The following is a guest post by Shane Neagle, Editor-in-Chief of The Tokenist.

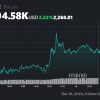

Since the conclusion of the US presidential election, Bitcoin has hit new all-time highs almost weekly in November. After reaching the nearly $100,000 threshold on November 22, Bitcoin revived the altcoin market, now holding $1.49 trillion market capitalization.

Common sense dictates that altcoins will follow Bitcoin’s lead, as previous trends have shown. But what types of altcoins should show significant performance? More importantly, are there new fundamental factors to consider this time?

First, let’s go back to the relationship between Bitcoin and altcoins. This is more important than you might think.

Why is Bitcoin leading the cryptocurrency market?

It took almost 9 years from the launch of the Bitcoin main network in January 2009 to the price of Bitcoin crossing the $10K threshold in November 2017. Although Bitcoin gradually became a household name, it still retained its status as a new, highly speculative asset. This is understandable in a central banking system where money is synonymous with government fiat – paper money.

Thus, faith in government edicts and the government’s use of force is what gives money its value. This has been the accepted wisdom of many generations. Then there is the issue of environment. If Bitcoin is not a physical paper token issued by a central bank, but a digital one, then how can it be trusted?

Blockchain enthusiasts already know the answer. The central bank, the Federal Reserve, also relies on an electronic ledger that can reflect its accounting in the form of physical tokens (paper money). but not necessarily. In contrast, the whole point of the Bitcoin ledger is that its ledger is protected from arbitrary dilution.

This makes Bitcoin pseudo-digital. It is accounted for through computational power through a proof-of-work algorithm that builds a bridge between the digital and the physical. Physical is the energy and hardware required for computing power. Therefore, Bitcoin defines the altcoin market:

- Since Bitcoin is the first cryptocurrency, its sound money aspect is easy to understand.

- Since the Bitcoin network computing power is growing, holders are increasingly confident in the integrity of the Bitcoin ledger (distributed ledger).

- As new altcoins emerge, they are traded against Bitcoin because it is a market benchmark tied to the physical state of energy and hardware.

- In times of uncertainty in the valuation of altcoins, holders are turning to Bitcoin as a safer asset.

- Likewise, during times of rising Bitcoin prices, holders shift to small-cap altcoins because the profit potential is higher. After all, it is harder to move the large market weight that Bitcoin holds.

Conversely, Bitcoin’s large market capitalization serves as a psychological cushion, always ready to absorb fleeing altcoin capital during difficult times. But in an extremely stressful situation, this capital may leave Bitcoin itself.

The problem is that if enough altcoin capital leaks out, the entire crypto market will collapse because many view Bitcoin as just another cryptocurrency, albeit one with first mover advantage.

Altcoin-Bitcoin pullback

The relationship between the Federal Reserve and the cryptocurrency market is an integral one. When the central bank increased its balance sheet beyond 6 trillion dollarsBetween 2020 and 2022, inflated liquidity spilled over into crypto assets, prompting traders to explore popular trading strategies to maximize opportunities.

Crypto liquidity previously skyrocketed during the initial coin offering (ICO) era, peaking between 2017 and 2018. This era gave birth to the best altcoins of the time; Ethereum (ETH), Cardano (ADA), EOS (EOS), Tezos (XTZ), Stellar (XLM), Algorand (ALGO), NEO (NEO), Filecoin (FIL), Tron (TRX), Chainlink (LINK), and many others.

However, all liquidity is limited. The expansion of the altcoin market has taken away Bitcoin’s dominance in the market. Traders often turn to trading floors during such dramatic changes, to share strategies and knowledge to effectively manage market changes.

While the ICO boom has spawned dozens of altcoins, it is also true that most of them were scams or dead in the water. Consequently, Bitcoin has regained some of the ground it lost prior to the Fed’s unprecedented monetary intervention during the pandemic.

After the Fed started printing money, Bitcoin’s dominance shrank even further. Following the collapse of the over-leveraged Terra (LUNA) algorithmic stablecoin TerraUSD, the altcoin market suffered an estimated $60 billion in losses.

But with leading altcoins already outperforming Bitcoin due to their lower market capitalization and higher profit potential, speculative sentiment remained. This further reduced Bitcoin’s dominance, but only temporarily.

In a classic domino toppling scenario, by the end of 2022, Fed-induced liquidity ultimately triggered the collapse of the over-leveraged FTX exchange, shocking the entire cryptocurrency market. Bitcoin was caught in a sell-off panic, falling to its pre-2020 price level of $16.5K.

However, with a big question mark hanging over the entire cryptocurrency market, Bitcoin began to recover. Regional banking crisis in the US in the spring of 2023 helped the cause for Bitcoin basics. The approval of a Bitcoin ETF in early 2024 and the fourth halving set the stage for recent new all-time highs.

But how did the altcoin market develop along with Bitcoin?

Memecoin’s dominance speaks volumes

Most of the “old guard” altcoins have focused on blockchain infrastructure, decentralized finance (DeFi), and other efforts to tokenize human activity through smart contracts. However, the destruction of cryptocurrency in 2022 appears to have left psychological scars.

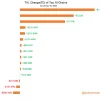

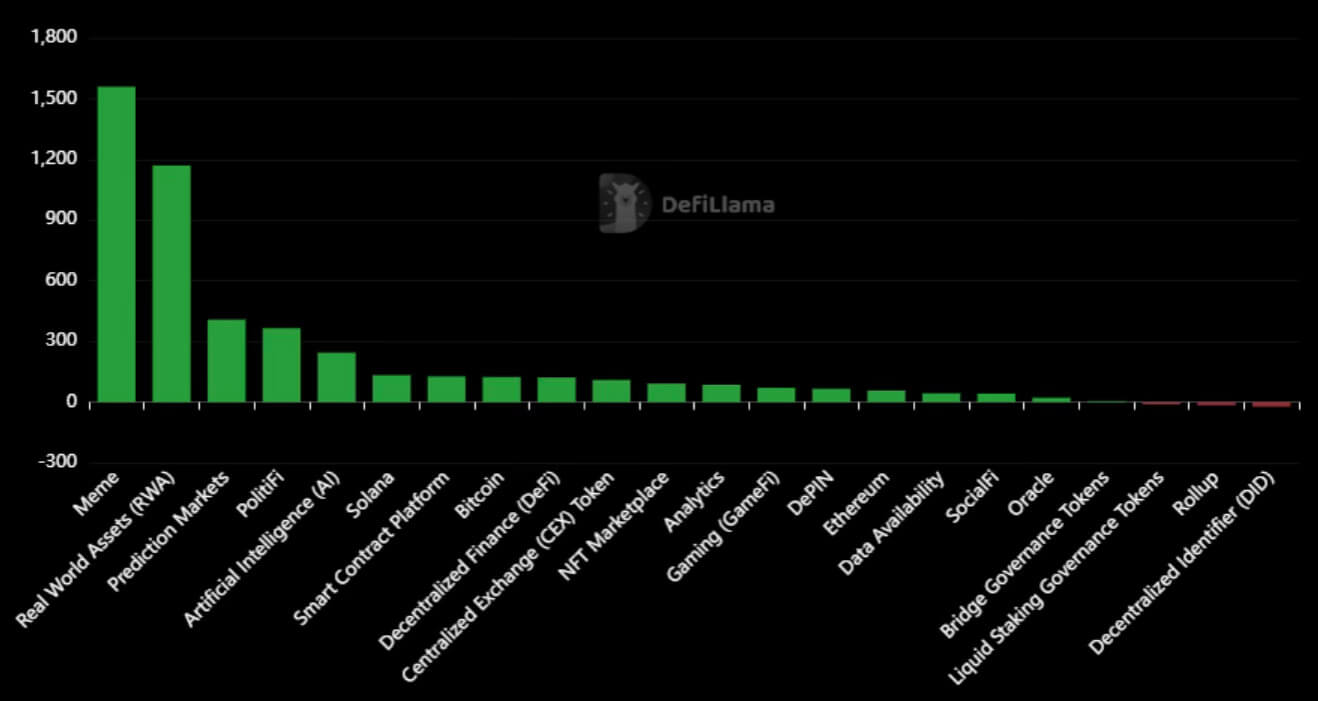

The lofty narratives of the previous cycle have been largely supplanted by memecoin hype. Artemis data shows that memcoins dominated the cryptocurrency market, with only AI tokens outperforming them in early 2024.

By mid-November memcoins returned 6 times their value than the average for the cryptocurrency market.

This coincides with Donald Trump winning his second term in the Oval Office. In turn, this indicates that cryptocurrency holders are becoming accustomed to community hype cycles driven by social media rather than altcoin fundamentals.

Likewise, the artificial intelligence revolution is still gaining momentum. In addition to various programs and providers “ChatGPT with a makeover”. We offer hosted servers with GPUAI cryptocurrencies are also a hot topic as the long-awaited release of AI agents is expected to cap another bull run.

Kaito AI, a market intelligence platform, has determined that one in four crypto investors prioritize the memcoin discourse. In other words, the focus is on short-term profits rather than long-term value returns. This suits more dynamic traders who follow cryptocurrency trends on a daily basis.

From a narrative perspective, the following altcoin categories have outperformed Bitcoin since the start of the year: memes, real world assets (RWA), prediction markets, PolitiFi, AI, Solana, and smart contract platforms.

Total exists 15,713 Cryptocurrencies in circulation tracked across 1,178 exchanges and 494 categories. Such a huge number of digital assets across so many categories creates a huge mental burden to filter the wheat from the chaff.

Conversely, the popularity of memcoins is one manifestation of the ability to cope with this mental load. After all, their simplicity and virality is a filtering mechanism in itself. But another manifestation of overcoming is the return to altcoins of the “old guard”.

Old altcoins are returning to a friendlier scene

The crash in cryptocurrency prices in 2022 was so severe that it became pointless to sell altcoins at such dropped prices. Therefore, it is fair to say that many losses remained unrealized in anticipation of another bull run.

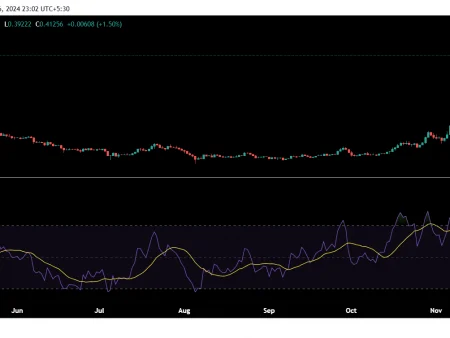

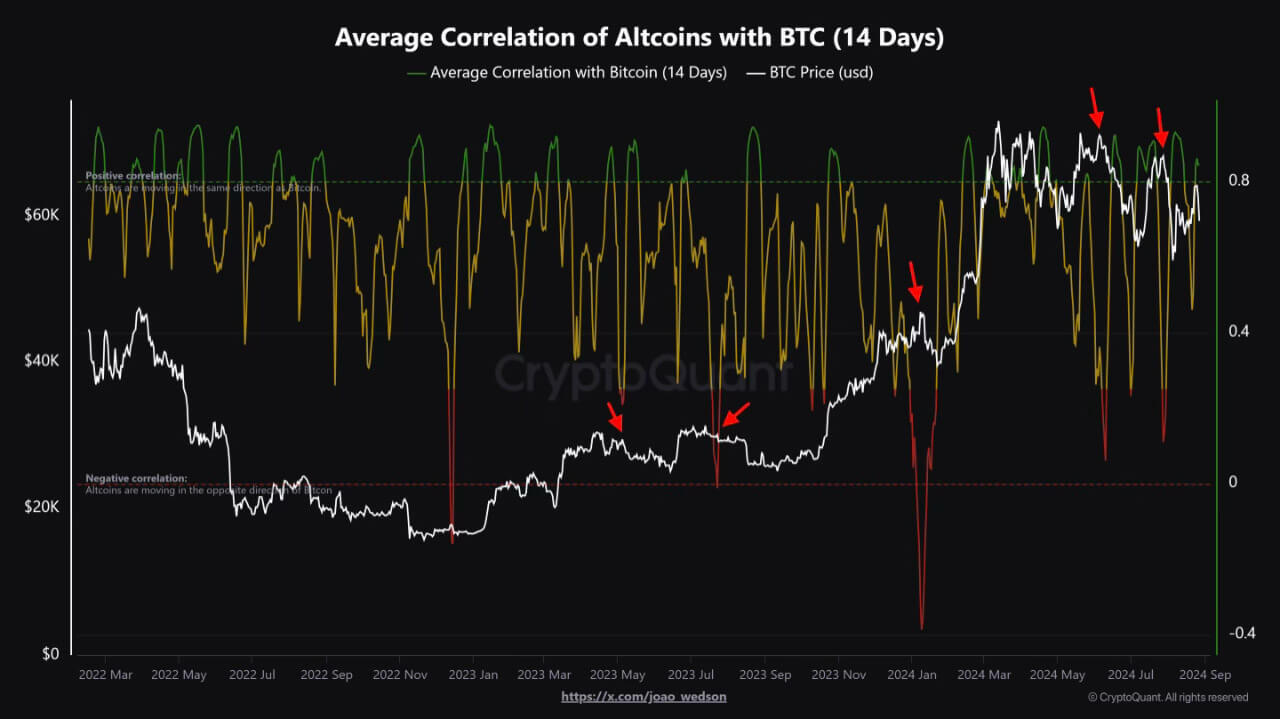

Bitcoin’s latest bull run appears to be starting this cycle. At the end of August, Joao Wedson of CryptoQuant noticed that the altcoin market was again aligning with Bitcoin.

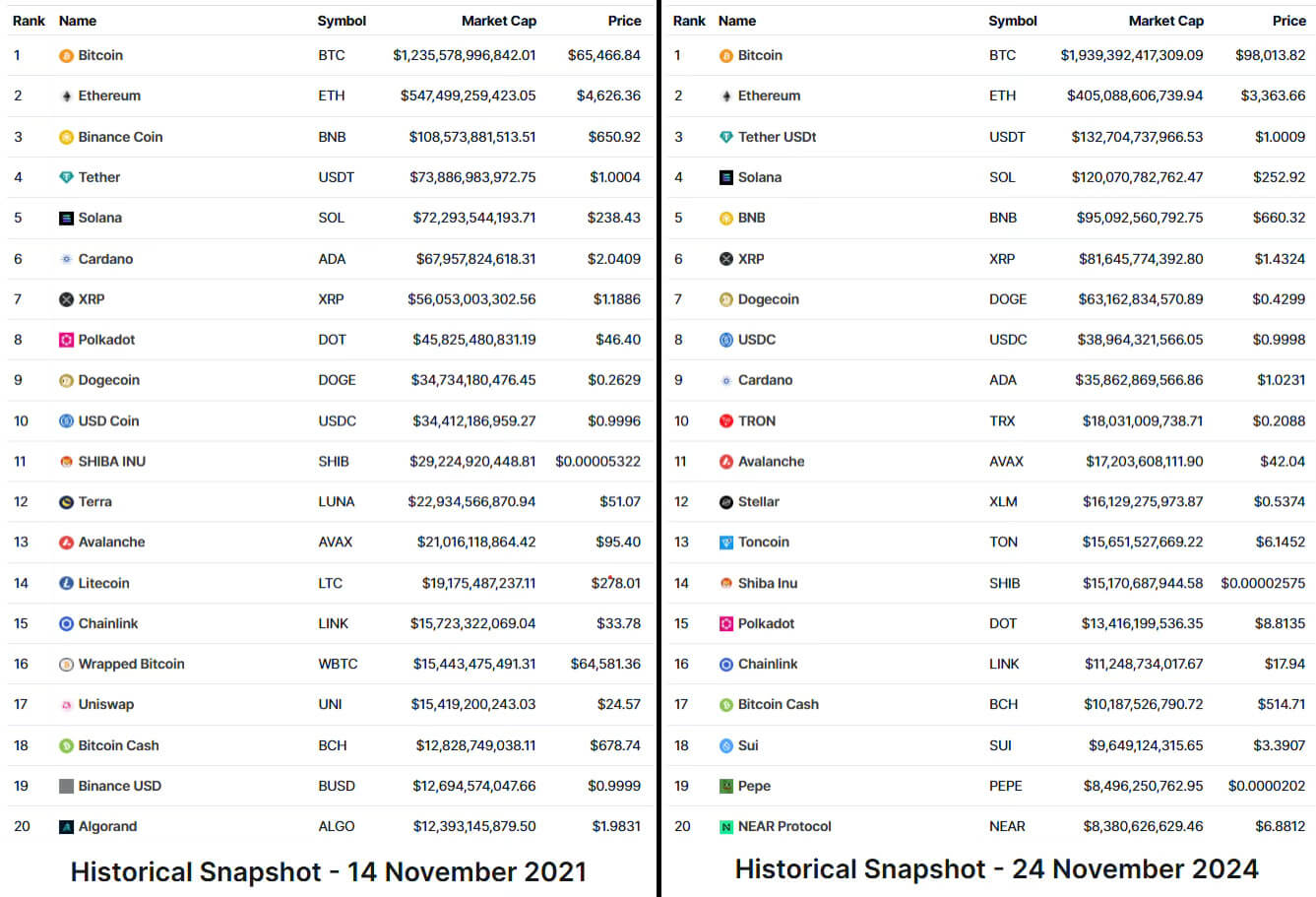

There are 11 remaining in the top 20 altcoins (excluding stablecoins) in the previous cycle, during the peak of the bull rally in November 2021. While most of their prices are still far from previous peaks, they have the potential to regain their positions, assuming this just the beginning of a new bull run.

This could happen if more exchange-traded funds (ETFs) are approved, prompting Bitcoin to rise and strengthen at the start of the year. Case in point, NYSE Arca recently filed for the Bitwise 10 Crypto Index Fund, including the following coins:

| Portfolio asset | Symbol | Weight |

|---|---|---|

| Bitcoin | BTC | 75.10% |

| Ethereum | ETH | 16.50% |

| Solana | SOL | 4.30% |

| XRP | XRP | 1.50% |

| Cardano | ADA | 0.70% |

| avalanche | AWACS | 0.60% |

| Chain link | CONNECTION | 0.40% |

| Bitcoin Cash | Warhead | 0.40% |

| Polka dots | DOT | 0.30% |

| Uniswap | UNI | 0.30% |

Interestingly, Bitcoin’s weight in the index far exceeds Bitcoin’s current dominance. This once again points to the problem of cryptocurrency dilution. Even though altcoins are much cheaper, there are so many of them that it is difficult to estimate their fair value over the long term.

Likewise, shortages are not guaranteed. Because projects are more centralized, their inflation rate may be subject to change. For example, the current inflation rate for SOL Solana tokens is 4.886% while long term supply 1.5%.

However, now that the anti-cryptocurrency SEC chairman is leaving and a supposedly crypto-friendly Trump administration is in office, the cryptocurrency market is likely to increase its liquidity pool. Moreover, the recent verdict that Sanction against Tornado Cash turned out to be illegal will likely have far-reaching consequences.

The court actually recognized that decentralized applications are a new type of asset that is not subject to sanctioned ownership as smart contract code. In other words, the court restored the common sense that open source code cannot be proprietary.

Bottom line

Even with historical growth in the money supply, liquidity is limited. Bitcoin managed to capture most of the cryptocurrency liquidity because it offered a completely different way of looking at money. This monetary potential has fueled the emergence of countless altcoins, expanding the capabilities of smart contracts.

But instead of expanding, the cryptocurrency market contracted due to massive fraud and excessive leverage, causing Bitcoin to fall. In a cleaner market and a more optimistic regulatory environment, Bitcoin is now poised to spark another altcoin bull run.

Against the backdrop of a huge number of altcoins, 1st generation altcoins have re-emerged, attempting to tie value to established prominence.