- Bitcoin rose 2% on Monday after losing more than 10% over the past week.

- CryptoQuant’s Bitcoin Coinbase Premium Index is falling, indicating a decline in investor interest and activity on Coinbase.

- Last week, US spot Bitcoin ETFs saw outflows, and a whale wallet added over $240 million worth of BTC to Binance.

- Historically, September has not been a good month for Bitcoin, but overall, the fourth quarter tends to end on a positive note.

Bitcoin (BTC) is recovering slightly on Monday after falling 11% last week to close below $57,500, driven by weak demand from US spot Bitcoin ETFs, which saw $279.4 million in outflows. Additionally, a whale has placed a large amount of BTC in Binance, while a decline in investor interest and activity in Coinbase suggests that Bitcoin’s rebound may be short-lived at the start of a month that has historically not been positive for prices.

Daily Market Drivers Digest: Few Signs of Optimism

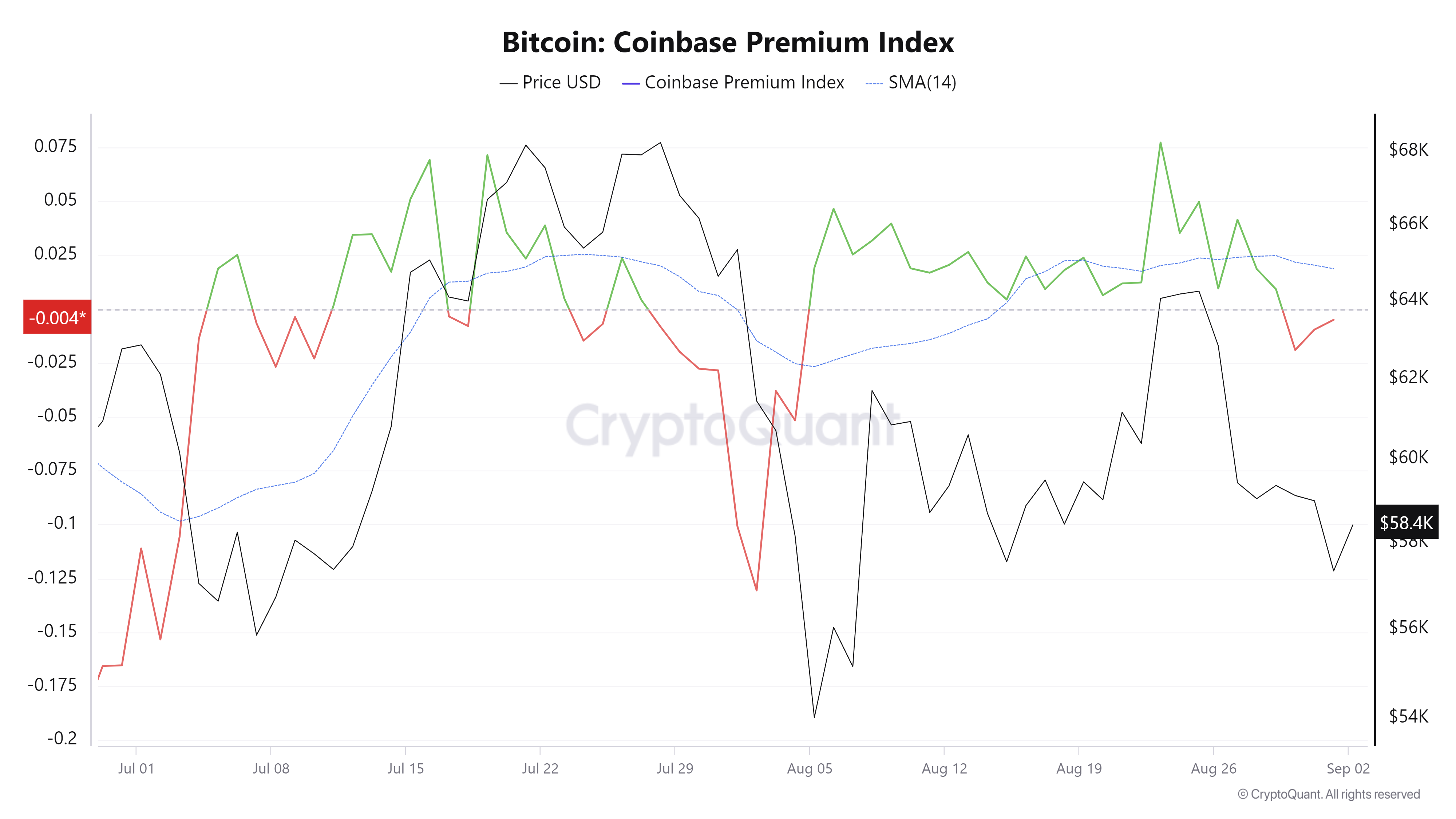

- CryptoQuant’s Bitcoin Coinbase Premium Index, a key indicator of big-wallet investor behavior, suggests a decline in whale interest in top cryptocurrencies. The indicator shows a gap between the Coinbase Pro price (USD pair) and the Binance price (USDT pair). Coinbase Premium data is one of the indicators that shows a sign of whale accumulation, as the Coinbase Pro platform is considered a gateway for institutional investors to buy cryptocurrencies.

In the case of Bitcoin, the index fell from 0.077 to -0.004 from August 24 to September 1, trading below its 14-day simple moving average (SMA) of 0.018. This suggests that whales continue to sell at a lower premium. It also shows a decline in investor interest and activity in Coinbase.

Bitcoin Coinbase Premium Index Chart

- According to Lookonchain, the whale added 4,164 BTC worth $243.8 million to the Binance exchange from Saturday to Monday. BTC fell 3% over the weekend.

This whale has deposited $4,164BTC ($243.8M) to #Binance in the last 3 days. https://t.co/vdx96ZrFRH pic.twitter.com/N1j8LHqJ3D

— Lookonchain (@lookonchain) September 2, 2024

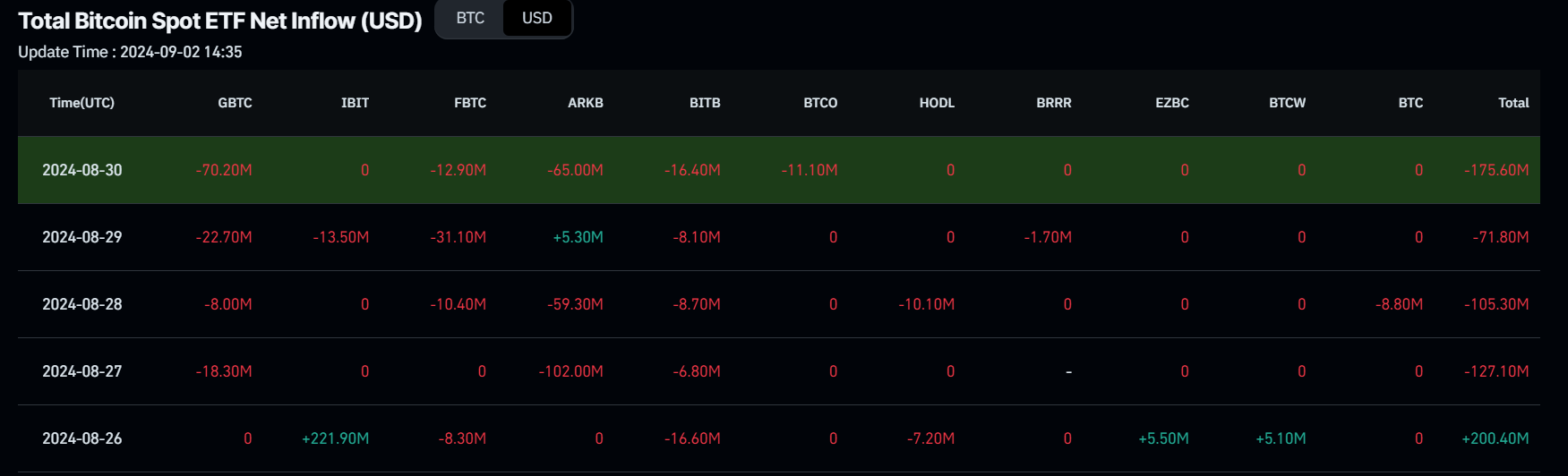

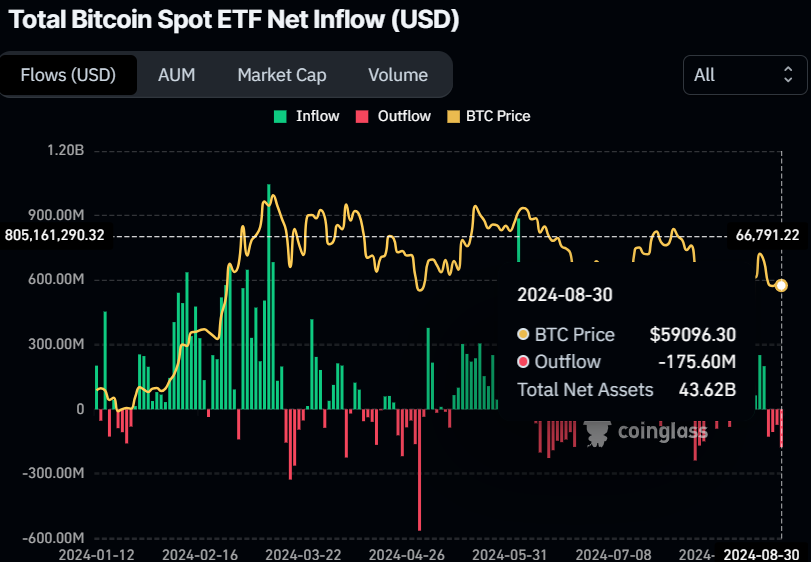

- Last week, U.S. spot Bitcoin ETFs saw a combined net outflow of $279.4 million, according to Coinglass data, a sign of deteriorating market sentiment. The combined Bitcoin reserves held by 11 U.S. spot Bitcoin ETFs are worth $43.62 billion.

Bitcoin Spot ETF Net Inflow Data

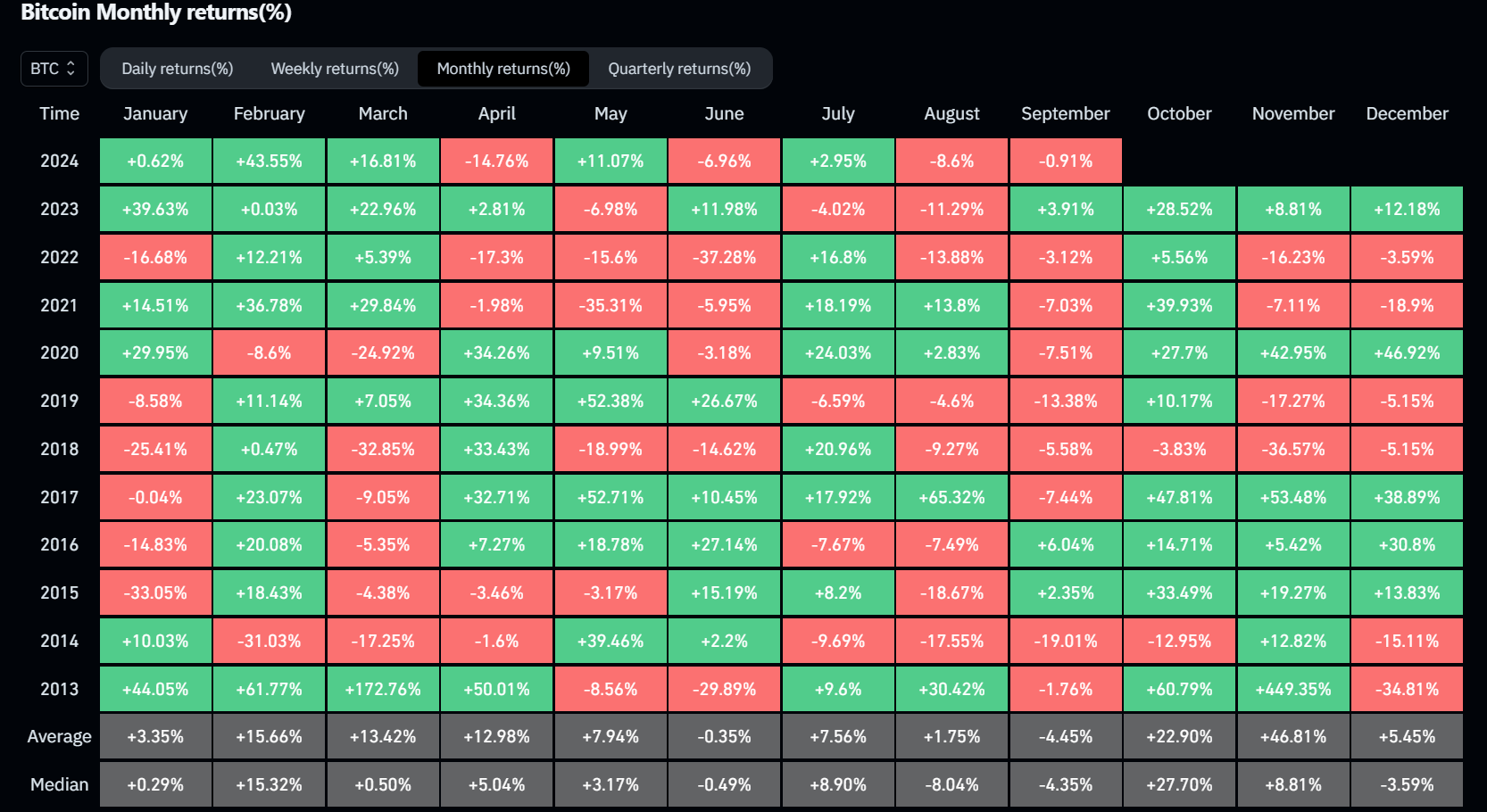

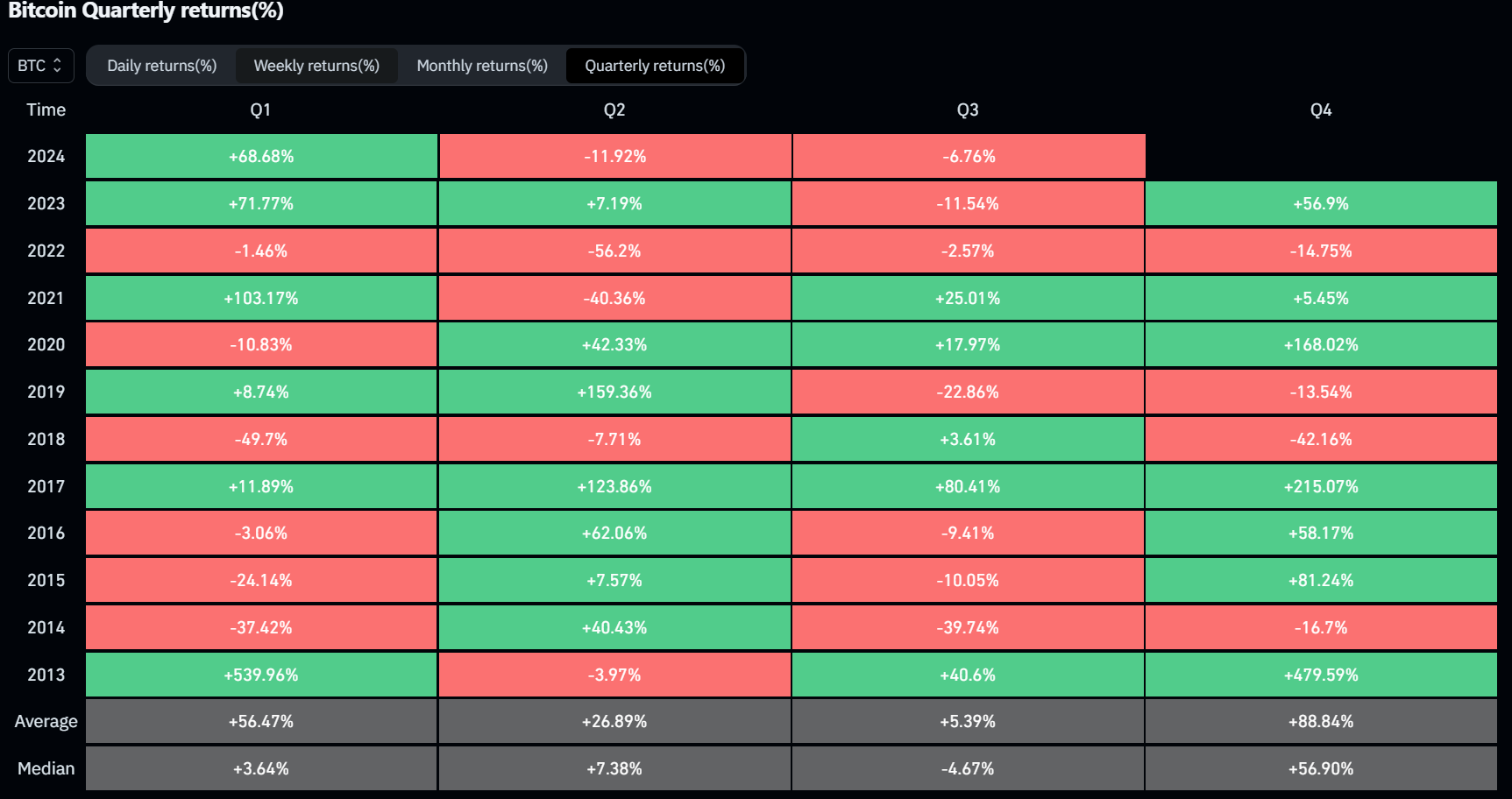

- Coinglass’s Historical Bitcoin Monthly Return (%) data shows how Bitcoin has performed on various monthly percentages. As the chart below shows, Bitcoin overall returned negative returns to traders in September, with an average of -4.45%. However, the fourth quarter (Q4) data overall showed a positive trend, with an average of +88.84%. Q4 will be important for the largest cryptocurrency, as the upcoming US elections in November could, under favorable conditions, push up the price of Bitcoin.

Bitcoin Monthly Return Chart (%)

Bitcoin Quarterly Return Chart (%)

Technical Analysis: BTC Closes Below Support

Bitcoin price closed below the $58,783 support level on Sunday and hit a low of $57,201. On Monday, it is trading slightly higher by 2% at $58,435.

If the 50% price retracement level at $59,560 (drawn from the late July high to the early August low) holds as resistance, Bitcoin could decline 4% from its current trading level at $58,435, retesting its daily support level at $56,000.

The Relative Strength Index (RSI) and the Awesome Oscillator (AO) on the daily chart are trading below their neutral levels of 50 and zero, respectively. Both indicators indicate that neither the bulls nor the bears are in control.

BTC/USDT Daily Chart

In an upside scenario, Bitcoin price could break the $59,560 resistance and close above $62,042, its 61.8% Fibonacci retracement level. In this case, the bearish thesis would be refuted and BTC could rally by 5.5% to return to its daily resistance level at $65,379.