Table of Contents

What does СEO market maker DWF Labs think about the crypto market in 2023 ?

DWF Labs: Andrei Grachev shared his reasoning with readers on Twitter

Crypto Market - behind the Scenes (CT Edition). Perps, +1000% and -90%, lambo, spot market, altcoins, degens, professionals, retail, leverage, FOMO and FUD. That how the market looks like. Let's explore it! pic.twitter.com/X33OFMg8N6

— Andrei Grachev (@ag_dwf) September 17, 2023

Thread on Twitter by DWF CEO Andrei Grachev 2023

1. Why people love the cryptocurrency market – it is volatile and bullish. 100x, 1000x is the dream of beginners who want to get rich quickly. Plus, it’s very democratic, you can trade it everywhere and always. The market is cool and dynamic. but

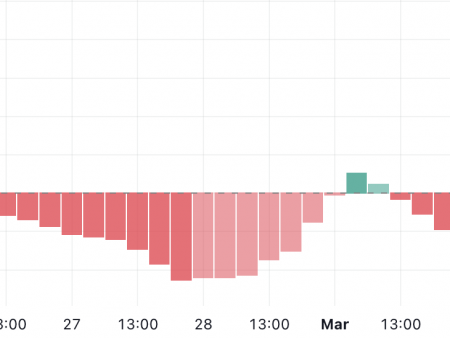

2. Conditions are quite different now. Nothing is moving, there is no lambo, only REKT. People are afraid, instead of getting rich quickly, it seems that they will quickly become impoverished. Of course, this affects the behavior of traders, and trading activity decreases.

3. Competition. It is no secret that the bulk of the trading volume is provided by MMs and HFTs. It is not true to assume that the strong raise funds from the weak and provide more liquidity and depth. No. Funds accumulate in accounts and are not used for operations now, because volumes and demand are not so high = depth decreases. It is correct to think that there are enough funds on the main MM/HFT accounts. As soon as volumes and demand return, they will appear in the books. Just look at the recent extreme events.

4. Consolidation. As a result, volumes and liquidity are concentrated around several hundred coins. It is correct to say that it has always been so, but when small players have 20% of the volume of 150 billion, this is a big difference from 20% of the volume of 25 billion. That’s why strange things happen.

5. Fragility. The market is not dead, people are buying, people are selling. People are hungry. When something moves, people try to catch a chance. Up and down is better than down and up, despite the greater risk. People love it more. That’s why low-capitalized altcoins are at the peak of popularity.

Is the cryptocurrency market good? – yes. Is the cryptocurrency market risky? – yes, very risky. Is it right now to buy dead altcoins and pray? – no one knows. But make sure that you are ready to lose the allocated funds.

DWF Labs’ Unconventional $200M+ Crypto Ventures: A New Investing Paradigm

CryptoGPT, Synthetix, and more – DWF Labs makes waves with over $200 million in crypto deals. But, wait, is it really about traditional investments? Let’s unravel this intriguing story.

The Crypto Landscape Giants vs. DWF Labs

In a world dominated by crypto venture capital behemoths like A16Z, Paradigm, Pantera Capital, and Digital Currency Group, the sudden ascent of DWF Labs has left everyone bewildered.

The Headlines vs. The Reality

DWF Labs made headlines with flashy investments, but it’s not your typical venture capital firm. Let’s dig deeper.

Investments or Misunderstanding?

While the media tags DWF’s crypto dealings as “investments,” it’s more like a sophisticated over-the-counter (OTC) trading desk operation. They buy tokens at a discount to market value, making their approach unique.

The Controversy Surrounding DWF Labs

- Conflict of Interest: Critics claim a massive conflict of interest, suggesting DWF’s actions manipulate token prices.

- Blurring Lines: DWF combines various services under the banner of “strategic partnerships,” making it challenging to discern the true nature of their dealings.

DWF Labs’ Approach

DWF Labs, an investment-focused arm of Digital Wave Finance, relies on profits from high-frequency trading to fund their endeavors. They favor projects that have already launched tokens and have a multifaceted approach, including market-making.

Investment Strategy and Due Diligence

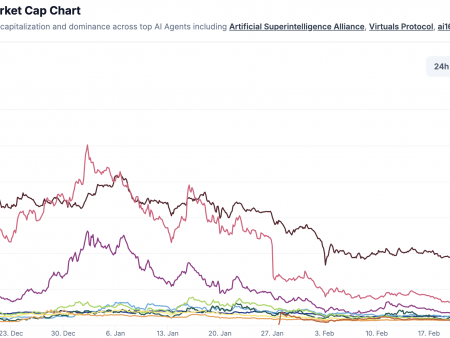

DWF Labs focuses on five sectors: Traditional Finance (TradFi), Decentralized Finance (DeFi), GameFi, Centralized Exchanges (CEX), and Artificial Intelligence (AI). They prefer projects listed on BitFinex, Coinbase, or Binance, considering them proven and reliable.

The Fine Line

DWF Labs’ investments often include token lockups, market-making agreements, or a combination of both. Their commitment to providing liquidity to the projects they invest in is a key feature.

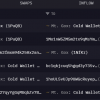

Token Transfers and Exchange Activity

While DWF Labs keeps most of its investments on centralized exchanges (CEXs), it’s worth noting that this practice raises concerns among industry experts, who see it as a potential red flag.

The Need for Transparency

Andrei Grachev, DWF’s managing partner, acknowledges the need for transparency and wants the community to understand their operations better.

In the crypto investment realm, where to draw the line between VC and market making remains a conundrum. It’s a story of a new player reshaping the rules in the ever-evolving crypto market.

A cryptocurrency exchange is an online platform where you can buy, sell, or trade cryptocurrencies like Bitcoin, Ethereum, and others.

Safety varies by exchange. Look for platforms with strong security measures, like two-factor authentication and cold storage for funds.

Consider factors like security, fees, available coins, user interface, and customer support.

Centralized exchanges are managed by a company, while decentralized exchanges operate without a central authority.

Many exchanges require Know Your Customer (KYC) verification for security and regulatory compliance.

Trading fees vary but typically include maker fees (for adding liquidity) and taker fees (for removing liquidity).

Yes, most exchanges offer cryptocurrency-to-cryptocurrency trading pairs.

Withdrawal times depend on the exchange and the cryptocurrency. Some are instant, while others may take hours or even days.

A wallet address is like a bank account number for cryptocurrencies. It’s required to send your crypto to the right place.

Yes, depending on your country’s tax laws, trading cryptocurrencies may have tax consequences. Consult a tax professional for guidance.

Yes, many cryptocurrency exchanges operate 24/7, allowing you to trade at any time.

A market order buys or sells at the current market price, while a limit order sets a specific price at which you want to buy or sell.

Yes, each exchange sets its own minimum and maximum trading limits, which can vary widely.

It’s not recommended. For security, it’s better to use a cryptocurrency wallet, especially for significant holdings.

Exchanges typically have account recovery processes, including password reset options and support for forgotten usernames.

Some exchanges offer insurance, but coverage can be limited. It’s essential to check an exchange’s insurance policy.

Use strong passwords, enable two-factor authentication, and be cautious of phishing scams and suspicious emails.

Yes, but it’s recommended to learn the basics of trading and understand the risks involved before you start.

Stablecoins are cryptocurrencies pegged to the value of a fiat currency like the US dollar. They provide stability and are commonly used for trading and transferring funds on exchanges.

Yes, regulations vary by country. Many countries have implemented or are considering regulations to govern cryptocurrency exchanges for consumer protection and financial stability.