Bitcoin continues to show remarkable resilience, trading above the $100,000 mark despite a record sell-off by CEOs in traditional markets.

The largest cryptocurrency by market capitalization absorbed potential profit-taking and maintained its momentum. We see strong demand and renewed investor confidence behind market activity. New capital inflows appear to be fueling the surge as Bitcoin endures a price decline that lasts barely a day.

Bitcoin Above $100K as It Eats Potential Profit-Taking

Bitcoin’s performance remains strong after hitting a long-awaited all-time high of $100k. At press time, BTC is trading above this level after hitting a 24-hour high of $102,528, according to data from CoinGecko on Friday.

IntoTheBlock data shows that 99% of holders are profiting at the current price. What’s remarkable is the strength of Bitcoin’s price despite volatility in traditional financial markets. Data from blockchain analytics firms also highlights that 71% of Bitcoin holders hold their assets for more than a year, again demonstrating long-term belief.

Fresh capital appears to be a key factor in Bitcoin’s sustainability. CryptoQuant’s Ki Young Joo previously attributed “fresh capital” as the reason for the sustained price momentum.

In addition, transaction volumes for transfers worth more than US$100,000 exceeded US$233 billion in the last week, which can only mean one thing – institutional interest.

The stock is seeing strong sales at a 6:1 ratio.

As Bitcoin rises, corporate executives are selling stocks at record levels. According to The Kobeissi Letter on X, the ratio of stock sellers to buyers has reached a staggering 6:1 ratio. This may indicate that managers are capitalizing on high valuations or are repositioning their portfolios either in light of economic uncertainty or in light of valuation overvaluation.

BREAKING: Corporate executives are now selling their shares at record levels, with the buyer-seller ratio reaching 6x.

Why are insiders cashing out? pic.twitter.com/MqBlkVHpMz

— Kobeissi Letter (@KobeissiLetter) December 12, 2024

Despite this, Bitcoin remains largely unaffected, with little profit-taking in 24 hours and a fairly quick recovery. Kobeissi’s letter said Bitcoin has recovered quickly from its recent price decline of less than 24 hours, falling more than 5% since November 5.

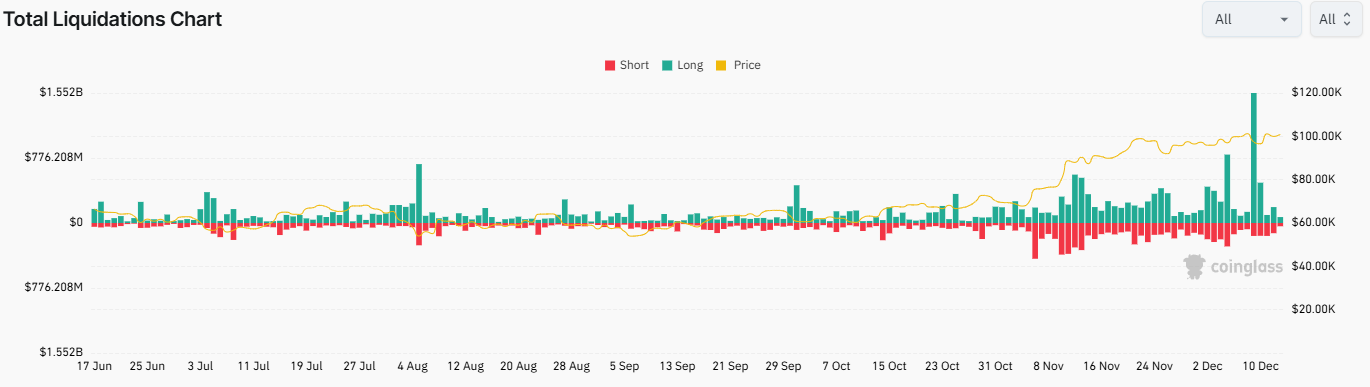

Bitcoin is approaching 140% YTD as investor confidence continues to end the year. Data from Coinglass shows that $36.59 million worth of long positions were liquidated in the last 24 hours. This indicates that the fall in prices caught many by surprise, with $14.37 million worth of short positions being liquidated, reflecting some recovery.

A step-by-step system for starting your Web3 career and landing a high-paying cryptocurrency job in 90 days.