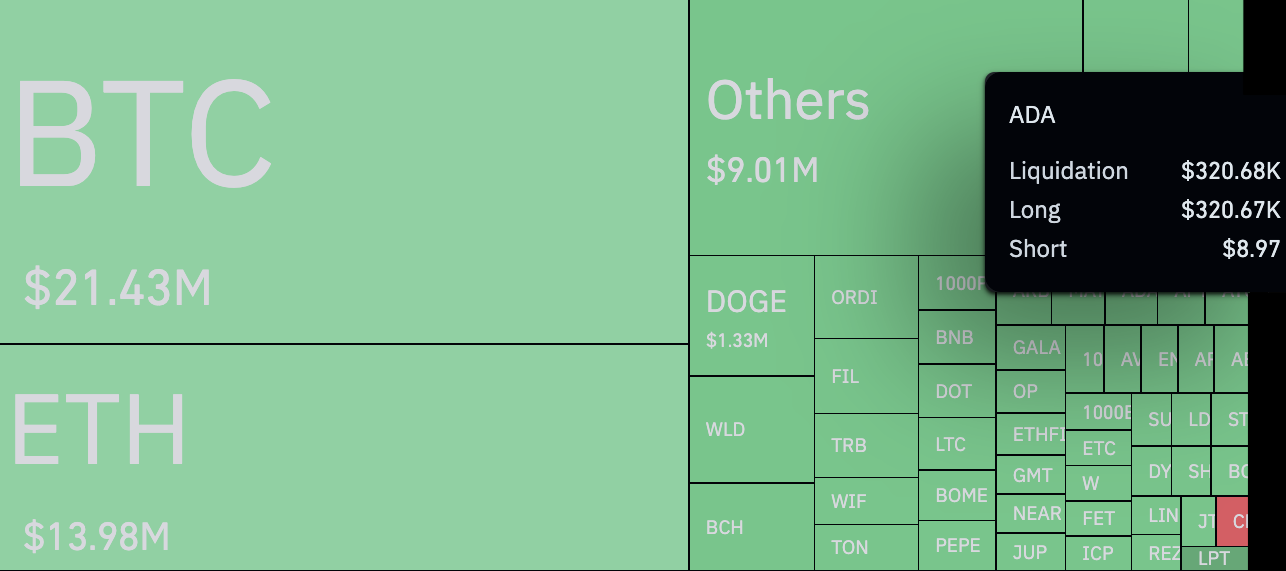

In an unexpected turn of events within the cryptocurrency market, Cardano (ADA) has seen an extraordinary increase in bullish liquidations, diverging significantly from bearish ones. In the course of just one hour, a remarkable $320,670 of long positions have been liquidated, a figure that dwarfs the comparatively small $8.97 liquidated of short positions, resulting in a staggering disparity of almost 4,000,000%.

In an unexpected turn of events within the cryptocurrency market, Cardano (ADA) has seen an extraordinary increase in bullish liquidations, diverging significantly from bearish ones. In the course of just one hour, a remarkable $320,670 of long positions have been liquidated, a figure that dwarfs the comparatively small $8.97 liquidated of short positions, resulting in a staggering disparity of almost 4,000,000%.

The surge in bullish liquidations coincided with a 3% drop in Cardano price in the same hour. One of the main contributing factors could be the recent negative macroeconomic indicators of the US economy.

Among these indicators, Michigan’s consumer sentiment index fell from 77.2 to 67.4, reflecting a decline in consumer confidence. Additionally, consumer inflation expectations saw an uptick, with 1-year expectations increasing from 3.2% to 3.5% and 5-year expectations increasing from 3% to 3.1%.

The Michigan Consumer Sentiment Index serves as an indicator of consumer sentiment regarding economic conditions, with lower values indicating lower confidence, which can affect spending patterns. Meanwhile, rising inflation expectations suggest that consumers anticipate higher prices for goods and services in the future, which could lead to changes in spending behavior and economic dynamics.

This combination of economic factors may have influenced market sentiment, contributing to the increase in liquidations seen in Cardano trading. However, the fact that long liquidations exceeded short liquidations by 4,000,000% is obviously due to excessive greed in the market.