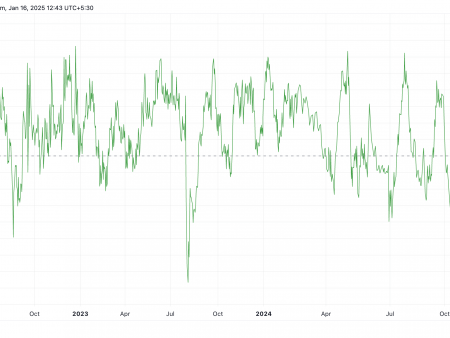

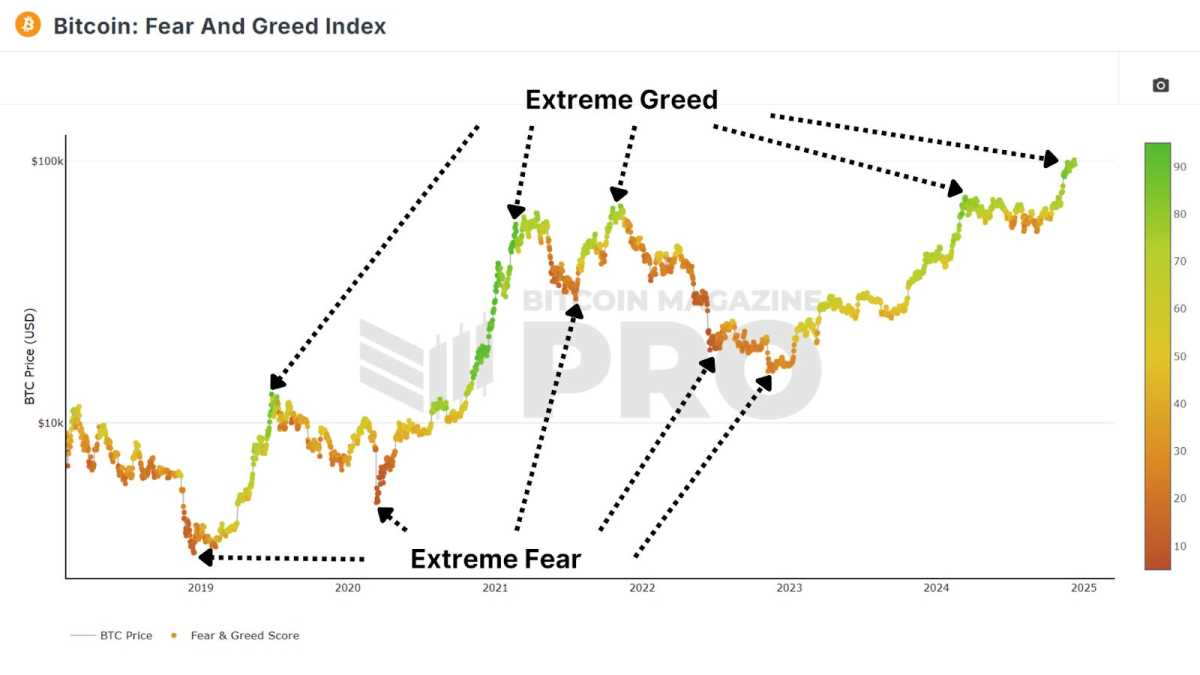

The Bitcoin Fear and Greed Index is a sentiment analysis tool that reflects the collective sentiment of Bitcoin traders and investors. Spanning a scale from 0 to 100, the index measures market emotions ranging from extreme fear (0) to extreme greed (100). Although it is a popular resource among many analysts, it certainly has its doubters! So let’s look at the data to quantify whether this index can actually help you make better investment decisions.

Investor emotions

The Fear and Greed Index combines various indicators to provide insight into market sentiment. These indicators include:

Price volatility: Large price swings often cause fear, especially during downturns.

Impulse and volume: Increased purchasing activity usually signals greedy sentiment.

Sentiments on social networks: Public discourse about Bitcoin across platforms reflects a collective optimism or pessimism.

Bitcoin Dominance: Bitcoin’s higher dominance compared to altcoins usually indicates cautious market behavior.

Google Trends: Interest in Bitcoin search criteria correlates with public sentiment.

By synthesizing this data, the index provides a simple visual representation: red zones represent fear (lower values) and green zones represent greed (higher values).

View the chart in real time 🔍

What you will also immediately notice is that this tool really shows how with mass psychology it is almost always best to act as an adversary. Essentially, if everyone is bearish, you should probably be more optimistic, and vice versa.

Does the opposite behavior apply?

To assess whether the Fear and Greed Index is more than just a colorful chart, a test was conducted using data dating back to February 2018, when the index was created. The implementation of the strategy was simple:

Allocate 1% of your capital to Bitcoin on days when the index is 20 or below, and sell 1% of your Bitcoin assets on days when the index reaches 80 or above. If such a basic strategy has performed well enough, then we can definitely consider it a useful tool for investors.

Results

This strategy significantly outperformed a simple buy-and-hold approach. The above-mentioned Fear and Greed strategy produced an ROI of 1,145%, while the Buy and Hold strategy achieved an ROI of 1,046% over the same period. The difference, while not colossal, demonstrates that carefully adding and exiting Bitcoin based on market sentiment can yield greater returns than simply owning the asset.

The fear and greed index is rooted in human psychology. Markets tend to overreact in both directions. By operating against these extremes, the strategy effectively exploits the irrational and emotional behavior of the market. By scaling up in times of fear and scaling down in times of greed, this strategy has reduced risk and increased returns, outperforming one of the world’s best-performing assets.

Keep in mind that this strategy was only profitable when trading properly by slowly increasing and decreasing through macro cycles and does not take into account any fees or taxes that may apply. Conditions may remain irrationally fearful or greedy for months, and attempts to significantly increase risk or profit solely based on this indicator are unlikely to be successful in the long term.

Conclusion

Despite its simplicity, the Fear and Greed Index has proven its effectiveness when used correctly. This follows the “buy when others are afraid, sell when others are greedy” principle that guides many successful investors.

The Fear and Greed Index should be used in conjunction with other tools such as network data and macroeconomic indicators for confluence, but the data proves that it is definitely worth considering as part of your own analysis.

For a deeper dive into this topic, check out the recent YouTube video here: Does the Bitcoin Fear and Greed Index REALLY Work?

Explore live data, charts, indicators and in-depth research to stay on top of Bitcoin price action in Bitcoin Magazine Pro.

Disclaimer: This article is for informational purposes only and should not be construed as financial advice. Always do your own research before making any investment decisions.