also increase the capitalization of Tether’s stablecoin, raising the level of play compared to XRP. In this regard, USDC Circle, a direct competitor to USDT, is also vying for a higher position in an innovative partnership with Binance.

Featured image from Shutterstock.