BlackRock’s ETF ETF (ETHA) made a big splash yesterday, December 10th, becoming one of the top four ETFs to launch in 2024, according to Nate Geraci, president of the ETF Store. With daily net inflows of approximately $81.6574 million, ETHA has seen consistent growth over the past 12 days, making it a key player in the highly competitive cryptocurrency space.

Yesterday’s data showed total net inflows into Ethereum spot ETFs reached about $305.74 million. Of these, BlackRock’s ETHA accounted for the majority of the change at $81.65 million, while Fidelity ETF (FETH) led the way with $202 million.

Make these 8 consecutive days of inflows into the iShares Ethereum ETF…

In total, more than $1 billion.

Top 4 ETF launches in 2024 (out of approximately 675 ETFs). https://t.co/5LKWrDdfjw

— Nate Geraci (@NateGeraci) December 11, 2024

As BlackRock’s ETHA continues to gain momentum, its success reflects broader trends in the cryptocurrency investment space. Ethereum-focused investment products saw record inflows this week, reaching a total of $1.2 billion and surpassing previous highs set in July.

But will BlackRock launch the Solana ETF (SOL)?

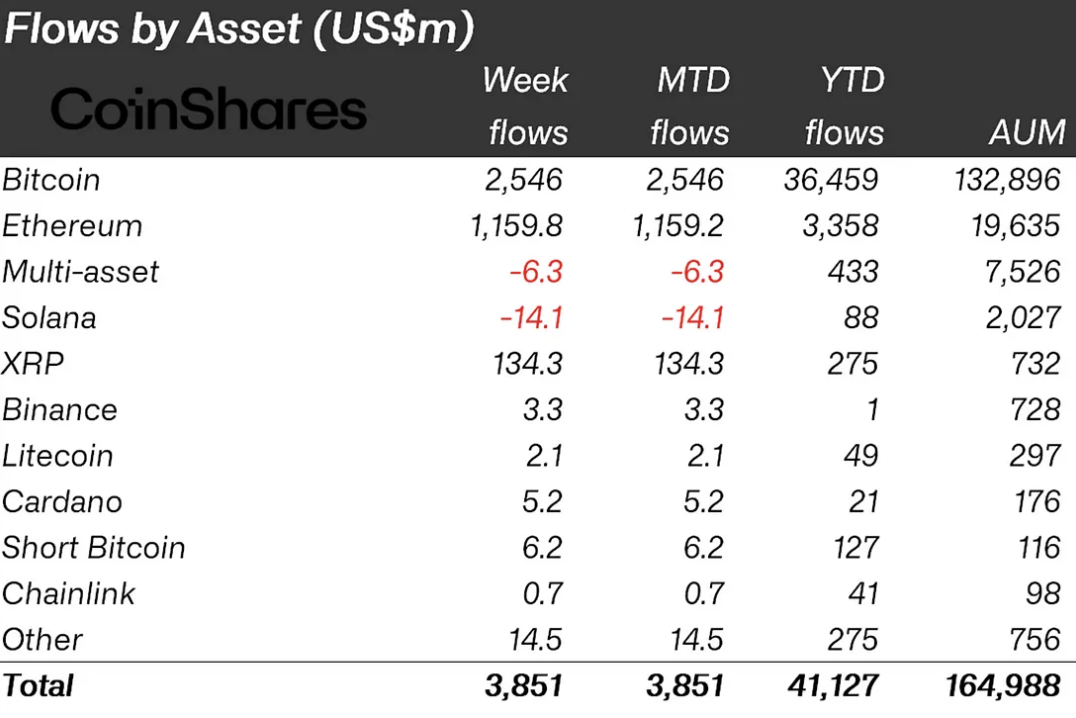

This led to a decline in Solana, which saw $14 million in outflows in two straight weeks, according to CoinShares analyst James Butterfill.

BlackRock’s overall performance was also quite impressive. His Bitcoin ETF, IBIT, is now equal to the combined size of 50 European ETFs, showing that his influence extends beyond Ethereum investments.

Meanwhile, ETHA is one of the top four ETF launches, just behind leaders like IBIT and FBTC. It has strong momentum and could close the gap before the end of the year and rank third among all ETFs.

BlackRock’s Ethereum ETF has carved out a unique position in the competitive market by giving investors exposure to Ethereum’s growth. With steady inflows of funds and growing visibility, ETHA is becoming a strong competitor in the digital asset investment market.