In January, the U.S. Securities and Exchange Commission approved the country’s first spot Bitcoin ETFs. BlackRock’s iShares Bitcoin Trust has amassed more than $17 billion in assets under management, as reported by Bloomberg, thanks to significant net inflows and substantial gains in digital asset prices this year.

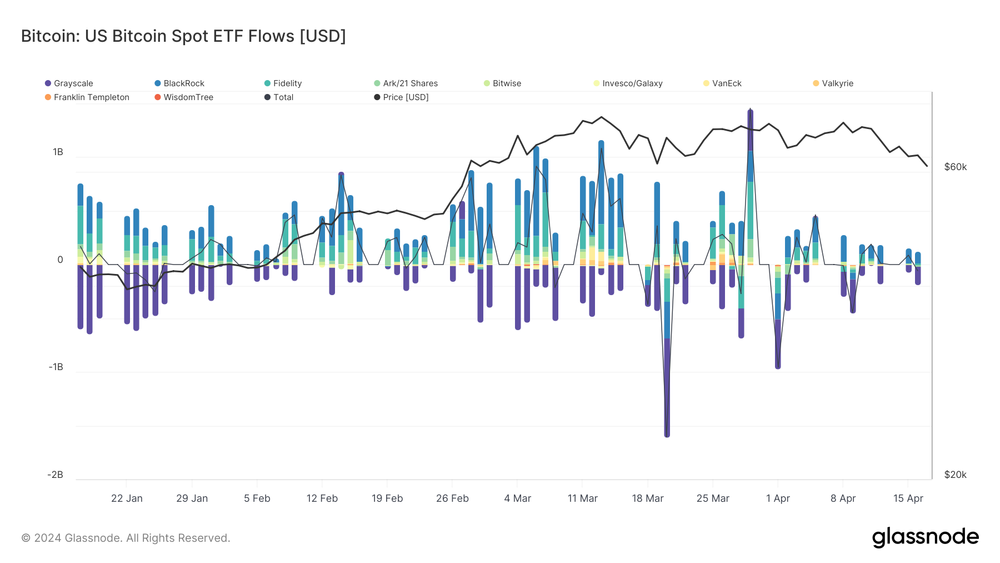

Since their launch, the 11 US-based Bitcoin spot ETFs have attracted approximately $12 billion in total net inflows, pushing the price of Bitcoin to a record high of more than $73,000 in March.

While Bitcoin ETFs have seen record inflows since January, there has been a slowdown in inflows since late March, indicating a potential shift in investor sentiment. Following the substantial corrections in the price of Bitcoin after the halving, significant outflows continue to occur.

Great success at the beginning

Since their introduction, Bitcoin ETFs have seen robust weekly inflows ranging from $1.2 billion to $2.5 billion in the first quarter. The cryptocurrency market has seen notable capital flows, which in turn are highly correlated with Bitcoin price movements.

Spot ETFs have created a significant source of new demand for Bitcoin, but the new supply of BTC is limited to miners’ rewards. In the two and a half months since spot ETFs began trading, demand for ETFs has significantly outpaced issuance.

In addition to these financial inflows, the market has also seen changes in trading patterns. For example, when comparing trading volumes, spot Bitcoin ETFs now represent a substantial portion of the total spot trading volume on centralized exchanges.

As of March 31, 2024, Bitcoin spot ETFs have accumulated nearly $60 billion in assets.

Decreasing demand

BTC ETF flows have started to slow due to the unexpected rise in US inflation for the second consecutive month, exacerbated by the Federal Reserve’s accommodative monetary policy keeping interest rates at 23-year highs following disappointing inflation data. ‘inflation.

The first sign of trouble emerged on April 25, when BlackRock’s Bitcoin ETF ended its streak of 71 days of consecutive inflows. During this period, IBIT recorded no new inflows, with total outflows of $120 million. Grayscale’s GBTC also saw significant outflows, topping $130 million. In contrast, Fidelity’s FBTC attracted $5.6 million and Ark’s ARKB garnered $4.2 million in inflows.

By May 2, each ETF reported outflows for the first time, totaling $563.7 million — the largest losses since trading began in January. This decline has persisted for nearly two months, with funds suffering losses of around $6 billion over the past four weeks, representing a 20% decline in assets under management.

Investors pulled a net $218 million from U.S. Bitcoin ETFs, one of their worst daily outflows as demand for risky investments takes a hit as hopes of interest rate cuts by the Federal Reserve fade.

The significant outflows are attributed to Bitcoin’s ongoing correction. Bitcoin is up 65% year-to-date to its all-time high of $73,000 in March, but has since fallen nearly 20%, currently trading near $59,000. This drop in Bitcoin prices coincides with the start of outflows from ETFs.

However, on May 3, Bitcoin ETFs posted their best performance in weeks. According to Farside, the Bitcoin spot ETF recorded a total net inflow of $378 million on May 3, marking the first net inflow after seven consecutive days of net outflows.

More information on U.Today

The Grayscale Bitcoin Trust (GBTC), the largest Bitcoin ETF by assets, saw a net inflow of new money from investors for the first time since its debut in January, with a net addition of $63 million to the trust.

Hong Kong fell short

Hong Kong Bitcoin and Ether spot ETFs made their debut on April 30. Combined trading turnover for all six ETFs reached $12.7 million. In contrast, US funds surpassed $4 billion in turnover on their first day.

Data from Arkham Intelligence indicates that Bosera HashKey’s Bitcoin and Ether spot ETFs have accumulated 964 BTC and ETH, for a total of $71.94 million in assets under management. Similarly, ChinaAMC’s Bitcoin and Ether spot ETFs have amassed $123.61 million in combined assets, as reported by Eric Balchunas, senior ETF analyst at Bloomberg.

As I said in the first tweets about Hong Kong, you understood that it is 1/168th the size of the US “What is this ETF market for ants!?” Yes. That said, Hong Kong ETFs were launched at the right time with the US slowdown, so their inflows of more than $141 million will more than offset the slightly negative flows into the US.

— Eric Balchunas (@EricBalchunas) April 30, 2024

Despite comparatively lower asset values, Hong Kong ETFs have garnered considerable interest. According to an April 28 survey conducted by OSL, a Hong Kong-regulated cryptocurrency exchange, 76.9% of informed respondents in the city plan to invest in the new Bitcoin and Ether spot ETFs.

The future of Bitcoin ETFs

JP Morgan principal analyst Nikolaos Panigirtzoglou believes that recent weeks have seen significant selling/profit-taking in both the stock and cryptocurrency markets, with retail investors perhaps playing a larger role than institutional investors .

It appears that retail investors have been selling both cryptocurrencies and equity funds. In terms of institutional investors, such as CTA or other quantitative funds, they appear to have profited from previous extremely long positions in stocks, Bitcoin and gold.

The main question is whether demand for Bitcoin ETFs from retail investors will rebound.

Morgan Stanley has reportedly expressed interest in allowing its brokers to recommend the product to their clients, but this plan has not yet been followed up by any policy. For now, issuers of spot Bitcoin ETFs currently do not have access to clients of major registered investment advisors and broker-dealer platforms such as Morgan Stanley, JPMorgan, or Wells Fargo.

Significant outflows from ETFs often align with notable price declines in the Bitcoin market, indicating that investors tend to react to existing recessions rather than cause them. This suggests predominantly reactive investor behavior in times of market volatility, which is critical to understanding the causality of price movements.